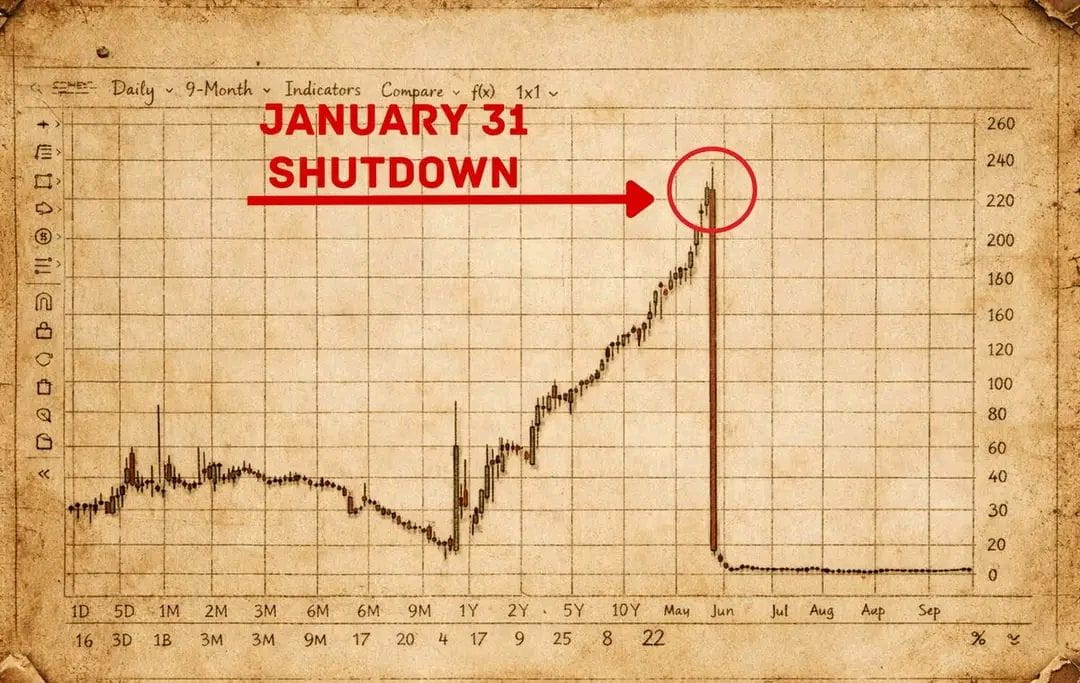

🚨 POTENTIAL U.S. GOVERNMENT SHUTDOWN RISK — MARKETS ARE WATCHING CLOSELY

Market participants are increasingly focused on rising shutdown risk heading into the end of January.

Prediction markets are signaling elevated probabilities, reflecting growing uncertainty around federal funding negotiations.

Why This Matters:

A Government Shutdown Is Not Just A Political Event.

It Directly Impacts Economic Activity And Market Confidence.

Historical Context Shows:

• Federal Operations Slow Or Halt

• Paychecks And Contracts Are Delayed

• Government Data Releases Are Interrupted

• Business And Consumer Confidence Weakens

Where The Risk Is Coming From:

Ongoing Budget Negotiations Remain Fragile.

Key Funding Bills Face Heightened Political Pressure.

Any Delay In Critical Appropriations Can Trigger A Shutdown Clock.

Markets Tend To React In Stages:

→ Bonds Often Move First

→ Equities React With A Lag

→ Crypto And Risk Assets Can See Sharp Volatility

The Key Point:

This Is Not A Forecast.

It Is A Risk Scenario That Markets Are Beginning To Price In.

Periods Of Political Uncertainty Often Create Liquidity Shifts Before Headlines Fully Catch Up.

Staying Informed And Risk-Aware Matters More Than Reacting To Noise.

Watch Policy Developments.

Watch Liquidity.

Watch Market Structure.$BTC

#GrayscaleBNBETFFiling #ETHMarketWatch #BTCVSGOLD #CPIWatch #MarketRebound