Regulation was never meant to slow markets it was meant to make them survivable.

Regulation was never meant to slow markets it was meant to make them survivable.

In crypto, regulation is often treated like gravity: unavoidable, restrictive, and hostile to innovation. But in capital markets, regulation plays a different role. It creates predictable boundaries so institutions can deploy size without fear of legal ambiguity, counterparty chaos, or systemic collapse.

The real problem isn’t regulation itself.

The problem is that most blockchains can’t express regulation natively.

They either ignore it entirely (which blocks institutions), or they hard-code restrictions so rigidly that innovation dies.

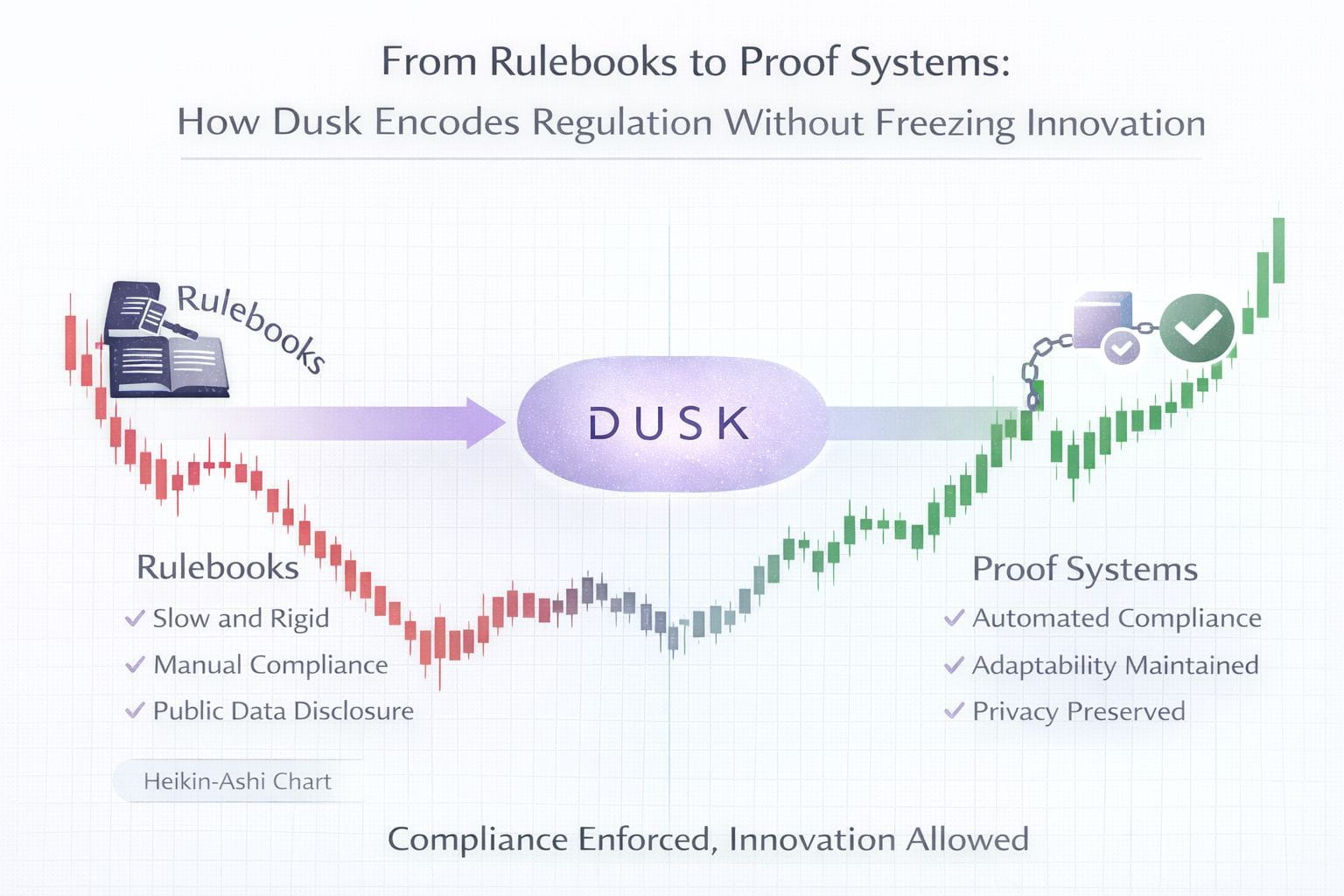

Dusk is pursuing a third path: turning regulation from a rulebook into a proof system — enforceable without turning the chain into a bureaucratic machine.

Rulebooks don’t scale on-chain because they rely on human interpretation.

Traditional compliance works through documents, committees, and procedures:

policies define eligibility

institutions interpret requirements

auditors validate adherence

regulators enforce through investigation

That system is slow, expensive, and inconsistent but it works because human discretion bridges edge cases.

Blockchains don’t have discretion. They have execution.

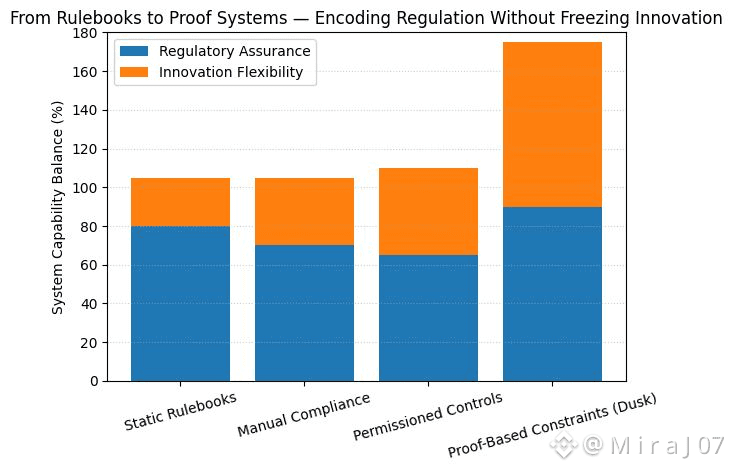

So when crypto tries to “add compliance,” it often produces two flawed outcomes:

Manual compliance (off-chain checks + on-chain settlement)

Frozen compliance (rigid rules that block composability)

Both approaches fail at scale.

Dusk’s thesis is that compliance must become programmable but not brittle.

The key upgrade is replacing “trust us” compliance with “prove it” compliance.

A proof-based compliance system doesn’t require participants to expose everything or rely on centralized gatekeepers. Instead, it allows the system to verify claims like:

the buyer is eligible

the transfer is permitted

jurisdiction restrictions were respected

limits were not exceeded

reporting conditions were satisfied

without revealing unnecessary private data to the public.

This is a major shift:

from enforcement through observation

to

enforcement through verification

Dusk is built for that shift.

Encoding regulation doesn’t mean turning DeFi into TradFi it means making constraints composable.

The fear in crypto is that regulation kills innovation. That fear is valid when compliance is implemented as a blunt instrument.

But proof-based regulation can be modular.

Instead of hard-coding one restrictive regime into the base layer, you can build:

reusable compliance modules

policy templates for different asset types

upgradeable constraints as markets evolve

jurisdiction-specific rule sets

permissioned participation without public doxxing

This creates a system where regulation becomes a plug-in, not a prison.

That’s how you preserve innovation.

Dusk’s real contribution is enabling “regulated privacy,” not “private regulation.”

There’s an important difference.

“Private regulation” implies hidden activity beyond oversight.

“Regulated privacy” means:

participants remain confidential

rules remain enforceable

audits remain possible

disclosures remain selective

outcomes remain verifiable

This matches how real markets work. Most financial activity is private, yet compliance is real because regulators can request proof and enforce rules.

Dusk is aligning on-chain finance with that reality.

Why this matters: tokenization fails when regulation cannot be expressed cleanly.

Tokenized RWAs and securities require:

investor eligibility checks

restricted transfers

private registries

corporate actions

reporting pathways

On public-by-default chains, you can enforce some restrictions, but you often sacrifice confidentiality. That creates institutional resistance.

On fully permissioned systems, you can enforce everything, but you sacrifice openness and composability.

Dusk aims to hold the middle ground:

enforceable constraints

confidentiality preserved

innovation not frozen

That’s the only design that scales tokenization into a real market.

Proof systems are how you make regulation compatible with open innovation.

A proof-based approach offers three structural advantages:

Minimized data exposure

Compliance is proven without public surveillance.

Standardized verification

Audits become machine-verifiable rather than interpretive.

Composable constraints

Builders can innovate inside clear boundaries without reinventing compliance every time.

This is the difference between:

building in a legal minefield

and

building inside a mapped, enforceable zone

Dusk is building that zone.

The long-term winners won’t be chains that “avoid regulation” they’ll be chains that make regulation programmable.

Institutions won’t scale into ecosystems that cannot express compliance. They also won’t accept systems that expose them to public monitoring.

So the winning architecture must provide:

privacy for participants

proof for regulators

composability for builders

enforceability for markets

Dusk’s design is aimed at that intersection.

This is not compliance as restriction.

It’s compliance as infrastructure.

In the end, regulation doesn’t freeze innovation ambiguity does.

Markets innovate fastest when boundaries are clear. The biggest innovation killer isn’t regulation; it’s uncertainty:

uncertainty about legality

uncertainty about enforcement

uncertainty about disclosures

uncertainty about exposure

Dusk’s proof-based approach reduces uncertainty while keeping the system open enough to evolve.

That’s how you encode regulation without turning Web3 into a slow-moving institution.

Innovation doesn’t die when rules exist it dies when rules can’t be proven, enforced, or trusted. Proof systems turn regulation from friction into foundation.