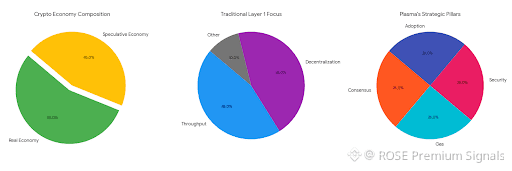

Plasma enters the market at a moment when crypto’s real economy is finally overtaking its speculative one. While most Layer 1s still chase generalized throughput and abstract decentralization ideals, Plasma targets the only use case that has consistently grown across every market cycle: stablecoin settlement. That focus reshapes everything, from consensus design to gas mechanics, from security anchoring to institutional adoption strategy. Plasma isn’t trying to be the best blockchain. It’s trying to be the most indispensable monetary rail. And in crypto, controlling settlement is how empires are built.

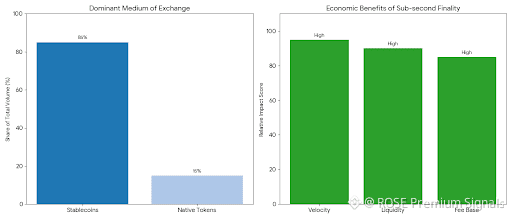

At the heart of Plasma is a fundamental observation that many blockchain architects still avoid: stablecoins have already become crypto’s dominant medium of exchange, store of value, and unit of account. In real transactional volume, stablecoins dwarf native tokens by orders of magnitude. On-chain data consistently shows that USDT and USDC flows represent the majority of economic activity, particularly in high-inflation economies, capital-controlled regions, and cross-border trade corridors. Plasma’s architecture treats this not as a side effect, but as the core design constraint. Every protocol decision flows from the assumption that stablecoins are the money, and everything else is infrastructure.

The decision to combine full EVM compatibility via Reth with PlasmaBFT sub-second finality reflects a pragmatic rather than ideological approach. Reth ensures immediate developer portability, allowing existing DeFi, payments, gaming, and oracle systems to migrate without rewriting their logic. PlasmaBFT, meanwhile, acknowledges a hard truth: financial systems do not tolerate probabilistic settlement. Sub-second finality is not a performance upgrade; it’s a behavioral unlock. Traders adjust leverage, arbitrage bots change latency strategies, and payment processors eliminate risk buffers. Settlement speed directly rewires economic behavior. When transfers feel instant, users transact more, settle smaller balances, and hold less idle capital. That increases velocity, which in turn expands fee bases and liquidity depth across the ecosystem.

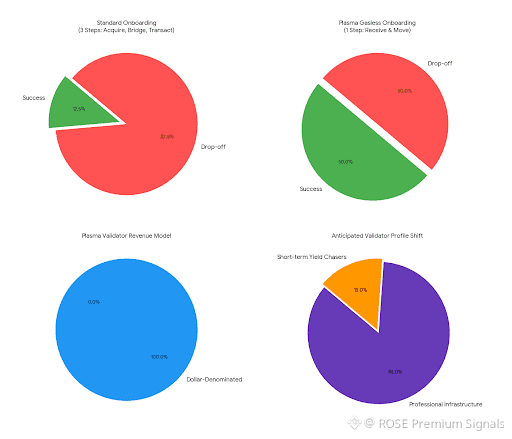

Gasless USDT transfers may look like a user experience trick, but they represent a deeper shift in who bears transaction costs. By abstracting gas away from the end user and denominating fees directly in stablecoins, Plasma collapses one of crypto’s biggest friction points: native token acquisition. This subtly rewires onboarding funnels. Today, onboarding into most blockchains requires three steps: acquire native token, bridge, then transact. Plasma reduces that to one: receive stablecoins and move. On-chain metrics already show that each onboarding step halves conversion rates. By eliminating native gas dependency, Plasma directly expands its total addressable user base, especially among non-speculative participants.

Stablecoin-first gas also realigns validator incentives. Instead of earning volatile native emissions, validators receive dollar-denominated revenue. That shifts their risk profile, capital strategy, and even jurisdictional compliance posture. Stable fee income allows validators to operate with lower leverage and longer planning horizons, encouraging professional infrastructure providers rather than short-term yield chasers. Over time, this produces a validator set that resembles financial infrastructure more than crypto mining pools, which materially improves uptime, reliability, and regulatory durability.

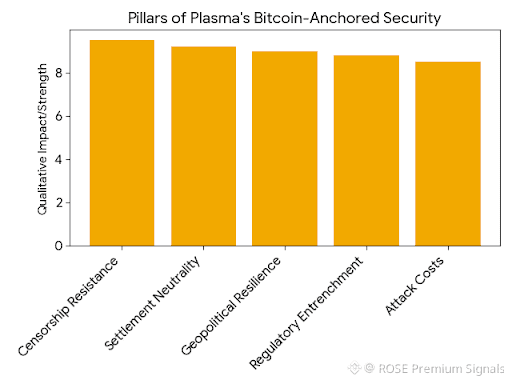

Bitcoin-anchored security is Plasma’s most understated weapon. Rather than chasing maximum theoretical decentralization, Plasma borrows finality assurance from the most battle-tested consensus layer in existence. Anchoring state to Bitcoin doesn’t just raise attack costs; it reshapes geopolitical risk. Bitcoin’s mining distribution, jurisdictional spread, and regulatory entrenchment give Plasma a censorship resistance profile that no new chain can realistically bootstrap. This anchoring quietly positions Plasma as a neutral settlement layer in a world where regulatory pressure is fragmenting blockchain geography.

That neutrality matters deeply for stablecoins. Stablecoin issuers increasingly operate under regulatory scrutiny, capital controls, and geopolitical tensions. A settlement network anchored to Bitcoin allows issuers and payment institutions to route flows through an infrastructure that no single jurisdiction can easily coerce. Over time, this makes Plasma not just a technical platform, but a geopolitical hedge for global finance. Institutions don’t migrate to chains for yield. They migrate for resilience.

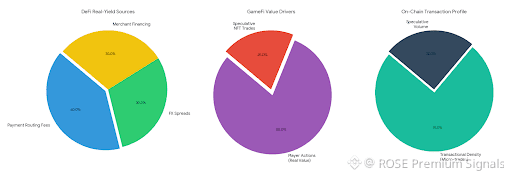

In DeFi, Plasma’s design destabilizes the traditional yield model. When gas becomes negligible and settlement becomes instantaneous, liquidity providers can operate with far tighter spreads. This compresses yields across AMMs, forcing protocols to innovate beyond inflationary incentives. Expect a rise in real-yield protocols based on payment routing fees, FX spreads, and merchant financing rather than token emissions. On-chain analytics would likely reveal declining speculative transaction volume but rising transactional density—more trades, smaller sizes, faster cycles. That’s the signature of financial maturity, not speculation.

GameFi economies also shift under Plasma’s architecture. Sub-second settlement enables true microtransaction gameplay loops, where every in-game action becomes a real economic event without latency friction. This allows developers to build economies where player actions, not speculative NFT trades, generate real value flows. Stablecoin-native gas allows in-game payments without forcing players to understand blockchain mechanics. The result is GameFi that feels like gaming, not DeFi cosplay. Metrics here would show rising transaction counts but declining median transaction sizes, a hallmark of consumer-grade adoption.

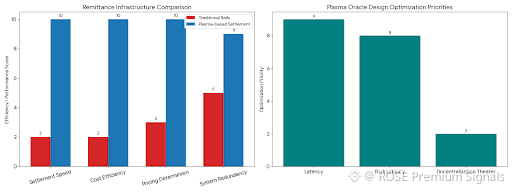

Oracle design evolves in tandem. Faster settlement and stablecoin-dominated flows mean that price feeds and liquidity metrics must operate at higher frequencies with tighter error tolerances. Plasma’s architecture incentivizes oracle providers to optimize for latency and redundancy rather than sheer decentralization theater. Over time, this favors professional data infrastructure over hobbyist networks, mirroring the maturation seen in traditional financial data markets.

Perhaps Plasma’s most disruptive impact lies in cross-border payments. Today’s remittance rails remain slow, opaque, and expensive despite decades of fintech innovation. Stablecoins already bypass these constraints, but their reliance on volatile gas and congested networks introduces unpredictability. Plasma’s stablecoin-native settlement allows remittance providers to offer near-instant, near-zero-cost transfers with deterministic pricing. In emerging markets, this could collapse informal hawala networks and disrupt local banking monopolies. On-chain flows would likely show rising corridor volumes between inflation-prone economies and stable reserve jurisdictions, mapping a new geography of money.

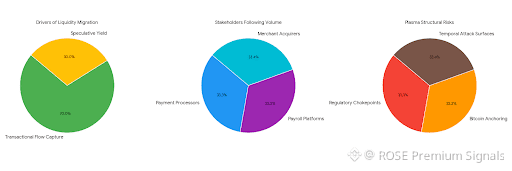

Capital flows reveal early signals. As stablecoin velocity increases on Plasma, liquidity providers will migrate not for speculative yield, but for transactional flow capture. Payment processors, payroll platforms, and merchant acquirers follow volume, not narratives. Once stablecoin settlement consolidates, DeFi liquidity naturally follows. This reverses the traditional bootstrap model, where speculative capital arrives first. Plasma’s growth curve will look slow, then vertical—because financial networks compound non-linearly.

There are risks. Stablecoin-centric design exposes Plasma to regulatory chokepoints. Issuer compliance decisions could ripple through the network. Bitcoin anchoring introduces settlement finality trade-offs. Sub-second PlasmaBFT must harmonize with Bitcoin’s slower cadence without creating temporal attack surfaces. These tensions will define Plasma’s engineering roadmap. But these are structural risks, not existential ones. They are the cost of building real financial infrastructure rather than speculative playgrounds.

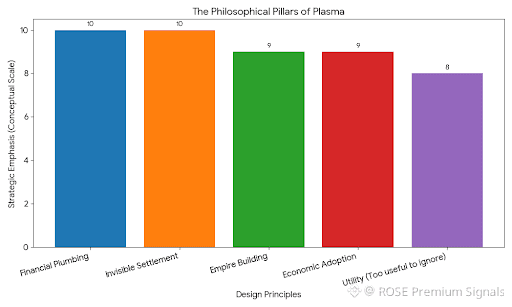

The deeper shift Plasma represents is philosophical. Crypto has spent fifteen years building financial instruments. Plasma is building financial plumbing. Instruments generate hype. Plumbing generates empires. When settlement becomes invisible, instant, and ubiquitous, it stops being noticed—and becomes indispensable. That’s how SWIFT, Visa, and Fedwire achieved dominance. Plasma’s design suggests its architects understand that the real war in crypto is not about decentralization metrics, throughput charts, or modularity debates. It is about owning the base layer where money actually moves.

If the next decade of crypto is defined by real economic adoption rather than speculative cycles, Plasma is positioned not as a contender, but as a gravitational center. The chains that win are not the ones with the loudest communities, but the ones that quietly become too useful to ignore. Plasma is building for that future, one stablecoin transfer at a time.