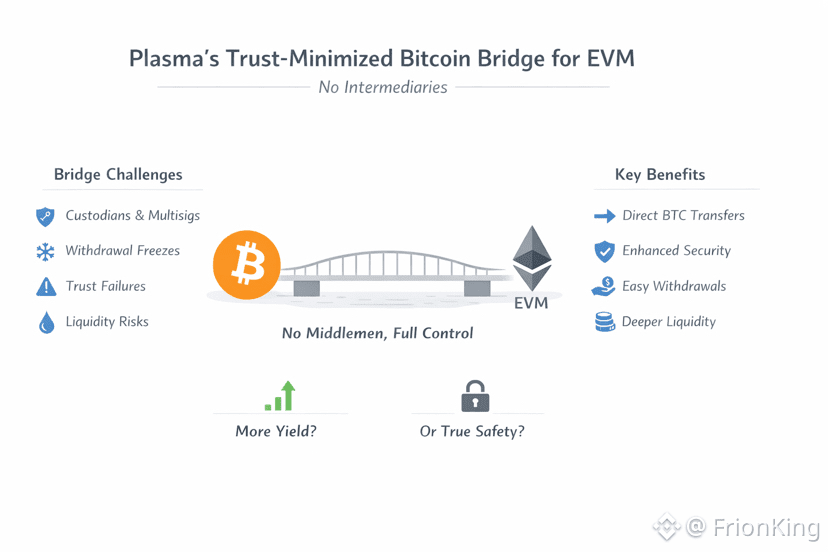

I’ve been in this market long enough to understand one thing, a bridge is not a marketing story, it is a trust test, and in crypto trust always has a price, Plasma announcing a trust minimized Bitcoin Bridge is, to me, a signal they want to take on the hardest part, bring BTC into the EVM environment without forcing users to hand their survival to a group of intermediaries

How many bridges have you seen fail because of something painfully ordinary, a few signatures, a multisig, a custodian, a decision to pause withdrawals, when the market is calm it all looks fine, when stress hits the truth shows up, users do not lose because price goes down, users lose because they cannot withdraw, so when Plasma says trust minimized, I do not hear it as a slogan, I hear it as a promise about an escape mechanism, about whether you still have the right to save yourself when the system is under pressure

Bringing BTC into EVM is an old dream, because EVM has applications, liquidity, and endless strategies, if BTC can enter, it becomes fuel for lending, margin, market making, and all the yield structures people chase, but I always ask readers directly, do you want more yield, or do you want to preserve the core nature of Bitcoin, and if you must trade something off, what are you willing to give up

A trust minimized bridge, if it truly means what it says, reduces the assumptions where you must trust humans, and replaces them with technical constraints, proofs, and mechanisms that force the system to behave correctly, or at least force it to return your funds when things go wrong, for me the standard comes down to a simple question, when crisis arrives, can you withdraw, and do you withdraw by your own right, or by someone else’s permission

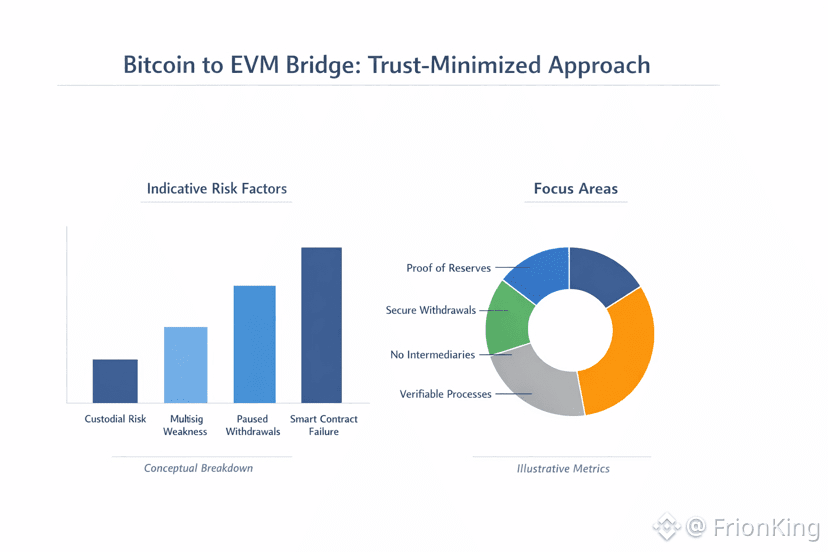

The market has paid brutal tuition for bridges, not because ideas were missing, but because discipline was missing, weak operations, risky upgrades, and trust models that were never clearly stated, if Plasma wants to win, they need to make these things explicit, who can change what, what the security assumptions are, how withdrawals work during disputes, and whether the system can handle pressure when large liquidity floods in, are you sure you understand the risk you are accepting, or are you just following the words trust minimized because they sound “on trend”

If Plasma gets it right, the benefit is not only BTC entering EVM, the benefit is risk being repriced, liquidity becoming deeper because fear is lower, and applications building smoother user experiences because they do not need third parties to manage worst case outcomes, but I will be honest, the bigger a bridge gets, the more it is watched, attacked, and turned into a concentrated risk point, so what Plasma must prove is not a demo, it is durability over time

I see Bitcoin as a standard of certainty, and EVM as an environment of flexibility, pulling them closer together is always tempting, but it is only worth doing if you do not turn BTC into a promise note, Plasma is trying to reduce forced trust, and if they can prove clear withdrawal rights, strong verifiability, and resilient operations, this becomes a meaningful step, but if it is only a renamed trust model made to look cleaner, the market will notice quickly, and the question I want you to answer for yourself is, are you entering a bridge to gain more, or to keep what you already have