Grayscale Investments filed a Form S 1 on January 23 2026 to register a spot BNB ETF that would trade under the proposed ticker GBNB. This move aims to give investors a regulated way to gain direct exposure to BNB the native token of the BNB Chain without having to buy and custody the coins themselves.

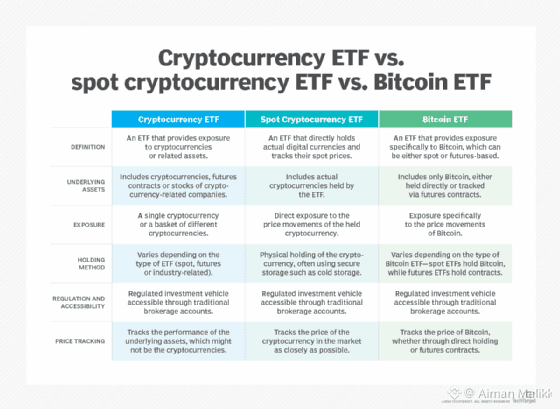

What is a spot BNB ETF A spot ETF holds the actual asset rather than futures or derivatives. In practice that means the fund would keep BNB in secure custody and issue shares that represent fractional ownership of those holdings. The ETF would operate as a Delaware statutory trust and if approved its shares would trade on Nasdaq making them accessible through ordinary brokerage accounts. Authorized participants such as large financial firms would create and redeem shares using cash or by delivering BNB directly to the fund.

Why this matters A spot BNB ETF would make BNB easier to buy for many investors by removing the need to manage wallets keys and custody. It could also bring more liquidity to BNB through traditional market infrastructure and reduce some operational risks by relying on professional custody services. For the broader crypto market the filing signals growing institutional interest in altcoins and expands the range of familiar investment products tied to digital assets.

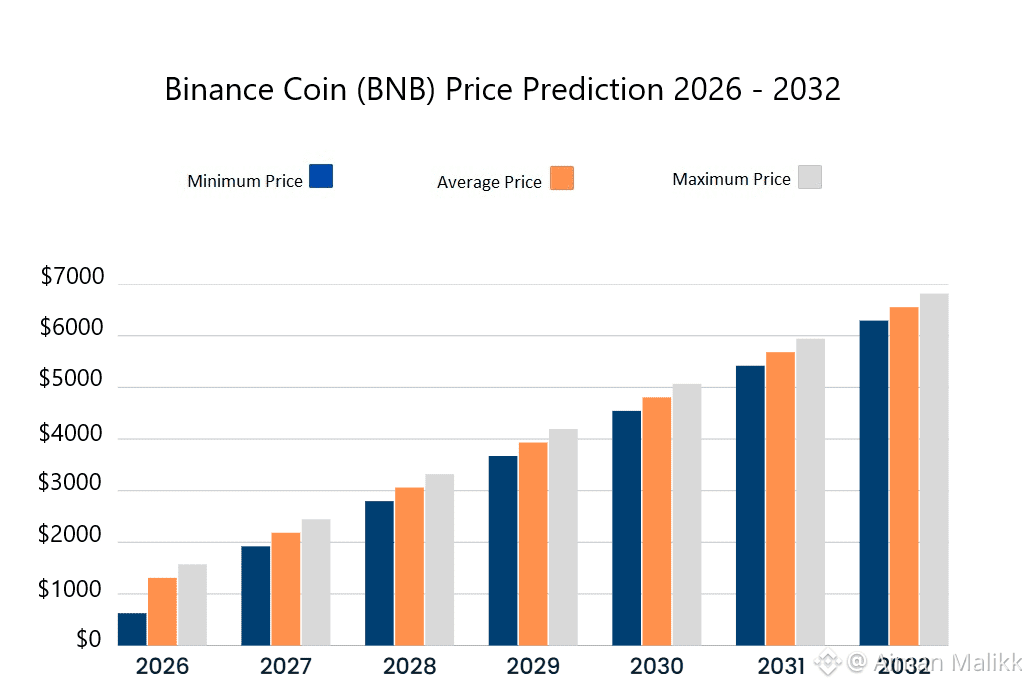

Key risks and the approval path The filing is preliminary and subject to SEC review and possible revisions. Approval is not guaranteed. Regulators will look at issues such as market surveillance liquidity and any legal questions tied to BNBs ecosystem and its connections to centralized platforms. BNB price volatility regulatory uncertainty and custody complexities remain real risks even if an ETF launches.

What investors should consider If you are interested consider how a spot ETF fits with your goals time horizon and risk tolerance. An ETF can simplify access and custody but will come with fees and not remove market risk. Watch the SEC review process for updates and pay attention to trading volume and spreads if the fund launches.

Grayscale filing for a spot BNB ETF is a notable step toward mainstream access to BNB. If approved it could attract institutional capital and offer a familiar regulated pathway for investors to gain exposure to the token.