As we move through 2026, the blockchain industry's long-hyped convergence with traditional finance is no longer a distant promise but an operational reality. At the forefront of this shift is Dusk Network, a project that has decisively transitioned from a visionary whitepaper to a live, production-ready Layer 1 blockchain. After six years of foundational development, Dusk's mainnet launch in January 2026 marked a pivotal inflection point, transforming it from a "tech experiment" into genuine "financial infrastructure". Dusk is not just another smart contract platform; it is a purpose-built public ledger designed to solve the core paradox facing institutional adoption: how to leverage blockchain's efficiency without sacrificing the confidentiality and compliance that regulated finance demands. By ingeniously blending zero-knowledge cryptography with regulatory frameworks, Dusk is establishing itself as the definitive core for the booming Real-World Asset (RWA) sector, reshaping the future of decentralized finance (DeFi) and its integration with Traditional Finance (TradFi).

As we move through 2026, the blockchain industry's long-hyped convergence with traditional finance is no longer a distant promise but an operational reality. At the forefront of this shift is Dusk Network, a project that has decisively transitioned from a visionary whitepaper to a live, production-ready Layer 1 blockchain. After six years of foundational development, Dusk's mainnet launch in January 2026 marked a pivotal inflection point, transforming it from a "tech experiment" into genuine "financial infrastructure". Dusk is not just another smart contract platform; it is a purpose-built public ledger designed to solve the core paradox facing institutional adoption: how to leverage blockchain's efficiency without sacrificing the confidentiality and compliance that regulated finance demands. By ingeniously blending zero-knowledge cryptography with regulatory frameworks, Dusk is establishing itself as the definitive core for the booming Real-World Asset (RWA) sector, reshaping the future of decentralized finance (DeFi) and its integration with Traditional Finance (TradFi).

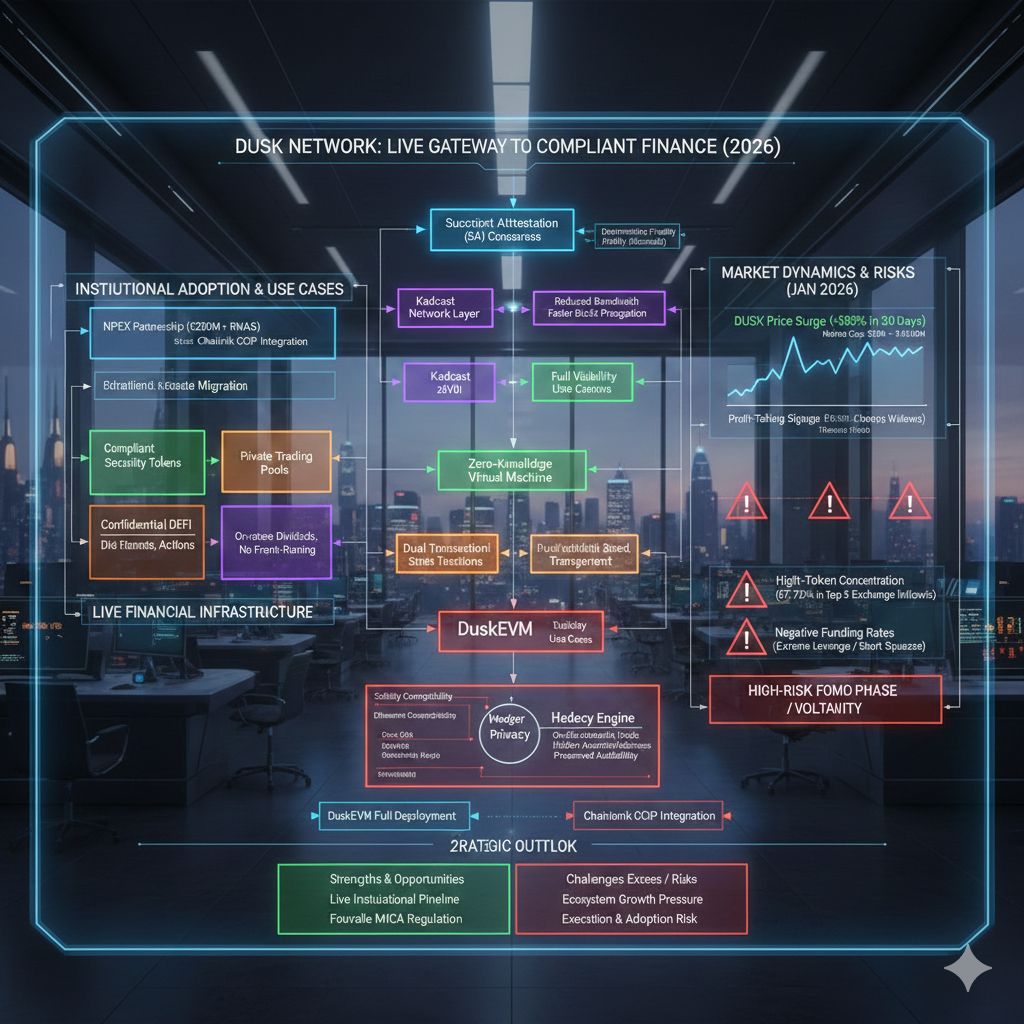

🔐 The Technical Engine: How Dusk Enables Compliant Privacy

Dusk's architecture is a modular stack engineered from the ground up for regulated finance, achieving what most blockchains cannot: "auditable privacy." This means transactions and smart contracts are private by default, yet designed for selective disclosure to authorized entities like regulators.

Core Technical Pillars:

· DuskEVM (The Application Layer): Launched in Q1 2026, this is a fully EVM-compatible layer that allows developers to write in Solidity and seamlessly migrate Ethereum dApps. Its killer feature is the Hedger privacy engine, which lets any transaction switch to confidential mode with one click, hiding amounts and addresses while preserving auditability.

· Zero-Knowledge Virtual Machine (zkVM): Unlike retrofitted solutions, Dusk runs smart contracts on a purpose-built zkVM optimized for confidential state transitions and financial cryptography.

· Dual Transaction Model: Applications can choose between two native frameworks:

· Phoenix: A UTXO-based, zero-knowledge system for fully confidential settlements.

· Moonlight: An account-based, transparent system similar to Ethereum for use cases requiring full visibility.

· Succinct Attestation (SA) Consensus: This Proof-of-Stake variant provides deterministic finality in seconds, a non-negotiable requirement for financial settlement, eliminating the uncertainty of probabilistic finality.

· Kadcast Network Layer: Replaces inefficient gossip protocols, reducing bandwidth usage by 25-50% and enabling faster, more reliable block propagation.

🏛️ From Theory to Reality: Use Cases and Institutional Adoption

Dusk's 2026 narrative is powerfully driven by tangible institutional adoption, moving beyond speculation into demonstrable utility.

· Flagship Partnership: Tokenizing €200M+ with NPEX and Chainlink: Dusk's most significant validation is a partnership with NPEX, a fully regulated Dutch stock exchange, and oracle provider Chainlink. This collaboration aims to bring over €200 million in real-world equities and securities on-chain as compliant, tokenized assets. The integrated dApp is slated for launch in Q1 2026.

· Core Use Cases Enabled:

· Compliant Security Tokens: The native framework for issuing and managing programmable digital assets like bonds, funds, and private equity that meet compliance standards.

· Confidential DeFi: Enables private trading and liquidity pools where institutions can participate without exposing their strategies to front-running.

· On-Chain Corporate Actions: Automates dividends, shareholder voting, and other governance events through smart contracts.

📈 Market Meteoric Rise and Associated Risks

The market's response to Dusk's operational milestones has been explosive, reflecting both high confidence and high stakes.

· Unprecedented Price Surge: In January 2026, the DUSK token became the best-performing privacy asset, with gains exceeding 583% in 30 days, breaking a year-long downtrend and reaching a 12-month high. Its market capitalization soared from around $20 million to over $130 million.

· A Market at a Crossroads: This vertical price action has shifted the rally's driver from fundamental breakout to speculative momentum. Analysts widely warn that the market has entered a high-risk FOMO (Fear Of Missing Out) phase, characterized by emotional trading and overbought conditions. Key risk indicators include:

· High Token Concentration: The top five wallet addresses control 67.72% of the DUSK supply, posing a centralization risk.

· Profit-Taking Signals: A spike in token inflows to exchanges suggests early investors may be preparing to sell.

· Negative Funding Rates: Perversely, this can act as fuel for a continued rally by forcing short sellers to cover their positions, but it also highlights extreme market leverage.

⚖️ Strategic Analysis: Weighing the 2026 Outlook

Strengths and Opportunities:

· First-Mover in a Critical Niche: Dusk uniquely occupies the intersection of zero-knowledge privacy, full EVM compatibility, and regulatory compliance, a triad essential for institutional onboarding.

· Live Institutional Pipeline: The NPEX partnership is a working proof-of-concept that validates its business model and can attract other regulated entities.

· Favorable Regulatory Tailwinds: Its "compliant privacy" model aligns perfectly with evolving frameworks like the European Union's Markets in Crypto-Assets (MiCA) regulation.

Challenges and Risks:

· Speculative Excess: The extreme price surge and FOMO dynamics create a volatile environment where the token is vulnerable to a sharp correction, which could temporarily overshadow technological progress.

· Ecosystem Growth Pressure: Success now hinges on rapidly attracting developers to build on DuskEVM beyond its flagship partner, transitioning from a single-use chain to a vibrant multi-application ecosystem.

· Execution and Adoption Risk: The ultimate test is whether the NPEX dApp and subsequent initiatives successfully onboard the promised hundreds of millions in assets, generating sustainable network fees and utility.

🔮 The Road Ahead: What's Next for Dusk?

The immediate roadmap for 2026 focuses on leveraging its new technical foundation for growth:

· Full deployment and adoption of DuskEVM to attract Ethereum developers.

· Successful launch of the NPEX-regulated dApp, bringing the first tranche of real-world assets on-chain.

· Continued integration with Chainlink's Cross-Chain Interoperability Protocol (CCIP) to enable secure movement of assets across blockchains.

💎 Conclusion: The Infrastructure for Finance's New Era

Dusk Network has entered 2026 not as a promise, but as a live, functioning protocol with a validated market fit. It has successfully engineered a public blockchain that respects the confidentiality mandates of global finance while being built for regulatory collaboration. The project stands at a critical juncture, having bridged the gap from visionary development to real-world utility.

The narrative for the coming year will be defined by execution and adoption. Dusk must now demonstrate that its groundbreaking technology can support scalable ecosystem growth, translate institutional partnerships into sustained on-chain activity, and navigate the speculative waves its own success has generated. If it succeeds, Dusk will cement its role not merely as another blockchain, but as the private, programmable foundation for the next era of institutional finance.

To explore specific areas in more detail, you might want to look into:

· The technical mechanics of the Hedger privacy engine within DuskEVM

· A deeper analysis of the competitive landscape in the RWA tokenization sector

· The specific regulatory implications and challenges of its "auditable privacy" model under MiCA @Dusk $DUSK #dusk