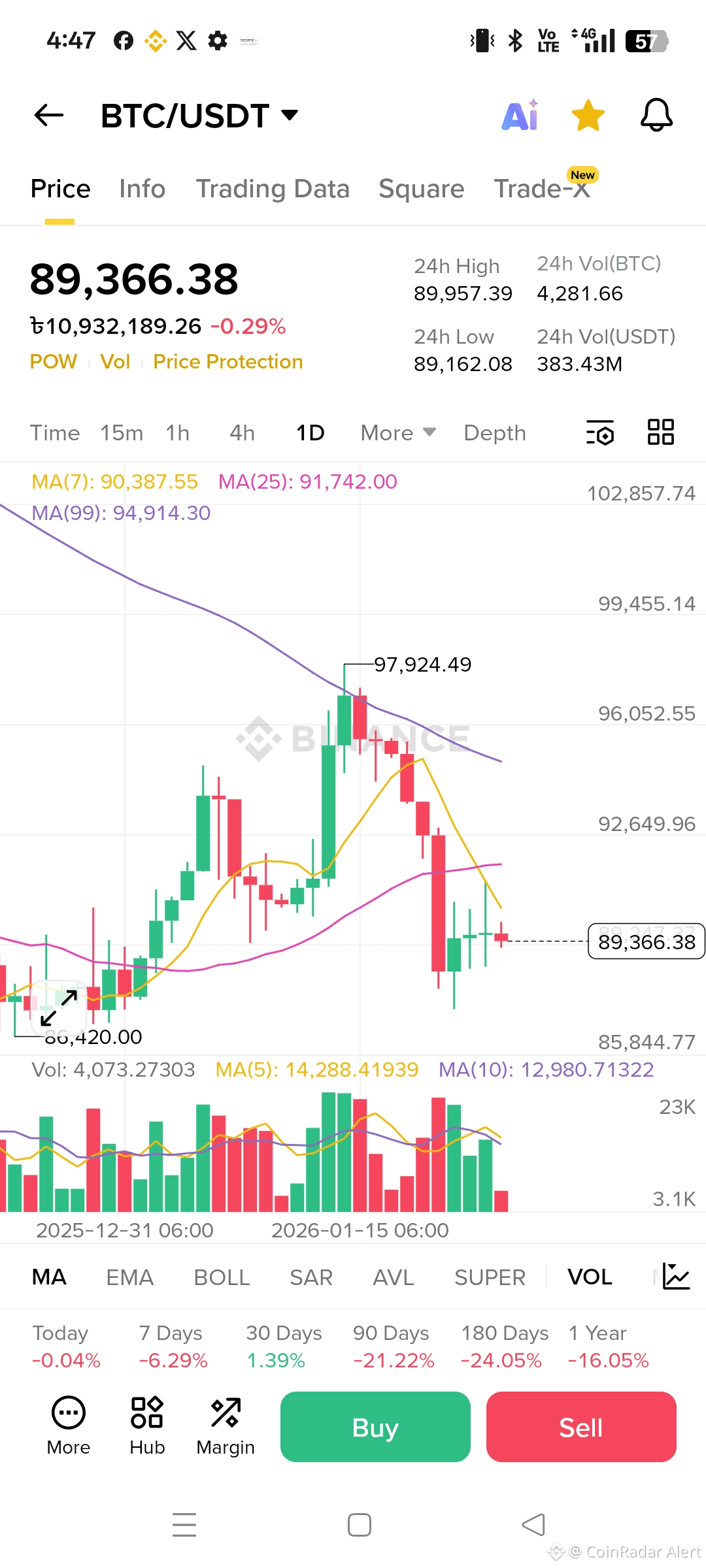

On the daily chart, Bitcoin is navigating a classic macro pullback after topping out near that 97.9k level, and right now it's sitting under the 7-day and 25-day moving averages, which means short-term pressure is still leaning bearish. But here's the key: price is stubbornly holding above this critical demand zone around 88k to 89k, with those long lower wicks popping up repeatedly—clear evidence that buyers are stepping in aggressively to defend it. This setup screams distribution phase turning into a correction, and potentially laying the groundwork for a proper base rather than a full-blown collapse. It's not the moment to chase momentum; it's a textbook support-based long where the smart money tends to accumulate quietly.

For the highest-probability long trade plan, scale in carefully around the primary entry zone of 88,800 to 89,300—that's where the risk-reward shines brightest if you catch it with some conviction. If it dips a bit more aggressively, look to buy even lower in the 87,800 to 88,200 area, but only on strong bullish rejection wicks showing up on the 4-hour or daily candles to confirm buyers aren't just dipping their toes.

Protect the trade rigorously with a strict stop loss at 86,900—anything like a daily close below that level kills the bullish thesis and means it's time to stand aside without second-guessing.

Your upside targets are stacked logically: first, aim for TP1 around 91,000, which lines up with the range midpoint and a reclaim of the MA7 for some initial relief. Then push toward TP2 in the 93,000 to 94,000 zone, where the MA25 and broader structure come into play as resistance. If momentum really builds and we get acceptance higher, extend to TP3 near 97,000 to 98,000 to tag that previous high and the lingering supply area. Entering below 89.2k gives you the cleanest risk-reward profile overall.

Before pulling the trigger, run through this confirmation checklist and wait for at least two solid signals: a bullish close above 89k on the 4-hour or daily, those long lower wicks defending near 88k, increasing volume on the green candles as buyers commit, and no aggressive rejection or breakdown below 88k. Skip it entirely if you see a daily close under 87k, heavy sell volume smashing through 88k, or any fast impulsive drop without proper consolidation—those are classic traps for chasing.

Bottom line, #BTC is sitting in a genuine buy-the-fear zone right now, not some euphoric breakout. The sharpest traders build positions at supports like this, not by piling into green candles out of FOMO. Stay disciplined, respect the levels, and let the price action prove the reversal before going all in.