The Unseen Bridge

The Unseen Bridge

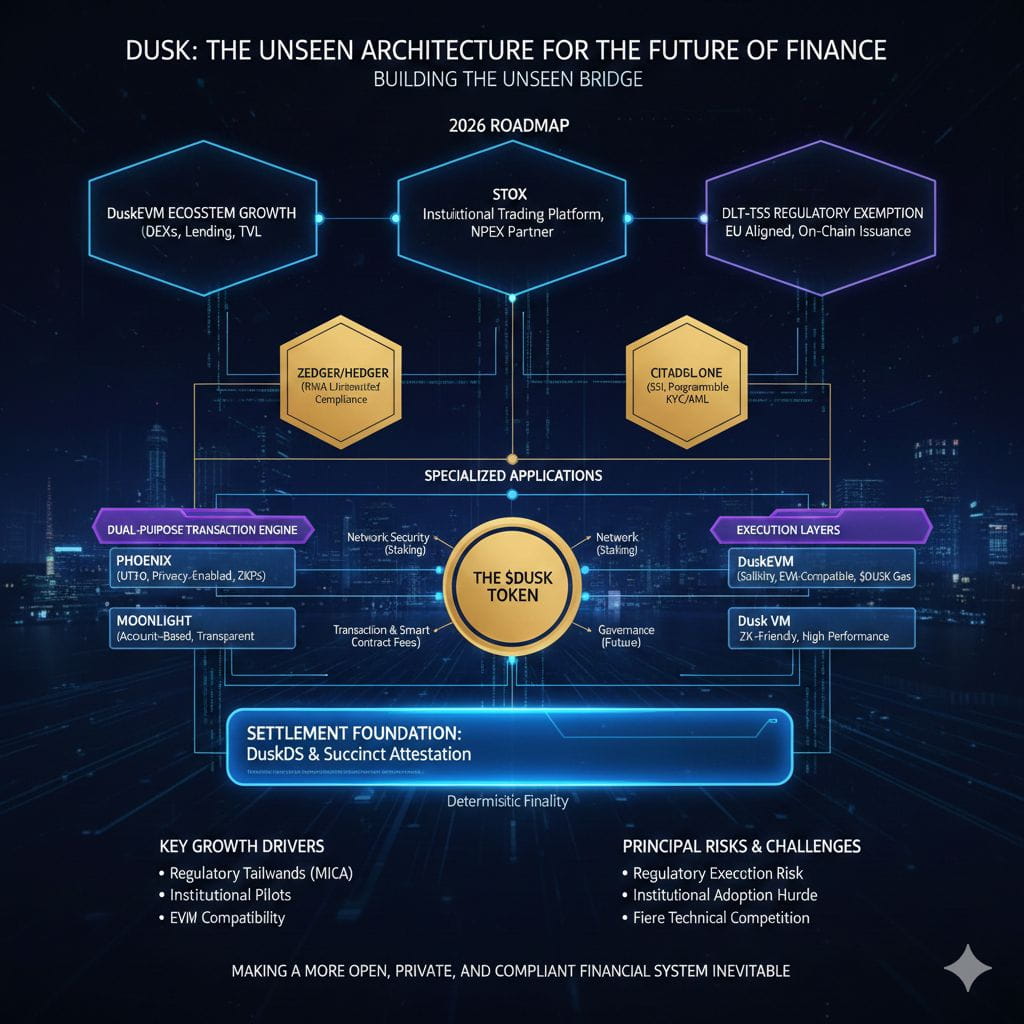

In the high-stakes arena of financial technology, a quiet revolution is building its foundation not on hype, but on architecture. The year is 2026, and the grand experiment of blockchain is undergoing its most critical stress test: the migration of the world's multi-trillion dollar regulated assets. For institutions, this shift presents a paralyzing paradox—how to leverage the efficiency of decentralization without sacrificing the privacy and compliance that are the bedrock of traditional finance. Public ledgers are too transparent; existing private networks are regulatory black boxes. Enter Dusk.

Founded in 2018, Dusk began with a clear, ambitious vision: to build a layer-1 blockchain purpose-built for regulated and privacy-focused financial infrastructure. Having recently shed its "Network" suffix in a strategic rebrand, Dusk now presents itself not merely as another blockchain, but as a corporate-grade financial institution built on cryptographic law. Its mission is audacious yet singular: to unlock economic inclusion by bringing institution-level assets directly to anyone's wallet. Dusk is building the unseen, indispensable rails upon which the future of regulated and decentralized finance will run.

The Core Conundrum: Bridging the Crypto-TradFi Gulf

The chasm between traditional finance (TradFi) and decentralized finance (DeFi) is defined by fundamental incompatibilities. TradFi operates within strict silos of privacy and regulatory oversight, burdened by fragmented liquidity, custodial risks, and slow settlement. DeFi offers transparency, self-custody, and global access, but at the cost of exposing sensitive financial data and struggling with regulatory acceptance.

Dusk identified this gulf as its primary market. Its solution is not to force one world to adopt the rules of the other, but to architect a new, unified landscape. This vision is underpinned by three non-negotiable pillars:

· Real-World Assets (RWAs) On-Chain: Creating a compliant bridge for stocks, bonds, and funds.

· Compliance by Design: Baking regulatory requirements into the protocol's foundation.

· Privacy as a Right: Using advanced cryptography to protect sensitive data.

For institutions, Dusk promises instant clearance and settlement, automated compliance, and access to consolidated global liquidity without the liability of holding user assets. For individual users, it grants unprecedented, self-custodied access to a diverse range of institutional assets directly from a wallet.

Deconstructing the Technological Moat: More Than Just Privacy

Dusk's competitive edge is not a single feature but a deeply integrated, modular stack engineered for institutional-grade performance.

The Settlement Foundation: DuskDS & Succinct Attestation

At its base lies DuskDS, the settlement and data availability layer. It is secured by Succinct Attestation (SA), a committee-based Proof-of-Stake consensus mechanism that provides deterministic finality in seconds. This eliminates the settlement uncertainty that plagues other blockchains—a critical feature for capital markets where timing and certainty are paramount.

The Dual-Purpose Transaction Engine

Dusk uniquely operates a dual transaction model, allowing applications to choose the right tool for the job:

· Phoenix: A UTXO-based, privacy-enabled system using zero-knowledge proofs (ZKPs) to fully conceal transaction amounts and participant identities.

· Moonlight: An account-based, transparent system designed for use cases requiring clear, auditable trails.

This flexibility allows a single platform to host a private securities exchange and a transparent public auction simultaneously.

The Execution Layers: Flexibility Meets Familiarity

Sitting atop DuskDS are specialized execution environments:

· DuskEVM: A fully EVM-equivalent Layer-2. This is Dusk's strategic bridge to mainstream adoption, allowing millions of Ethereum developers to deploy Solidity smart contracts using familiar tools while inheriting Dusk's underlying privacy and security. All gas fees are paid in $DUSK.

· Dusk VM: A highly optimized, ZK-friendly virtual machine for developers requiring the utmost performance and flexibility for building novel, privacy-focused applications from the ground up.

Specialized Applications: The Regulatory Toolkit

This powerful stack enables purpose-built applications:

· Zedger/Hedger: An advanced asset protocol designed for the full lifecycle management of security tokens (stocks, bonds, ETFs). It enforces compliance rules like investor accreditation and transfer restrictions directly within smart contracts, automating regulatory oversight.

· Citadel.one: A self-sovereign identity (SSI) protocol. It allows users to cryptographically prove personal attributes—such as being over 18 or an accredited investor—without revealing the underlying data. This enables programmable, privacy-respecting KYC and AML checks.

The 2026 Roadmap: From Infrastructure to Ecosystem

With its mainnet live and core technology maturing, Dusk's focus for 2026 is crystallized into three concrete, high-impact pillars aimed at transitioning from robust infrastructure to a vibrant, value-generating ecosystem.

1. DuskEVM Ecosystem Growth

The top priority is catalyzing a thriving financial economy. The business development team is aggressively onboarding decentralized exchanges (DEXs), lending protocols, asset management platforms, and other DeFi primitives. The goal is to create a composability flywheel, where each new application increases the utility and attractiveness of the entire network. Success here is measured by a growing Total Value Locked (TVL) and a diverse array of live applications.

2. STOX: The Flagship Trading Platform

Internally codenamed STOX, this is Dusk's proprietary, institutional-grade platform for trading regulated assets. Built on DuskEVM and leveraging the existing broker license of its strategic partner, the Dutch stock exchange NPEX, STOX aims to bring real-world assets like money market funds, equities, and bonds on-chain. It represents the most direct bridge for both traditional finance capital and DeFi-native liquidity to interact in a compliant marketplace.

3. The DLT-TSS Regulatory Exemption

Perhaps the most significant near-term catalyst is a joint application with NPEX for a specific Dutch regulatory exemption known as the DLT-TSS (Distributed Ledger Technology-Trading & Settlement System). Approval would grant a clear, compliant pathway for the native, on-chain issuance of financial instruments. This breakthrough would remove a major legal and operational hurdle, positioning Dusk and its partners at the forefront of Europe's regulated digital asset landscape.

The DUSK Token: Fueling the Financial Machine

The DUSK token is the indispensable utility fuel and security backbone of this entire architecture. With a maximum supply capped at 1 billion tokens, its emission follows a controlled, long-term schedule designed to align incentives between early builders and long-term network participants.

Primary Utilities:

· Network Security & Staking: Validators (known as Provisioners) must stake DUSK to participate in the Succinct Attestation consensus, securing the network and earning block rewards.

· Transaction & Smart Contract Fees: Every computational step, asset transfer, and compliance check on the Dusk blockchain—whether on the base DuskDS layer or the DuskEVM—consumes DUSK as gas.

· Governance: In the future, token holders will guide the protocol's evolution through a decentralized governance system, voting on key upgrades and parameters.

Value Accrual Thesis: The DUSK token's fundamental value is directly tied to real economic activity on the network. As assets are issued on STOX, traded on DEXs, or used as collateral in lending protocols, every action generates demand for DUSK to pay fees. This creates a powerful, demand-driven economic model where growth in the ecosystem's financial throughput directly correlates to token utility.

A Balanced Outlook: Catalysts and Caveats

Dusk operates at the complex intersection of cutting-edge cryptography and global finance regulation. Its path forward is illuminated by significant catalysts but also shadowed by inherent risks that require careful navigation.

Key Growth Drivers

· Regulatory Tailwinds: The final implementation of the European Union's Markets in Crypto-Assets (MiCA) regulation is creating the legal clarity Dusk was architecturally designed to meet. This framework could turn Dusk's compliance-by-design approach from a niche feature into a major competitive advantage.

· Institutional Pilots & Partnerships: Concrete, production-level integrations with regulated entities like NPEX serve as critical proofs-of-concept. Success here can unlock credibility and trigger a wave of adoption from other financial institutions seeking a compliant on-ramp to digital assets.

· EVM Compatibility: The launch and maturation of DuskEVM dramatically lowers the barrier to entry for the world's largest pool of blockchain developers. This accessibility is crucial for fostering the rapid innovation and liquidity essential for ecosystem health.

Principal Risks and Challenges

· Regulatory Execution Risk: While the direction of travel is clear, the final technical standards and implementation details of frameworks like MiCA remain in flux. Unexpected regulatory requirements could impact deployment timelines or necessitate protocol adjustments.

· Institutional Adoption Hurdle: Convincing large, conservative financial institutions to migrate core processes to a new technological paradigm is a marathon, not a sprint. Sales cycles are long, and competition from both other blockchains and legacy service providers is intense.

· Fierce Technical Competition: The RWA and institutional blockchain sector is becoming increasingly crowded. Dusk must continuously execute on its technical roadmap and clearly communicate its architectural superiority to maintain its edge against well-funded competitors.

Market Dynamics & Positioning

Early 2026 saw DUSK's token price surge by over 500%, driven by the successful mainnet launch and the NPEX partnership announcement. This volatility highlights both the significant market interest in Dusk's thesis and the speculative nature of the current crypto market. While technical indicators suggested the rally entered an overbought phase, the underlying narrative remains strong: Dusk is one of the few projects simultaneously achieving technical maturity, regulatory alignment, and institutional validation.

Conclusion: Building the Inevitable

Dusk is not chasing speculative trends. It is meticulously constructing the essential infrastructure for a future where digital asset ownership is global, private, and seamlessly integrated with the rule of law. Its evolution from "Dusk Network" to simply "Dusk" signifies a profound shift—from a technology project to a foundational financial institution.

The promise of Dusk is a world of radical financial inclusion and efficiency: where a retiree can self-custody a share of a private equity fund from another continent, where billion-dollar bond transactions settle in seconds without counterparty risk, and where every individual's financial data is protected by unbreakable cryptography.

This vision is not built on hype, but on layers of mathematical certainty and regulatory foresight. In the grand narrative of finance's digital transformation, Dusk is writing the foundational code. It is building the unseen bridge, and in doing so, is making a more open, private, and compliant financial system not just possible, but inevitable.@Dusk $DUSK #dusk