#

Solana ($SOL SOL): A Bright Future — Growth, Whales & Market Trends

Solana (SOL) has become one of the most talked-about cryptocurrencies in 2024–2026, widely recognized for its high-performance blockchain, fast transactions, strong on-chain adoption, and institutional interest. Its price history shows significant volatility, but also resilience and long-term growth potential.

---

🌱 1. Solana’s Growth Journey So Far

Since its launch in 2020, Solana has experienced dramatic price movements — from sub-$1 levels to multi-hundred dollar valuations, even surpassing $250 in strong market cycles. Its price has reflected both market sentiment and network adoption.

🔹 Solana’s ability to process thousands of transactions per second with extremely low fees has helped it attract developers, DeFi apps, NFTs, and institutional interest.

🔹 The integration of major exchange futures, DeFi ecosystems, and tools has pushed both liquidity and user growth.

This historic chart tells the longer-term story: rapid adoption, steep swings, dips, and recoveries — typical of major crypto assets with real ecosystem utility.

---

🐋 2. Whales & Big Investors — How They Impact Solana’s Future

Large holders (commonly known as whales) have played a notable role in Solana’s market behavior:

📌 Key Whale Activity Patterns

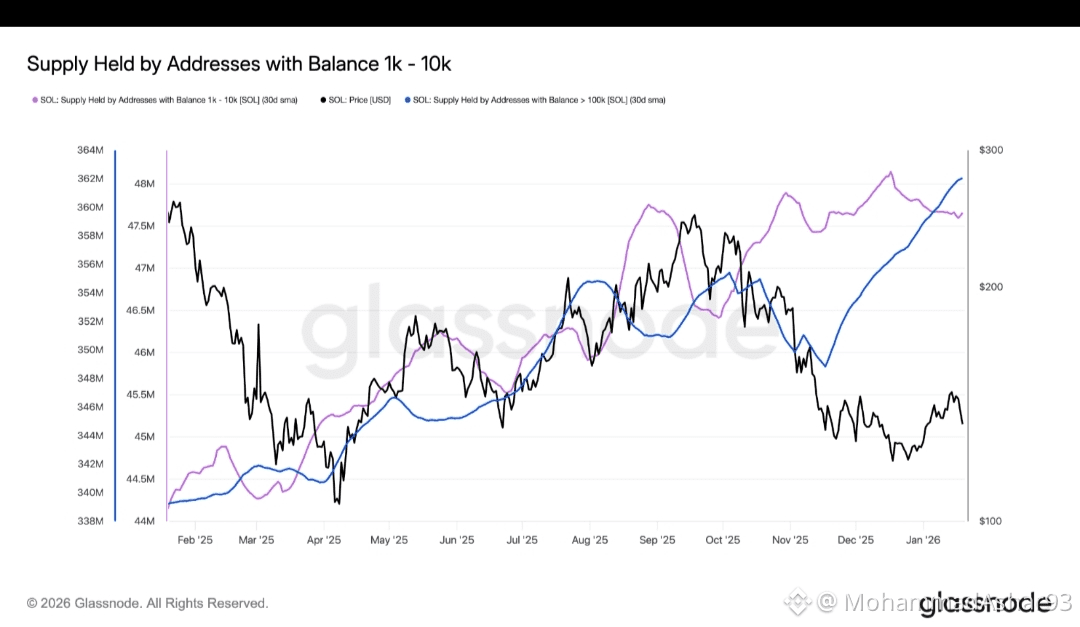

✔ Large wallets accumulating tens of thousands of SOL tokens suggests confidence in Solana’s long-term growth — not just short-term trading.

✔ Some addresses moved millions worth of SOL into staking or DeFi platforms, reducing sell pressure and increasing demand-side strength.

✔ On-chain data shows whale accumulation periods often precede price rallies as supply reduces on exchanges.

This accumulation by whales and long-term holders can be a bullish signal because it suggests confidence in Solana’s technology, ecosystem, and future demand.

📈 3. Recent Price & Market Momentum

Even when SOL prices dip or consolidate, technical indicators often hint at potential rebounds:

Recent charts show Solana finding support around key price zones and forming patterns that historically precede recoveries.

Exchange outflows (solana leaving exchanges into private wallets or staking contracts) show holders are reducing available supply — a bullish supply-side signal.

Long-term trend lines still point to growth environments when market cycles turn bullish.

🚀 4. Why Solana’s Future Could Be Bright

Here are the key fundamentals behind Solana’s growth prospects:

🔹 High Throughput & Low Fees

Solana’s tech keeps attracting DeFi, NFTs, and high-frequency applications that struggle on slower blockchains.

🔹 Institutional Interest

Growing flows into Solana-linked ETFs and private holdings suggest more traditional investors are building exposure.

🔹 Ecosystem Expansion

More developers, dApps, and real-world integrations are fueling total value locked (TVL) and developer activity.

🔹 Strategic Whale Accumulation

Long-term whale buying and staking reflects confidence in Solana not just as a token, but as a foundational blockchain.

🔹 Potential Regulatory Tailwinds

Developments like regulated futures and ETF support in some regions could open doors to more institutional capital

📊 5. Price Outlook & What Investors Watch

Note: These are projections, not financial advice.

Analysts and prediction models suggest multiple scenarios depending on market direction:

Bullish Scenario: If adoption continues and institutional flows increase, Solana could attract major inflows and revisit multi-hundred to possibly thousand-dollar levels.

Moderate Growth: Continued ecosystem expansion could keep $SOL trading in a strong range with gradual price appreciation.

Volatility Remains: Crypto markets are inherently volatile; price swings and corrections are still likely.

While price forecasts vary, many models see Solana’s potential tied directly to real adoption, ecosystem usage, and broader crypto market cycles.