In January 2026, Bitcoin remains the consensus "safer" and more established investment, while XRP is positioned as a higher-risk, higher-reward utility play with recent performance outstripping Bitcoin in short-term bursts.

1. Performance Comparison (As of 2026)

Market Trends: Bitcoin recently reached all-time highs above $126,000 before cooling, while XRP has surged as much as 20% since the start of 2026, trading near $2.40-$3.02.

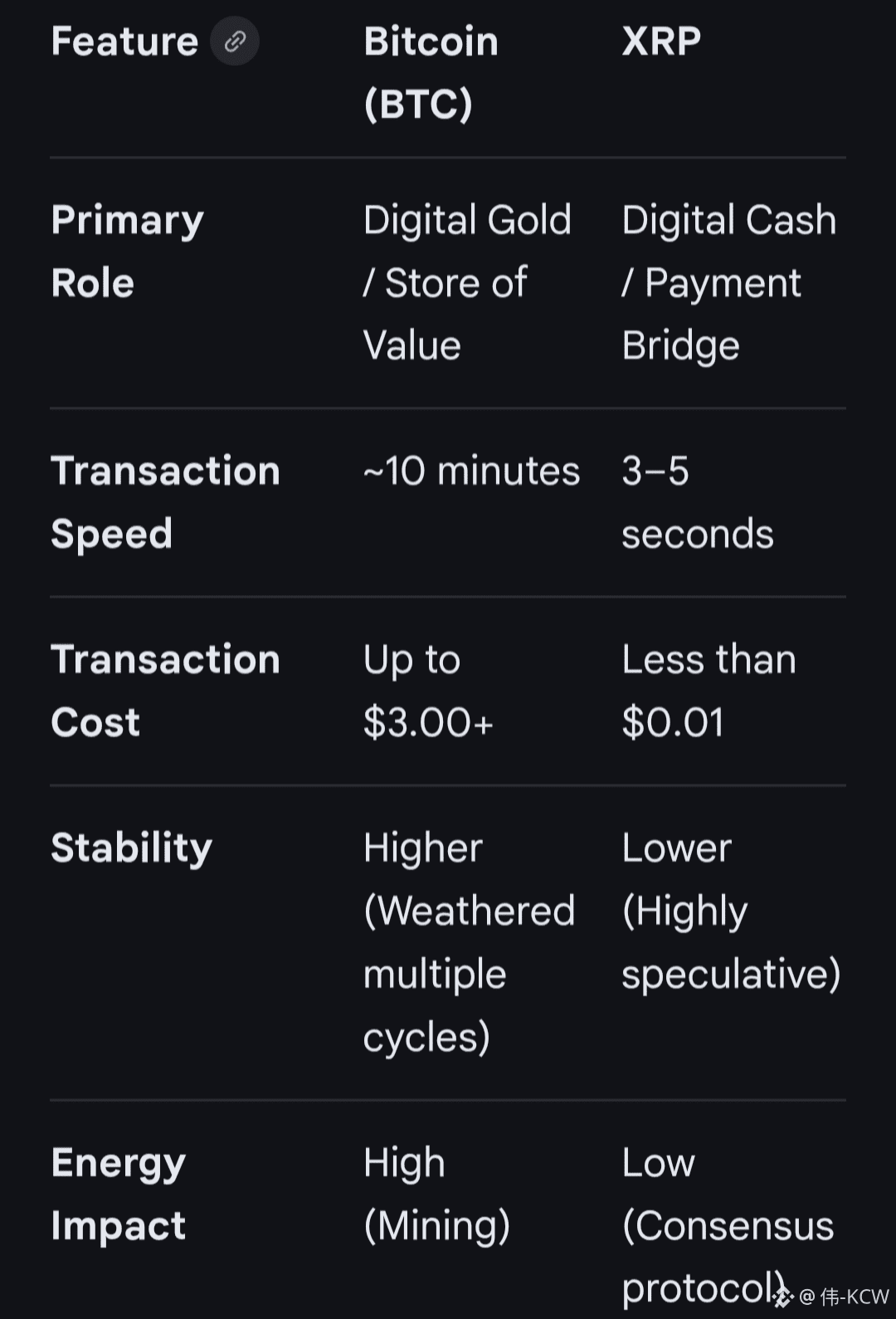

Volatility: Bitcoin is valued for its resilience and "digital gold" status. XRP has shown explosive short-term growth (e.g., rising 390% in late 2025 compared to Bitcoin's 83%) but remains more speculative.

2. Core Investment Theses

Bitcoin (The Store of Value):

Scarcity: Hard-capped at 21 million coins, creating a mathematical hedge against inflation.

Institutional Adoption: Bolstered by spot ETFs (e.g., iShares Bitcoin Trust) and its role as a potential U.S. strategic reserve asset.

Network: Uses Proof-of-Work, prioritizing maximum security and decentralization over transaction speed.

XRP (The Utility Play):

Use Case: Designed specifically for cross-border payments, offering settlement in 3–5 seconds with fees under $0.01.

Regulatory Clarity: XRP emerged from longstanding SEC litigation, which has allowed it to go "on the offensive" with new institutional partnerships.

Ecosystem: Heavily tied to Ripple Labs, which controls a significant portion of the supply in escrow.

3. Key Trade-offs

The Verdict: Bitcoin is widely recommended as the core of a crypto portfolio due to its proven longevity and institutional backing. XRP may be a "better buy" for those seeking a speculative growth play tied to the success of global fintech adoption, especially following the recent launch of XRP ETFs.

"SHARING IS CARING"

Disclaimers:Info and knowledge sharing.Not a financial advice.