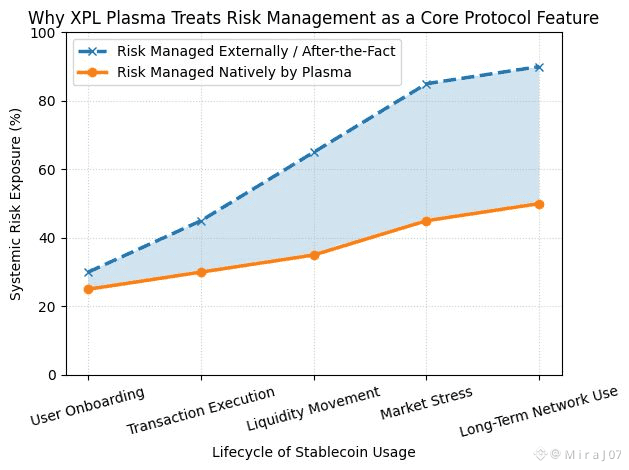

Most blockchains treat risk management as something users should handle. XPL Plasma treats it as something the protocol must engineer.

Most blockchains treat risk management as something users should handle. XPL Plasma treats it as something the protocol must engineer.

In many ecosystems, “risk” is outsourced to the user: choose the right bridge, avoid malicious contracts, manage gas volatility, and hope the network stays stable under stress. That model doesn’t scale to mainstream adoption.

XPL Plasma approaches the problem differently. It assumes that if a chain wants billions of transactions and consumer-grade usage, risk management cannot be optional it must be embedded into the architecture, enforced by design, and resilient in worst-case conditions.

The first principle of risk management is acknowledging reality: scaling systems fail differently than Layer-1s.

High-throughput environments introduce risks that are not always visible in normal usage:

operator downtime

data availability stress

congestion bursts

exit coordination challenges

dispute window timing risks

adversarial behavior during market panic

If these risks are treated as edge cases, they become existential failures.

XPL Plasma treats them as expected conditions and builds around them.

That’s what it means to make risk management a protocol feature: design for failure before failure arrives.

Plasma’s exit mechanism is risk management in its purest form: enforceable recoverability.

Most protocols measure safety by how well they prevent bad outcomes.

XPL Plasma measures safety by how well users can recover from them.

The exit mechanism functions like an insurance-grade safety system:

if the operator misbehaves, users can exit

if the network halts, users can exit

if censorship occurs, users can exit

if uncertainty rises, users can exit

This is risk management that does not depend on trust, support tickets, or emergency governance votes.

It depends on proof and enforcement at Layer-1.

Predictable performance is not only UX it is a risk control system.

In finance and consumer payments, unpredictability is a hidden risk multiplier.

When users cannot predict:

confirmation time

failure rates

network responsiveness

congestion behavior

they react defensively. They overpay fees rush exits and create panic loops that destabilize the system further.

XPL Plasma’s focus on predictable performance reduces systemic risk by stabilizing user behavior under load.

This is how infrastructure prevents chaos: by preventing surprise.

Fee stability is a form of economic risk management.

Unstable fee levels cause second-order failures:

microtransactions become irrational

marketplaces lose velocity

Gaming economies break their reward loop

apps throttle activity

users delay transactions in dangerous ways

XPL Plasma helps stabilize the ecosystem by reducing reliance on variable and volatile fee conditions inherent in the current L1 fee paradigm.

In fact, a system which contains a demand surge while holding costs constant is not only equitable, it is secure.

Also included is the risk management concept, which entails the design of incentives that do not promote behaviors that are likely to destabilize the

Sustainable chains don’t just process transactions they shape what kinds of transactions happen.

XPL Plasma’s architecture must incentivize:

useful throughput rather than spam

consistent participation rather than bursty abuse

monitoring and contestability rather than complacency

predictable state growth rather than bloat

This prevents “throughput inflation,” where the network appears active but becomes fragile due to low-quality usage.

Healthy activity is a risk control mechanism.

Validators and watchers are not optional participants they are the protocol’s enforcement workforce.

In Plasma systems, risk management depends on contestability: fraud must be challengeable.

That requires a strong ecosystem of:

validators verifying commitments

watchers monitoring exits

automated systems detecting invalid claims

challenge infrastructure operating reliably under stress

XPL Plasma’s risk posture depends on making this enforcement layer economically sustainable.

If monitoring is unpaid, it becomes unreliable.

If monitoring is rewarded, it becomes an industry.

This is why the “watcher economy” is not a side feature it is risk management at scale.

Worst-case resilience is the highest standard of protocol risk management.

Risk is not tested in calm markets.

It is tested when:

volatility spikes

users panic

exits surge

attackers attempt exploits

network load becomes adversarial

XPL Plasma’s emphasis on exits, contestability, and predictable performance suggests an architecture built to survive exactly these moments.

A chain that cannot handle stress is not a scalable chain it is a temporary chain.

The deeper insight: risk management is what turns scalability into sustainability.

Scaling without risk management creates fragility:

more users amplify failure modes

more volume increases attack incentives

more assets raise systemic consequences

more reliance increases trust collapse during outages

XPL Plasma treats scaling as a sustainability problem because it recognizes that growth without control mechanisms is not progress it is leverage.

Risk management is what prevents leverage from becoming collapse.

In the long run, risk-managed scaling becomes the competitive advantage that users don’t notice until they need it.

Users rarely reward safety during good times.

They reward it when things break.

If XPL Plasma continues to encode risk management into its core protocol design, it positions itself as a network where:

consumer apps can rely on predictable execution

funds remain recoverable under worst-case conditions

economic loops remain stable under stress

trust survives volatility

That is how infrastructure earns long-term adoption not through marketing, but through survival.

Speed attracts attention, but resilience earns trust. The protocols that treat risk management as architecture not advice will define the next decade of scalable crypto.