When I first started paying attention to Dusk Network, what stood out wasn’t loud marketing or constant announcements. It was the direction. While most blockchains were leaning harder into transparency and speculation, Dusk was moving the opposite way, asking a question few wanted to tackle.

How can finance live on a public blockchain if financial data isn’t meant to be public?

That question sits at the heart of everything Dusk is building. The network isn’t designed for memes or short-term hype. It exists for institutions, asset issuers, and financial systems that require privacy but still need to remain compliant. Over time, it becomes clear that Dusk isn’t trying to disrupt regulation. It’s trying to work with it.

How Dusk Came Together

The foundation behind Dusk formed in 2018, bringing together people with very different backgrounds but a shared understanding of finance’s real constraints. Emanuele Francioni, who comes from an engineering and academic background, helped shape the technical direction. Alongside him were contributors like Fulvio Venturelli and business leaders including Jelle Pol, Pascal Putman, and Mels Dees.

What I find interesting is that none of them approached blockchain as a replacement for traditional finance. Instead, they looked at it as infrastructure that still had to operate inside real legal systems.

They understood early on that banks, asset managers, and institutions couldn’t operate on chains where every transaction, balance, and counterparty is visible to the entire world. That model simply doesn’t work once real money and regulation enter the picture.

From the beginning, Dusk was built around privacy with accountability, not secrecy for its own sake.

A Different View of Blockchain Privacy

Most privacy chains focus on hiding everything. That works for individuals, but it breaks down in regulated environments. Dusk took a more nuanced approach.

On Dusk, transactions can remain confidential while still being verifiable. Sensitive details like amounts, identities, or contract logic stay hidden from the public, but authorized parties can access what they need through cryptographic proofs.

I like to think of it the same way everyday banking works. Your financial history isn’t public, but auditors and regulators can still review it when required. Dusk simply recreates that structure on-chain.

This is done through zero-knowledge proofs built directly into the protocol. Privacy isn’t added later. It’s native to how the chain functions.

Technology That Supports Real Finance

At the consensus level, Dusk uses a system called Segregated Byzantine Agreement. It’s a proof-of-stake model that separates responsibilities across validators, proposers, and verification committees.

That structure improves performance and security while maintaining decentralization. Transactions reach finality quickly, which matters a lot for financial applications where timing and certainty are critical.

On top of that, the network uses encrypted communication layers and privacy-preserving transaction routing. Users aren’t easily traceable, yet the system remains verifiable.

Confidential smart contracts allow assets to be issued, transferred, or settled without exposing details publicly. These contracts can represent things like bonds, funds, or tokenized equities, where privacy isn’t optional.

When I look at this setup, it feels far closer to how real financial infrastructure works than most blockchains today.

The Role of the DUSK Token

The DUSK token sits at the center of the network’s economy. It’s used to pay transaction fees, stake for network security, deploy smart contracts, and participate in governance.

The supply is capped, with emissions released gradually through block rewards. This avoids sudden inflation while still incentivizing validators and long-term participants.

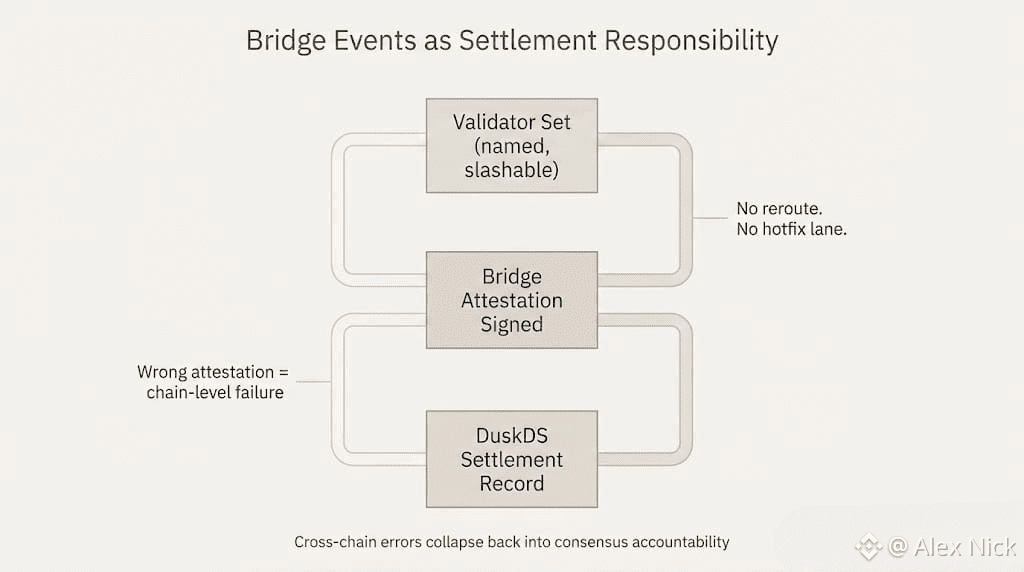

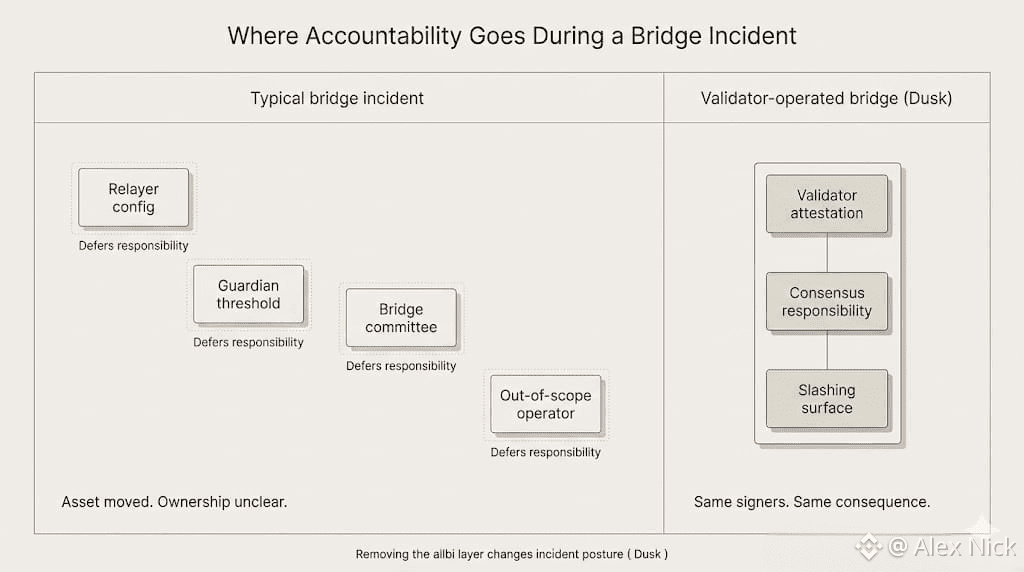

Staking plays an important role. Tokens locked for validation reduce circulating supply and align participants with network health. Slashing mechanisms discourage bad behavior, creating accountability without central control.

What stands out to me is that the token’s value is closely tied to network usage. As more financial applications go live, more activity flows through the chain, and more demand naturally forms.

It’s not designed around speculation first. Utility comes before narrative.

Where Dusk Is Being Used

Dusk’s strongest traction appears in areas where privacy is essential.

Tokenized securities are one of the clearest examples. Asset issuers need to control who can see ownership details, who can trade, and under what conditions. Dusk allows all of this to happen on-chain without exposing data publicly.

Partnerships with infrastructure providers like Chainlink help bring trusted external data into private contracts. Collaborations with platforms such as NPEX focus on compliant trading of tokenized equities.

Banks and enterprises are experimenting with tokenized funds, private settlements, and cross-border transactions where confidentiality matters just as much as transparency.

With the launch of DuskEVM in early 2026, Ethereum developers can now deploy familiar smart contracts while gaining access to privacy features they’ve never had before.

That combination lowers friction significantly. Developers don’t need to start from scratch. They simply gain new capabilities.

Recent Progress and Growing Attention

Toward the end of 2025 and into early 2026, Dusk delivered major protocol upgrades that improved performance and usability. The release of DuskEVM brought renewed attention, especially as interest in real-world assets began accelerating again.

Market activity followed, but what mattered more was ecosystem movement. Builder programs expanded. Institutional conversations increased. Compliance tooling improved.

We’re seeing a slow but steady pattern emerge. Instead of explosive hype cycles, Dusk grows through implementation.

Looking Ahead

As regulations like MiCA take effect across Europe and other regions move toward clearer crypto frameworks, infrastructure that already understands compliance gains a major advantage.

Dusk seems positioned for that environment.

Future development points toward deeper real-world asset tokenization, stronger interoperability, and expanded governance participation. The goal isn’t to make privacy optional. It’s to make it usable.

When I step back and look at the broader picture, Dusk feels less like a crypto experiment and more like financial plumbing being laid quietly beneath the surface.

A Thought That Lingers

Public blockchains taught the world that transparency builds trust. But finance has always relied on another truth as well.

Privacy builds confidence.

Dusk Network sits right at the intersection of those two ideas. It doesn’t reject transparency, and it doesn’t hide behind secrecy. Instead, it allows each to exist where it belongs.

As more institutions explore on-chain systems, the question may no longer be whether blockchain can support real finance, but which chains understand it well enough to do so safely.

Dusk doesn’t try to shout the answer.

It simply keeps building toward it.