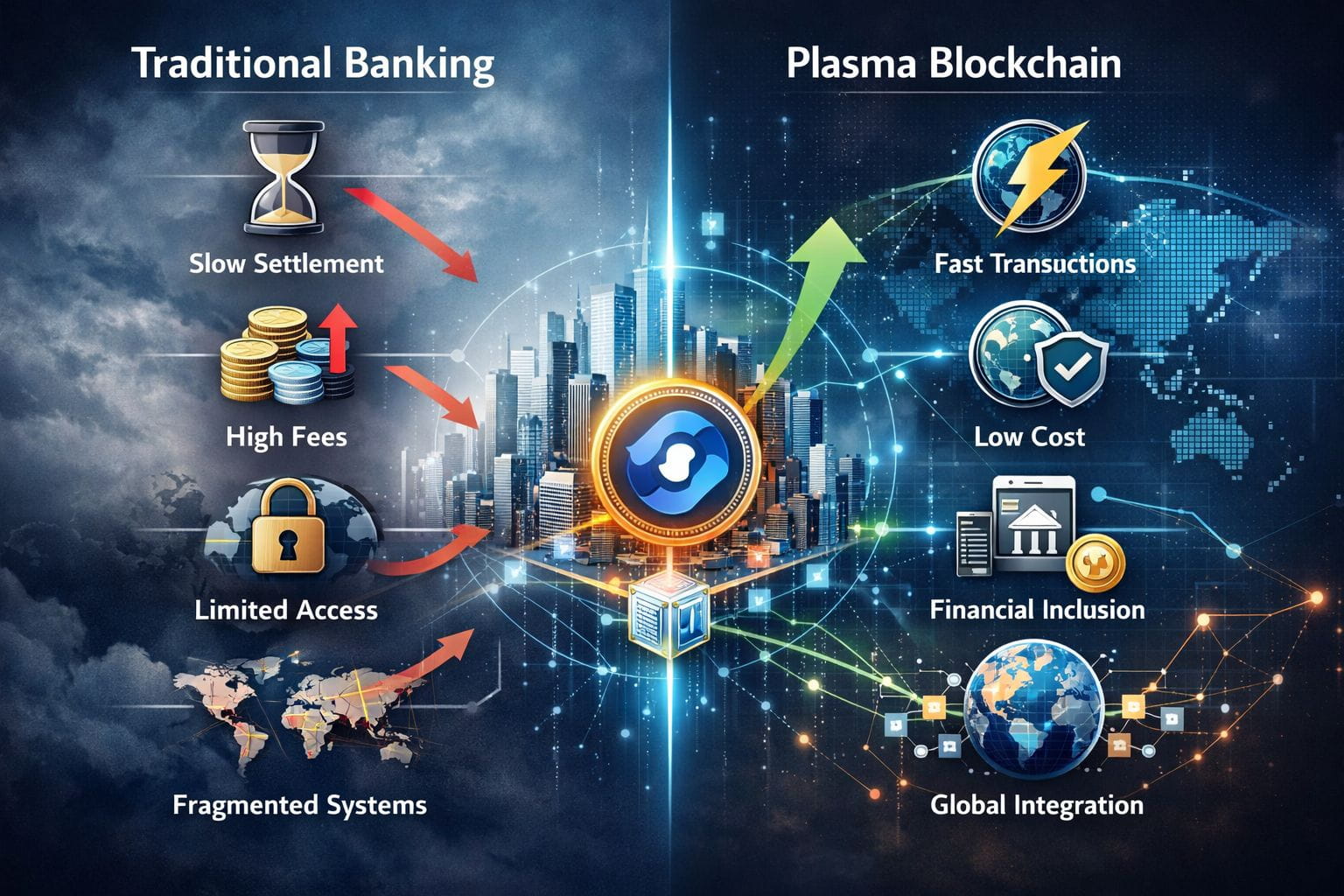

Plasma Blockchain, which focuses on Transforming Global Banking and Payment Solutions. The face of the world's financial system now faces a profound change at an unprecedented scale. Banking systems, decades-old banking infrastructure, today, has issues with slow settlement, cost, barriers to entrance and difficult cross-border transactions. As digital economies advance and intercontinental commercial ventures get bigger, the need for faster, more price-effective and inclusive financial rails grew more urgent; thus introducing new financial networks which are truly "green lights". Plasma Blockchain stands as a next-generation solution for modernizing global payments on a blockchain system. Though not for general use – a general-purpose blockchain is just for decentralized applications and speculative financial investments in the wild – Plasma aims to maximize stablecoin transaction speed and ensure real financial infrastructure for today’s people. By pooling blockchain efficiency with institutional performance, Plasma plans to take this whole generation digital payment world by storm.

Why Traditional Banking Must Continue with Innovation.

Slow Settlement Times

Traditional international transfers can take anywhere from one to five business days in duration. Intermediaries, correspondent banks, and manual reconciliation processes are so inefficient and slow payments.

High Transaction Fees

Cross-border remittances frequently come with 5% to 10% fees. These expenses have a disproportionate impact on migrant labor and the businesses and customers that depend on international transfers.

Limited Financial Access

Billions of people globally are still underbanked or unbanked. Traditional banks need bank paperwork, minimum balances and access to services with regional areas that most people can’t guarantee.