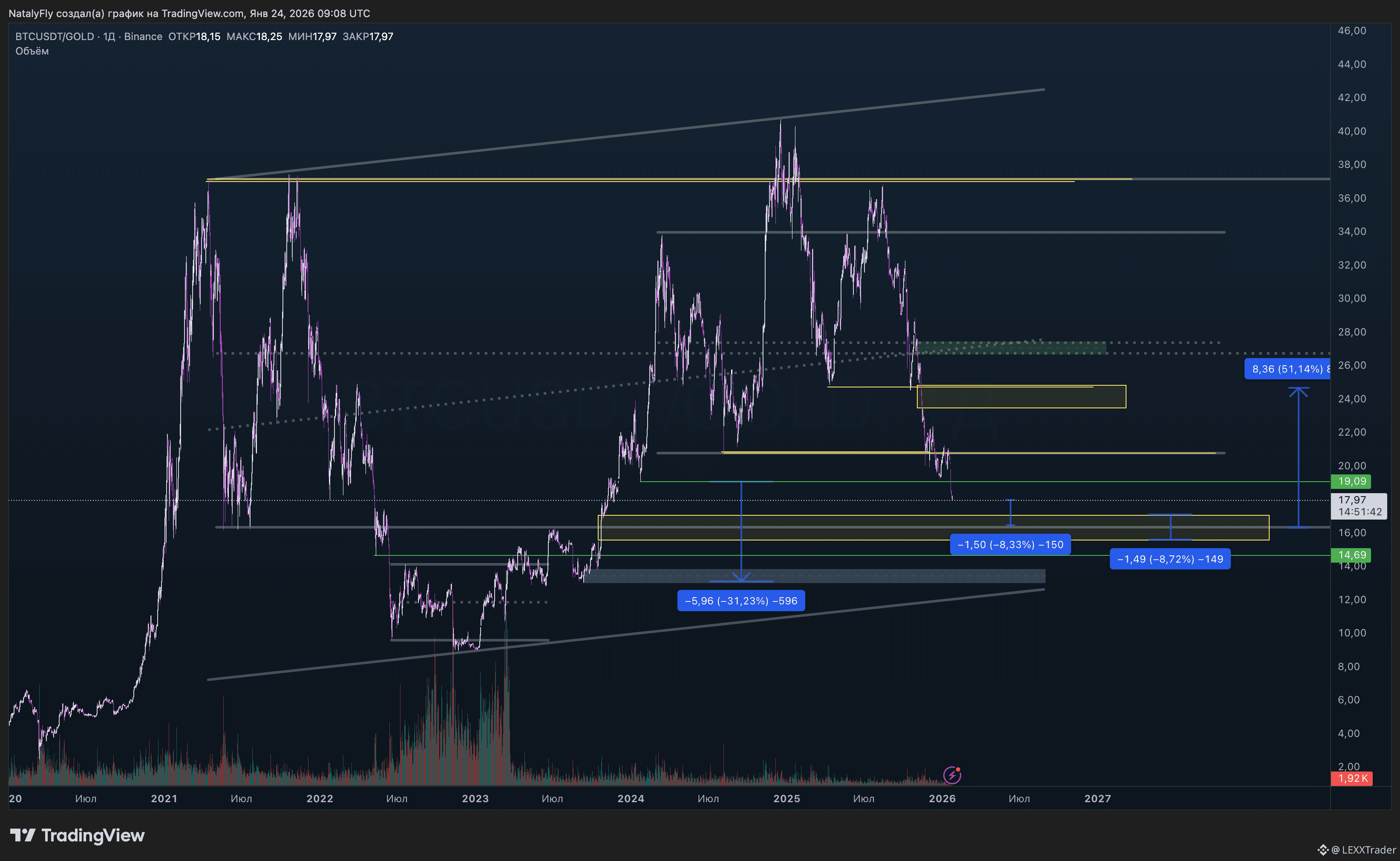

Sometimes the cleanest way to think about Bitcoin is to stop looking at it in dollars and instead compare it to gold — on the BTC/GOLD ratio.

@CZ in Dawos called for a Bitcoin supercycle in 2026.

Though he didn't provide a specific price target, he said it's "easy to predict" that prices will be higher in 5-10 years.

Right now that chart is saying something simple: there’s still room to move before BTC/GOLD reaches a support zone. And to me, that zone isn’t a “prediction.” It’s a test.

Why a test? Because when BTC/GOLD has returned to similar early-cycle base areas in the past, the market often delivered big reactions. Not always an immediate rally - but it quickly answered the real question: is there a buyer here, or not?

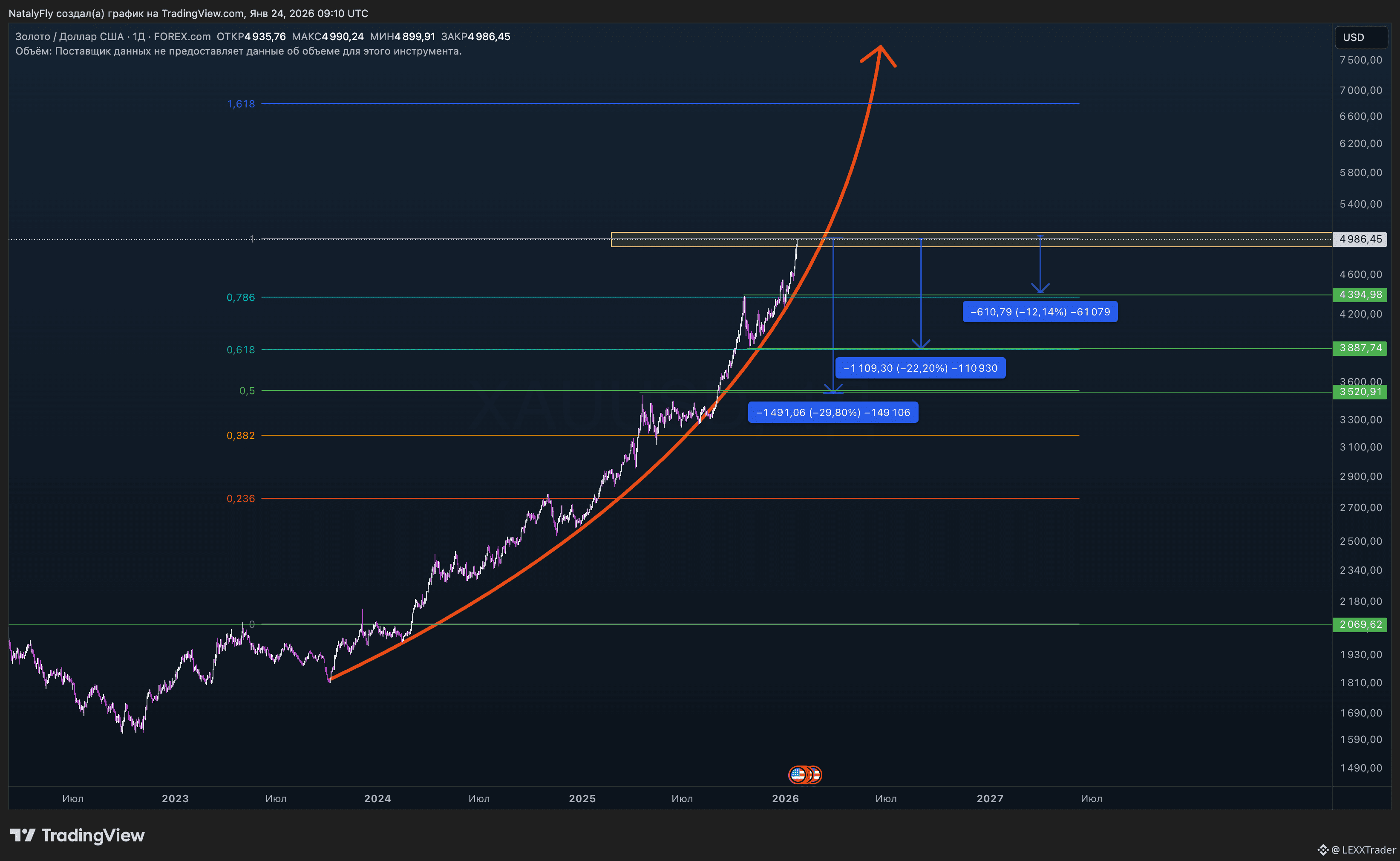

At the same time, gold itself looks like it’s in late-stage acceleration on a log scale - the kind of move that can end up feeling like a climax. If gold does start to cool off, that liquidity won’t just disappear. It has to choose a destination.

Equities don’t look like the easiest “next home” when they’re already near highs. Bitcoin, though - especially into a BTC/GOLD support zone - starts to look like one of the few large assets that could be relatively cheaper and capable of a stronger reaction.

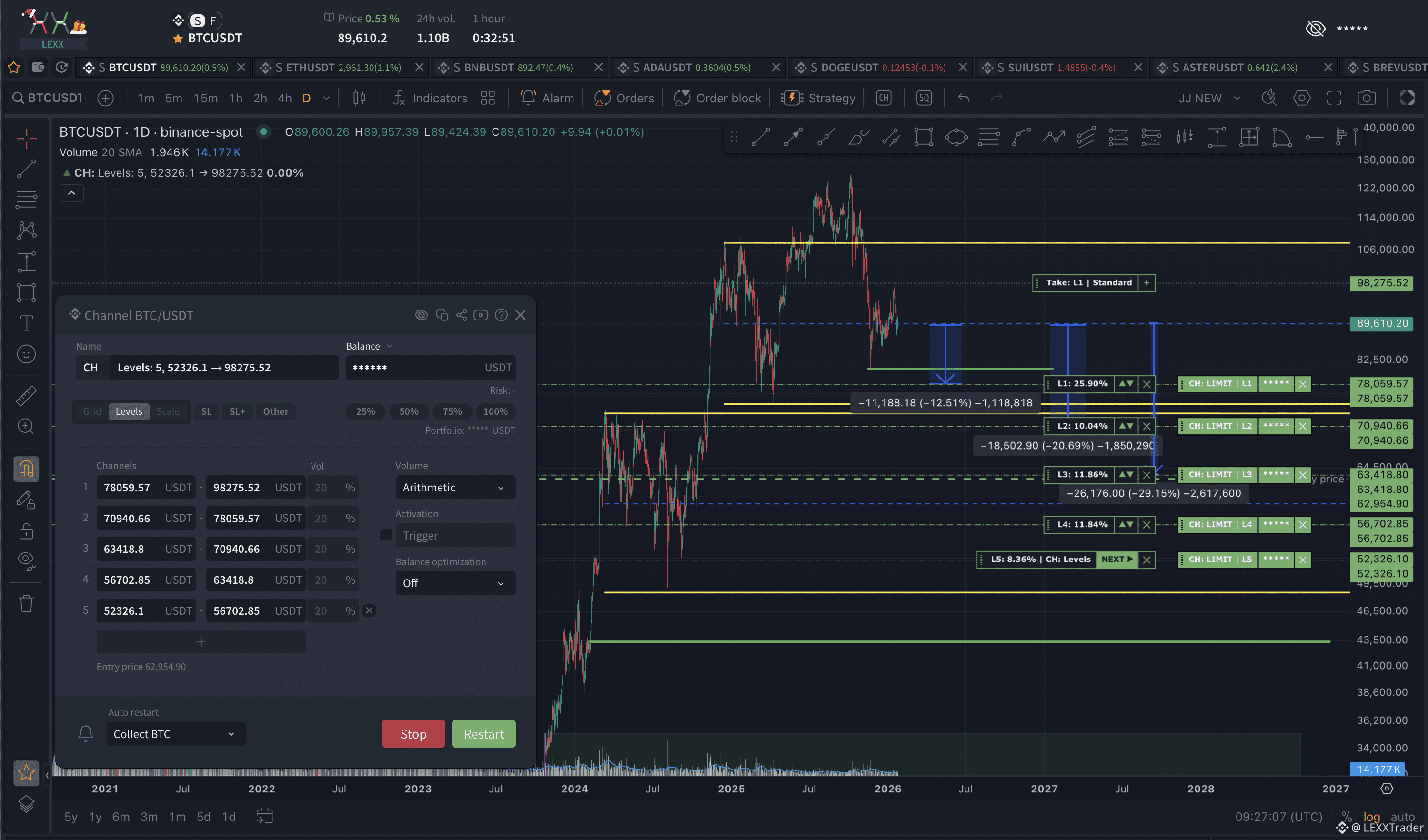

So the opportunity here isn’t about believing a story. It’s about waiting for the zone - and watching whether the market shows its hand.

A / B :

A) BTC/GOLD tags support and reacts cleanly — rotation into BTC starts to show

B) BTC/GOLD breaks support and keeps sliding — the market still won’t pay for BTC, even in gold terms.

One question:

What single simple signal would you accept as proof the reaction is real?

#BTCVSGOLD $BTC

#WEFDavos2026