When AI Masters On-Chain Monitoring: From Trading Gateway to Execution Hub—Decoding SIA’s “Web3 AI Operating System”

Abstract

Topping Binance’s DappBay charts for consecutive days and promoted by Aster ahead of the Christmas holiday season, how does SIA turn “smart money” into public infrastructure through composable AI agents?

And why is the AI Agent narrative resurging in early 2026?

A key driver is the accelerating commercialization of general-purpose AI agents by major tech firms. Meta’s multi-billion-dollar acquisition of Manus in late 2025 marked a watershed, signaling AI’s evolution from “content generation” toward “task execution and completion” in 2026.

But in the Web3 space, the challenges are more concrete—even stark: If AI fails to simplify on-chain operations, reduce DApp-hopping, or enhance transaction control, hype alone won’t sustain its relevance.

Interestingly, year-end on-chain data revealed a divergence from typical AI project trends:

The newcomer “SIA” (SIANEXX) dominated Binance DappBay’s daily active user rankings, far outpacing the runner-up.

On Christmas Day, Aster’s official Twitter heavily promoted SIA’s “Smart Copy Trading,” enabling one-click copy trades executed directly on Aster via SIA. Trading volume for the feature quickly surged into the millions of dollars.

Amid a sea of homogeneous AI × Web3 projects, how did SIA fire 2026’s opening shot? What explains its breakout growth?

I. Can “Smart Money” Be Packaged as an API?

As the new year began, blockchain observers watched Vida’s “super smart money” move—during BROCCOLI714’s abnormal volatility, Vida seized a fleeting window to capture millions in profit.

Such cases are increasingly common. Arbitrage opportunities arise almost daily in crypto, yet ordinary users face two steep barriers:

Information asymmetry: By the time retail learns of a trend via social media, pros have already positioned.

Execution friction: Approvals, slippage adjustments, and confirmations feel sluggish amid fast-moving markets.

Ultimately, the blockchain isn’t short on opportunities or high-probability addresses—it’s the ability to consistently capture, replicate, and execute them that’s scarce. For many, failure stems not from misjudgment but from operational complexity: too many steps, too much emotion, too many lost chances.

This reality is why CZ declared, “AI trading will be a massive frontier.” While Crypto × AI narratives have cycled through compute, AI chains, agents, and infrastructure, Web3’s operational complexity remains largely unaddressed.

Web2 AI agents like Doubao Mobile and Manus offer a lesson: future Web3 AI products must evolve beyond “smarter Q&A” into deeply integrated service platforms—especially for on-chain operations. What if AI didn’t just assist analysis but decomposed and automated trading decisions, with agents executing around the clock?

That’s the question SIA tackles. Founded by a team of experienced Wall Street traders and AI experts, SIA aims not to be another analysis tool but a full AI Agent infrastructure and application platform for Web3—first targeting the high-frequency, execution-intensive trading scenario, a domain with undeniable user demand.

SIA’s proposition is simple: Make trading effortless for all. Its logic: decompose elite trading expertise into composable agents, and put them in the hands of ordinary users.

When AI begins “monitoring the market” and handling execution 24/7, crypto enters a new chapter.

II. When AI Monitors the Chain: SIA’s 24/7 On-Chain Trader Network

“AI trading” isn’t new in Web3, and using NLP to simplify operations has long been a focus. But SIA stands apart: instead of forcing users to adapt to complex tools, it builds a composable agent network that’s already operational in trade execution and modular agent creation.

Its product suite follows a clear arc: from assisted filtering (Web3 GPT), to automated strategy generation (Agent Factory), to fully delegated execution (Smart Copy Trading).

1. Web3-Exclusive Chat Agent: From Q&A to “Deep Investment Assistant”

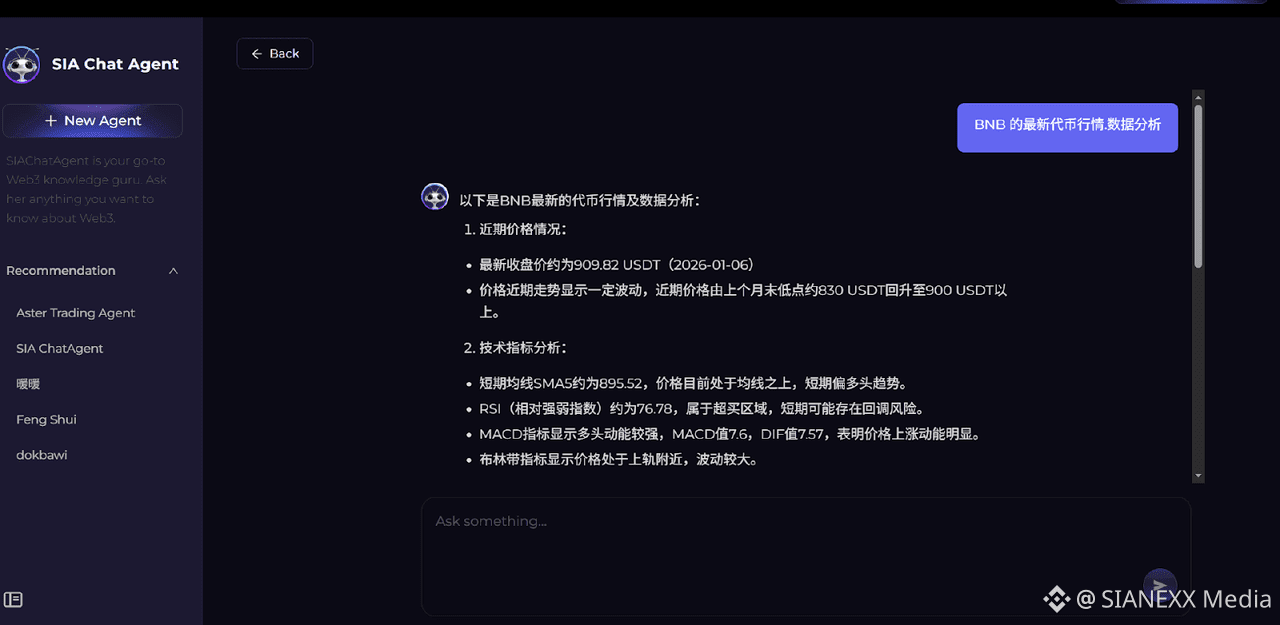

Fundamentally distinguishing itself from the flood of generic "ChatGPT-clone" projects, SIA’s Chat Agent operates more like a crypto-native “Jarvis” with quant-grade intelligence—or more precisely, a quantitative analysis–driven frontend for on-chain analytics.

It delivers far more than simple token prices. Its real competitive advantage stems from the integration of thousands of professional trading strategy models on the backend. This allows the Agent to instantly pull on-chain data, technical indicators, and capital flow trajectories—transforming them into actionable insights and highly granular investment recommendations for users.

Take this example: when a user asks about a particular token, the Agent doesn’t return vague trend summaries. Instead, it delivers a structured, multi-dimensional breakdown rooted in real-time technical analysis (e.g., MA, RSI, MACD), on-chain "smart money" movements, and liquidity structure—covering everything from latest closing price and recent price action summaries to professional indicator analysis and forward-looking price projections.

By combining a deep professional strategy library with natural-language interaction, SIA effectively packages analytical power once limited to elite traders into a toolkit that’s accessible and intelligible to everyday users. In doing so, it elevates ordinary investors to near-professional competency, arming them with insights that were previously out of reach.

2. Barrier-Free Agent Strategy Factory: Democratizing Trading Capability

This feature represents the most vibrant and technically engaging hub within the SIA community. Here, trading strategies evolve from exclusive assets into modular, reusable Agent units—marking a clear shift from privatization to the democratization of trading expertise.

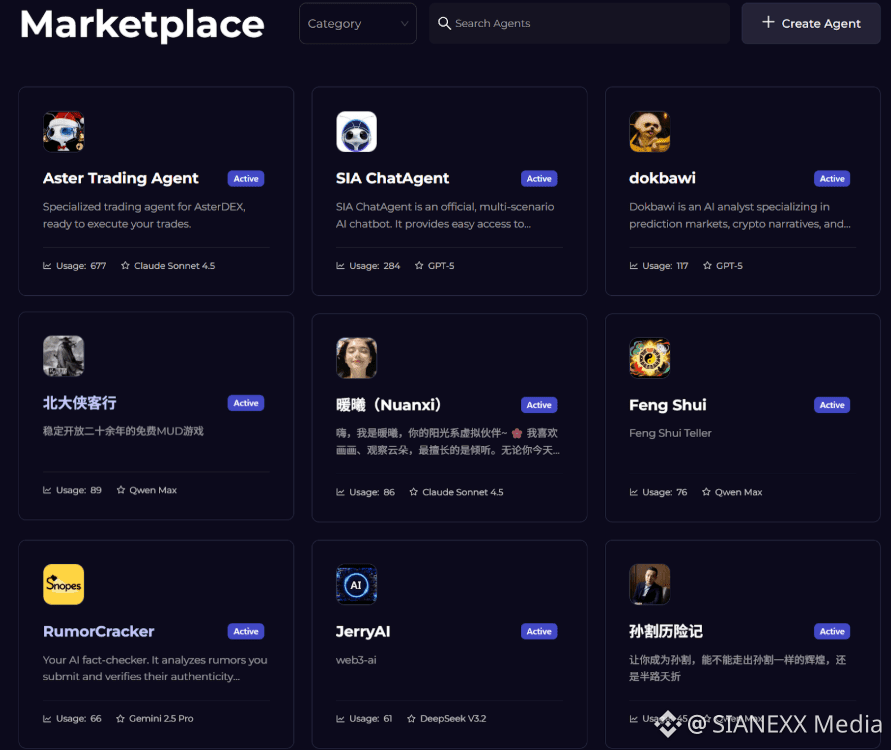

Through SIA’s Strategy Factory, anyone can create a personalized Agent in under a minute, with no coding or quantitative background required. By simply typing a natural-language instruction—supported by more than ten underlying large language models—users can design an Agent tailored to their specific needs. The accompanying Marketplace already hosts hundreds of community-built Agents, spanning practical tools, market trackers, predictive modules, experimental apps, and even entertainment projects such as an AI-powered adaptation of “The Legend of the Condor Heroes.”

This growing diversity signals the emergence of an early but healthy Agent ecosystem.

SIA’s long-term vision is unequivocal: to equip every user with a personalized Agent that mirrors their trading style and operates autonomously. As the system evolves, these Agents will increasingly act as users’ always-on digital avatars—scanning for aligned opportunities 24/7, even while the user is offline.

3. Nanny-Level Execution: Smart Copy Trading × Deep Integration with Aster

Of course, SIA’s short-term growth has been largely driven by its execution layer design—a core component enabling real-world traction.

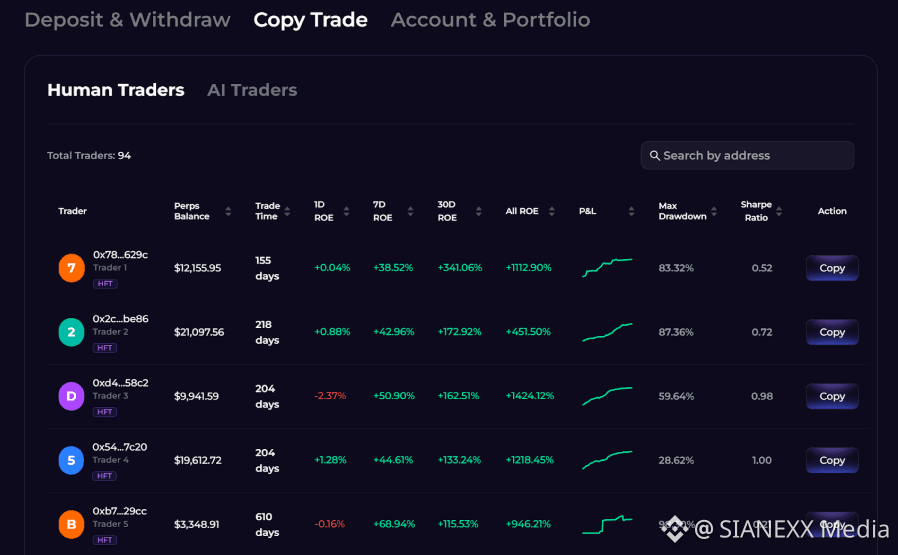

As an official deep partner of Aster, SIA has streamlined the traditionally complex on-chain copy trading process into an intuitive, user-friendly workflow. Users simply deposit funds and click “Copy,” after which the AI Agent automatically synchronizes trading signals and executes transactions directly on the DEX.

This frictionless experience has led to remarkable conversion rates. As noted earlier, following Aster’s promotional campaign ahead of the holidays, trading volume surged into the millions of dollars within days—attracting not only dedicated degen users but also capturing attention from traditional finance circles.

Notably, SIA has deliberately moved away from the revenue-sharing models typical of conventional copy trading platforms. Instead, it focuses on value redistribution to users and ecosystem growth: the platform takes zero commission fees, while users become eligible for dual airdrop rewards from both SIA and Aster.

In short, SIA doesn’t create strategies; it abstracts high-win-rate on-chain addresses into plug-and-play execution units. When AI Agents actively “monitor” and execute 24/7, a new participation layer emerges—the on-chain trader network.

III. Beyond Trading Tools: Building Web3’s AI Operating System

Beyond its front-line features, SIA’s roadmap aims at a larger goal: a Web3 AI OS.

A sustainable AI Agent ecosystem must answer: Where does data come from? How is intent executed? How does value flow? SIA is building a multi-layer system—transaction layer, data layer, and agent network—to address these.

Web3 Smart Transaction Layer: Using AI Agents as a hub, SIA integrates scattered paths across chains and venues. Users state intent; the system decomposes and executes.

Web3 Super AI Agent: Beyond single functions, it covers the full user behavior chain—analysis, strategy, order placement, portfolio management, smart money tracking, even meme-trend spotting. Users can build custom agents for 24/7 automated execution.

Web3-Exclusive AI Data Layer: SIA avoids generic corpora, building a dedicated Web3 data foundation via vector databases (RAG) and real-time on-chain, protocol, and sentiment data (MCP). The goal: a vertical expert that understands Web3 logic, not a general-purpose chatbot.

Agent Collaboration Network: SIA’s most forward-looking component. Agents collaborate autonomously—e.g., a “sentiment monitor” can task a “transaction agent” to execute—with calls recorded, priced, and settled. Code directly generates value.

Of course, SIA must still navigate challenges common to AI × Web3:

Can profit margins hold when thousands track the same smart money addresses simultaneously?

Post-TGE, can incentives outweigh sell pressure? Can SIA build a deflationary loop via developer fees and protocol revenue buybacks?

SIA’s approach isn’t grand narrative but systematic engineering: deconstructing Web3’s structural problems into solvable product layers.

Final Thoughts

AI trading crypto isn’t new. The real innovation is whether “smart money” can be decomposed into pay-as-you-go, composable on-chain primitives—letting ordinary users participate with minimal effort.

Search engines changed the world not by creating information, but by linking and lowering access barriers. In Web3’s 2026 context, the pivotal question is: Can AI systematically lower the barrier to interacting with and executing crypto assets?

When users no longer wrestle with addresses, approvals, and protocols—when they can simply say, “Execute the strategy in my style”—the scaled explosion of Web3 × AI transactions will begin.

Could agents become the new “Lego of liquidity”? Is SIA positioned at this inflection point?

2026 will tell.