If you step back from the daily noise of crypto price swings, debates on other social media, and endless short-term predictions you’ll notice something important happening in the background.

Crypto is slowly moving away from being seen as “magic internet money” and toward something much bigger: tokenized real world value.

We’re talking about stocks, bonds, real estate, and commodities moving onchain. These aren’t billion-dollar markets. They are hundreds of trillions of dollars in value. And this shift is already starting.

Real World Assets (RWAs) are expected to dominate the next phase of crypto. But there’s a truth most people don’t mention: almost no blockchains are actually ready to handle them in a legal and compliant way.

This is where Dusk ($DUSK) becomes more than just another token. It positions itself as infrastructure for the future of finance.

Why Institutions Can’t Use Most Blockchains

People often ask why large institutions don’t simply tokenize assets on popular public chains today.

The answer is simple: privacy and compliance.

In traditional finance, regulated trading works like this:

Your identity is verified

Regulators can audit activity

But your balances, trades, and strategies are not visible to competitors

Most blockchains don’t fit this model.

Some chains are fully public, where anyone can see everything. Others are fully private, where even regulators can’t see what’s happening. Neither works for institutions.

Dusk was built to solve this exact problem.

It enables selective disclosure users can prove they are allowed to participate without exposing sensitive data. This balance between privacy and regulation is not a “nice feature.” It’s a requirement for institutional adoption.

And once built, it becomes a powerful long-term advantage.

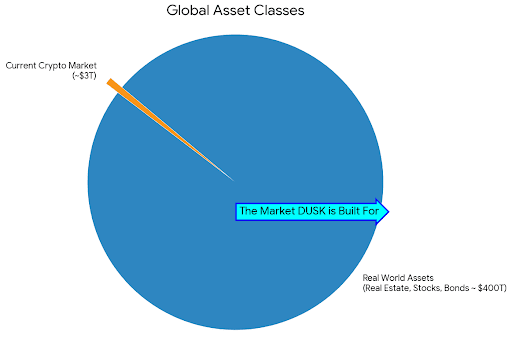

The Market Dusk Is Actually Targeting

When people compare crypto to traditional markets, the difference is massive.

The entire crypto market is still tiny compared to global real world assets. Stocks, bonds, and real estate completely dwarf today’s blockchain economy.

Dusk isn’t trying to fight over attention in the existing crypto market alone. It’s being built for the much larger market that hasn’t moved on-chain yet.

That’s the real opportunity.

Real Utility, Not Promises

For years, crypto has been full of announcements that never turned into real usage. Dusk is taking a different approach by working directly with regulated environments and real financial entities.

Instead of focusing on hype, the network is being stress-tested in scenarios that mirror how traditional finance actually operates. This includes areas like digital share ownership and compliant asset issuance.

Holding $DUSK is a bet on a future where:

Businesses can issue assets directly onchain

Real estate can be divided, traded, and settled instantly

Stock settlement times shrink from days to seconds

This kind of infrastructure isn’t flashy, but history shows that the most valuable companies often build the “plumbing” behind the scenes.

Why Institutions Are Paying Attention

Institutions don’t chase trends. They wait for systems that feel safe.

What makes Dusk stand out in RWA conversations especially in Europe is its compliance-first approach. It doesn’t try to avoid regulation. It integrates it directly into the protocol.

As regulatory frameworks like MiCA become more important, networks that were designed with compliance from the start may have a serious advantage. Capital doesn’t just chase returns it chases clarity and safety.

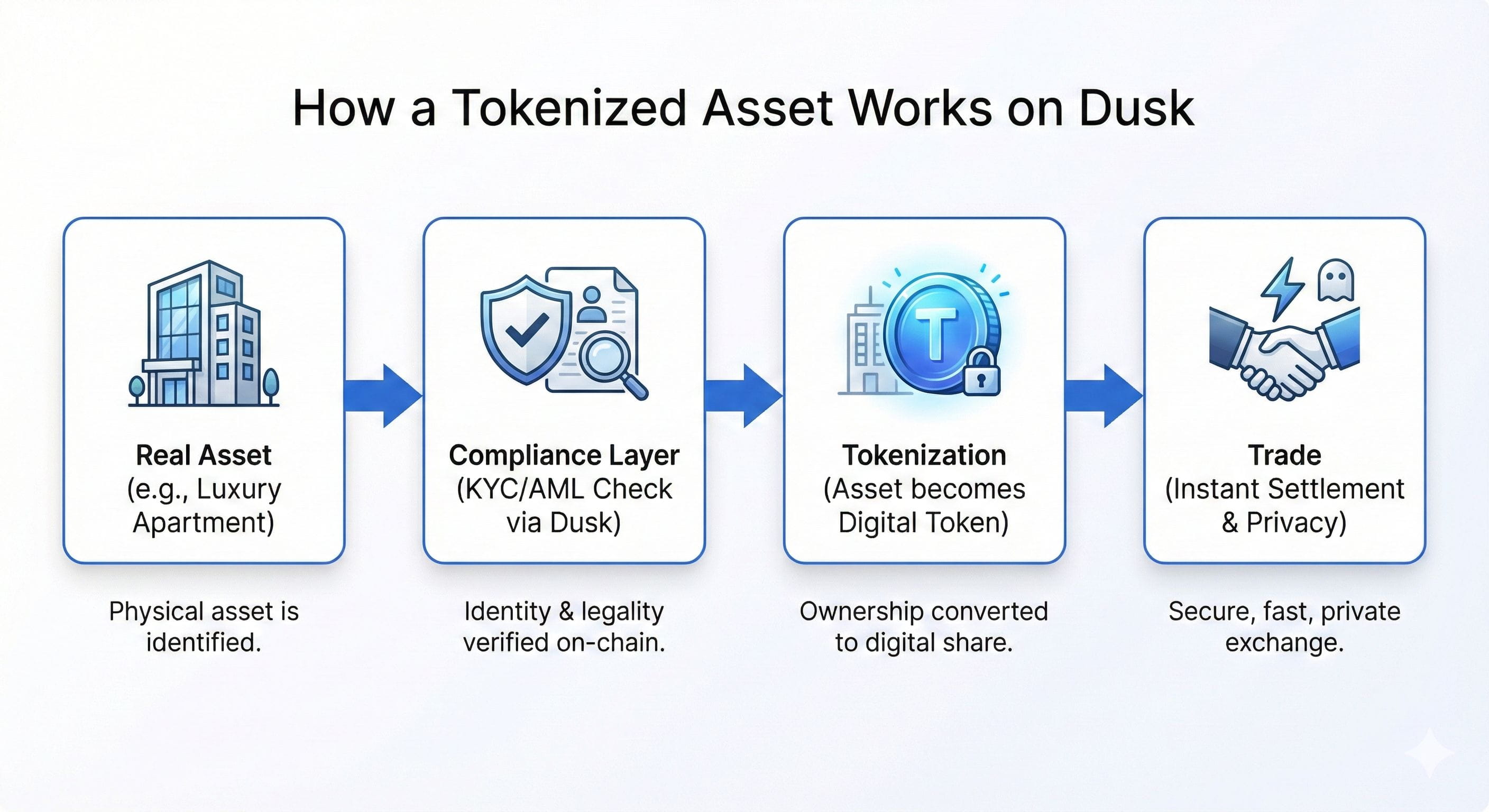

How Tokenized Assets Work on Dusk (In Simple Terms)

A real-world asset is first verified and checked for compliance.

Once approved, it is tokenized onchain.

That token can then be traded instantly, with privacy protections in place and regulatory rules enforced automatically.

This process removes friction, reduces costs, and opens the door to global participation without breaking the rules.

Conclusion: This Is Still the Beginning

When it comes to real world assets on chain, we are still extremely early. The amount of traditional value tokenized today is almost insignificant compared to what exists.

Think of this phase as the early internet slow, experimental, and misunderstood.

Dusk is positioning itself to be the infrastructure for when this market truly takes off. The long-term opportunity isn’t about next week’s price action. It’s about what happens when serious capital starts moving on chain at scale.

The bridge between traditional finance and blockchain is being built quietly.

The question is whether you notice it early enough.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions.