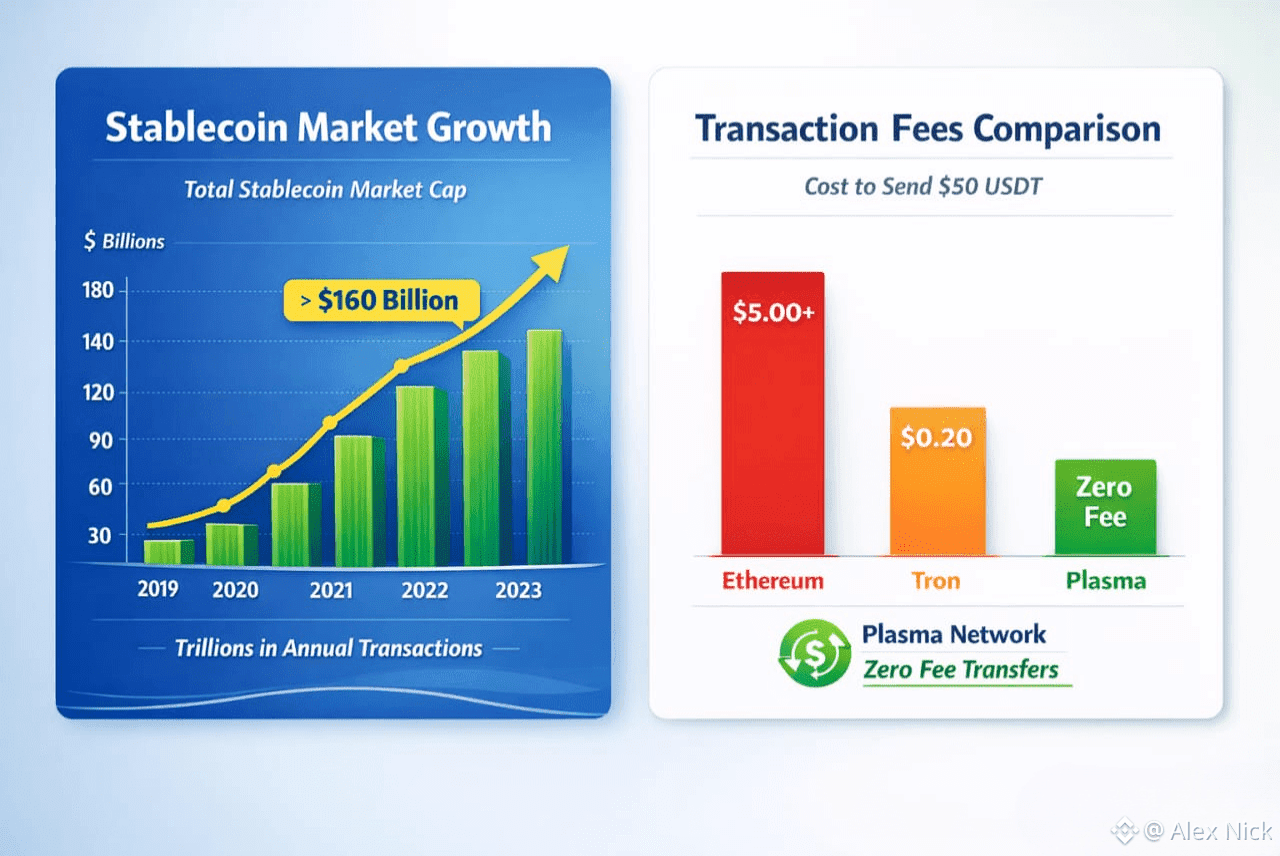

When stablecoins quietly became the most used asset in crypto, something important happened. The industry realized that speculation was no longer the center of activity. People were not only trading tokens anymore. They were sending money, settling payments, moving value across borders, and storing digital dollars as a new form of financial infrastructure.

Yet despite this shift, the blockchains supporting stablecoins were never designed for that responsibility.

Fees fluctuated unpredictably. Transactions slowed during congestion. Small transfers became inefficient. Even the simplest act of sending USDT could cost more than the amount being sent.

Plasma XPL emerged from this imbalance.

Instead of building another general-purpose blockchain, Plasma was created around one clear idea: if stablecoins are becoming global money, then they deserve a blockchain designed specifically for money.

Not for NFTs. Not for speculation. Not for experimentation.

Just for value transfer at internet speed.

The Environment That Gave Birth to Plasma

By 2024 and 2025, stablecoins had become the backbone of the crypto economy. Billions of dollars moved daily through USDT and USDC. Exchanges relied on them. Traders trusted them. Businesses adopted them. In many countries, stablecoins had become easier to access than traditional banking.

But the infrastructure underneath them remained fragile.

Ethereum was secure but expensive. Layer 2 networks improved cost but still depended on congested settlement layers. Tron became popular largely because it was cheap, not because it was technically advanced.

I remember noticing how odd this felt.

The most important financial instruments in crypto were running on networks never meant to handle payments at global scale.

This contradiction became the foundation of Plasma’s vision.

The idea wasn’t to compete with Ethereum or replace existing ecosystems. It was to create a specialized settlement layer focused entirely on stablecoin movement.

From the beginning, Plasma treated stablecoins not as tokens, but as digital dollars.

And once viewed through that lens, everything else changed.

A Blockchain Designed Around Payments

Most blockchains are designed like cities built without planning. They grow organically, accumulating layers of features until complexity becomes unavoidable.

Plasma took the opposite approach.

It started by defining what a payment network must do well.

Transactions must be instant. Fees must be negligible. Finality must be deterministic. Users must not be forced to hold volatile assets simply to move stable money.

These principles shaped every design decision.

Plasma launched as a Layer 1 blockchain built specifically for high-volume, low-value transactions. It prioritized consistency over experimentation and reliability over theoretical throughput.

Instead of chasing thousands of use cases, Plasma focused on one.

Move money properly.

The Stablecoin-First Philosophy

What sets Plasma apart is its stablecoin-native architecture.

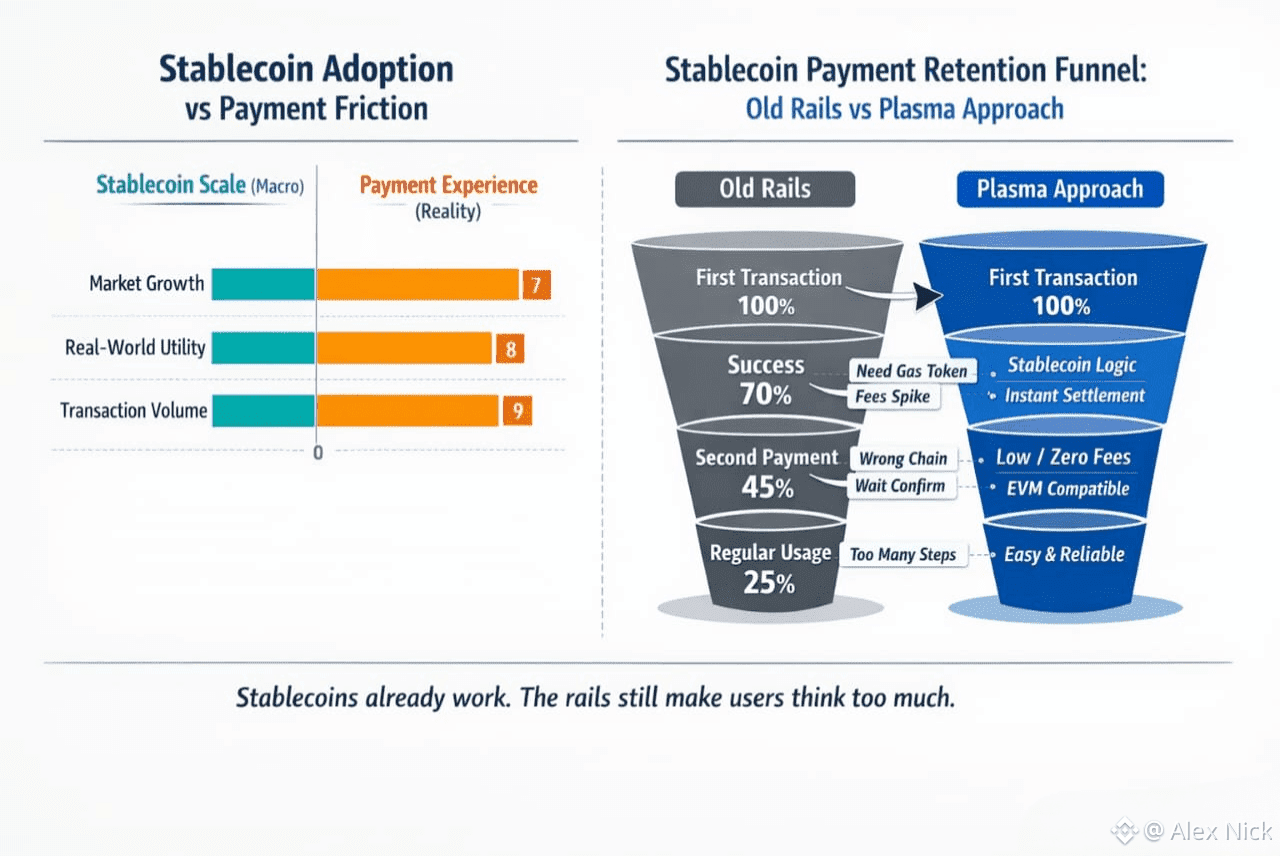

On most chains, users must hold the native token to pay gas. This creates friction. Someone receiving USDT must still acquire ETH or another asset just to move their funds.

Plasma removes that barrier.

USDT transfers on Plasma are designed to be effectively gasless. Users are not required to hold XPL to move stablecoins. Fees are abstracted away at the protocol level.

This may sound like a small detail, but it fundamentally changes user experience.

For everyday users, this feels natural. Money moves like money. There is no technical complexity exposed. No need to understand gas markets or token conversions.

It becomes closer to fintech than crypto.

They’re not trying to make users learn blockchain.

They’re trying to make blockchain disappear.

The Paymaster System and Gas Abstraction

Plasma achieves this through a paymaster-style mechanism.

Instead of charging users directly for gas, applications or the protocol itself can sponsor transaction costs. Fees can be paid in stablecoins or absorbed by the network’s economic model.

This allows wallets, exchanges, and payment platforms to offer seamless transfers.

If someone sends ten dollars, the receiver gets ten dollars.

No deductions. No surprises.

This approach mirrors traditional payment systems while maintaining decentralized settlement.

We’re seeing how this model dramatically lowers onboarding friction, especially in regions where users are new to crypto.

PlasmaBFT and the Consensus Layer

At the core of Plasma’s infrastructure lies PlasmaBFT, a consensus mechanism inspired by modern Byzantine Fault Tolerant research.

Rather than relying on probabilistic finality, PlasmaBFT provides deterministic settlement. Once a transaction is confirmed, it cannot be reversed.

This is essential for payments.

When money moves, certainty matters more than throughput metrics.

PlasmaBFT is designed to finalize transactions in under one second under normal conditions. Blocks are produced rapidly, and finality occurs without long confirmation delays.

The system can tolerate malicious validators up to defined thresholds, maintaining safety without sacrificing speed.

I find this particularly important because payment systems cannot afford ambiguity. There is no room for “wait six confirmations” when users expect instant settlement.

Built in Rust for Performance and Safety

The Plasma stack is written in Rust, a language known for memory safety and performance.

This choice wasn’t cosmetic.

Rust significantly reduces vulnerabilities related to memory corruption and concurrency errors. For financial infrastructure, this matters deeply.

Execution runs on a modern Ethereum-compatible client, allowing Plasma to remain fully EVM compatible while benefiting from modular architecture.

Developers can deploy Solidity smart contracts without modification.

What works on Ethereum works on Plasma.

This compatibility accelerates ecosystem growth without forcing developers to rebuild from scratch.

Bitcoin Integration and the Role of BTC

Another important pillar of Plasma’s design is its relationship with Bitcoin.

Rather than ignoring Bitcoin or wrapping it through centralized custodians, Plasma aims to integrate BTC in a trust-minimized way.

Bitcoin acts as a foundational store of value, while Plasma provides programmability.

Through decentralized bridges and validator-secured mechanisms, BTC can be represented within Plasma’s execution environment.

This allows developers to build financial products using Bitcoin as collateral while settling in stablecoins.

If this vision continues to mature, it creates a powerful triangle.

Bitcoin as value storage. Stablecoins as medium of exchange. Plasma as settlement infrastructure.

That combination begins to resemble a full monetary system rather than a speculative network.

The Role of XPL

XPL is the native token of the Plasma network.

Unlike stablecoins, XPL is not meant to be used as money. Its role is infrastructural.

XPL secures the network through staking. Validators lock XPL to participate in consensus. Governance decisions are weighted by stake. Protocol upgrades and parameter changes flow through on-chain voting.

While stablecoin transfers may be gasless, other operations rely on XPL to sustain the network economically.

Inflation exists early to incentivize validators but declines over time. As transaction volume increases, fees gradually replace emissions.

This structure aligns long-term incentives.

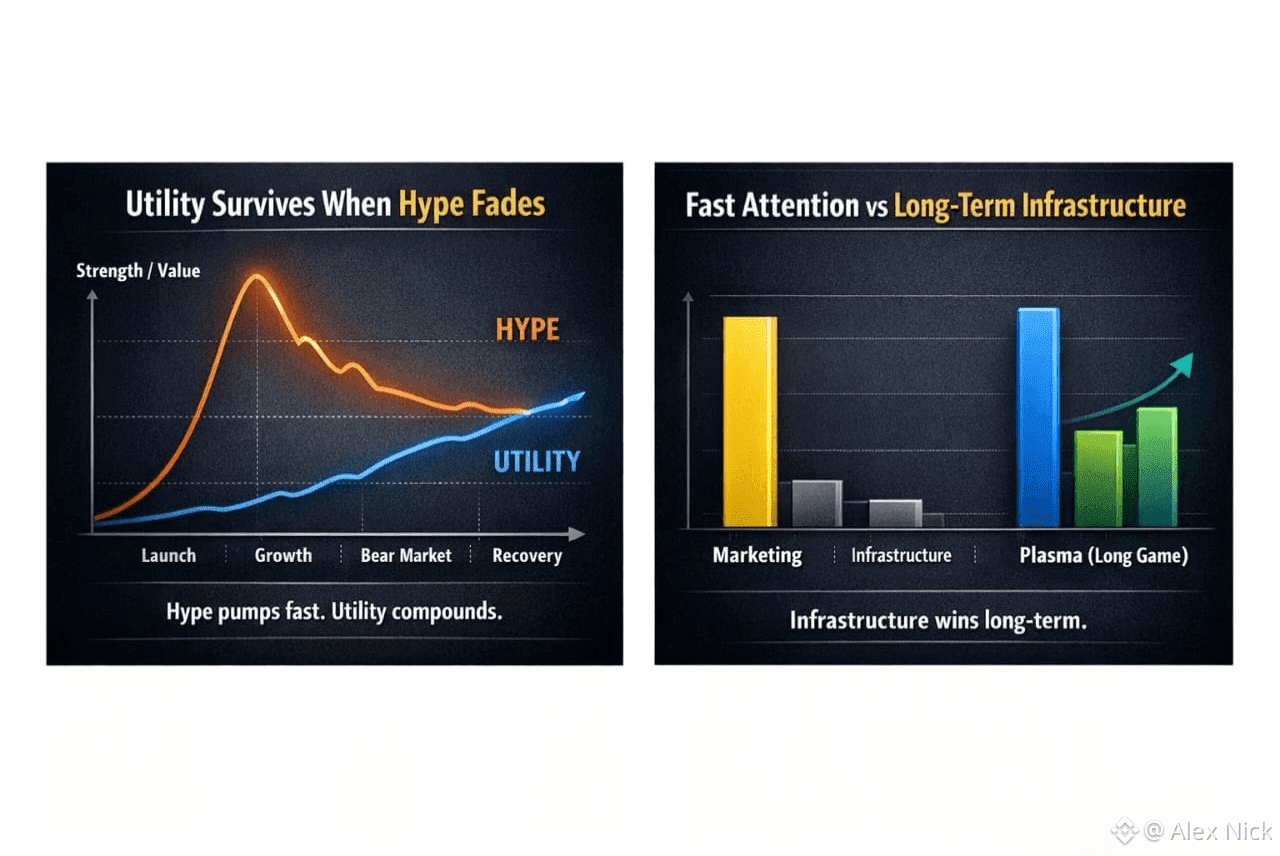

XPL becomes valuable not because users speculate on it, but because the network it secures processes meaningful financial volume.

Token Distribution and Economic Design

Plasma’s tokenomics were structured with longevity in mind.

A portion of supply was allocated to ecosystem development, validator rewards, community incentives, and early contributors, all subject to vesting schedules.

Rather than front-loading emissions, distribution unfolds gradually.

This approach helps reduce short-term sell pressure and supports sustainable growth.

As stablecoin usage grows, network activity increases, and the value captured by infrastructure expands organically.

It becomes less about price cycles and more about transaction throughput.

Mainnet Launch and Early Adoption

Plasma’s mainnet beta launched in late 2025.

From the start, it attracted attention not through marketing, but through liquidity movement.

Billions in stablecoins were bridged into the ecosystem as exchanges, market makers, and payment providers tested zero-fee transfers.

Early integrations included wallets, DeFi platforms, and cross-border payment services.

Instead of retail speculation driving activity, institutional flows dominated early usage.

This pattern made sense.

Institutions are the ones who suffer most from inefficient payment rails.

They’re also the first to move when infrastructure improves.

Use Cases Emerging on Plasma

Plasma’s strongest traction appears in areas where cost sensitivity matters.

Cross-border remittances benefit immediately. Sending money between countries becomes nearly instantaneous and virtually free.

Merchant payments become viable without card processing fees. Settlement occurs in seconds rather than days.

Treasury management improves as companies can move large stablecoin balances without friction.

DeFi applications benefit as well, particularly those focused on stablecoin lending, yield generation, and liquidity management.

What stands out is how practical these use cases are.

They’re not hypothetical.

They solve existing problems.

Competing in a Crowded Landscape

Plasma does not operate in isolation.

Networks like Tron, Base, and Solana already process massive stablecoin volumes.

But Plasma’s differentiation lies in specialization.

Tron became dominant largely due to low fees, not architectural intent.

Layer 2s reduce costs but remain dependent on parent chains.

Plasma was designed from the ground up for payments.

This focus allows optimizations others cannot easily replicate.

Zero-fee stablecoin transfers are not a feature. They’re the foundation.

Challenges and Risks Along the Way

No infrastructure project is without challenges.

Validator decentralization must continue to expand. Bridges remain one of the highest-risk components in crypto. Regulatory frameworks around stablecoins continue to evolve.

Plasma must navigate these carefully.

Trust builds slowly in financial systems.

Audits, transparency, and gradual decentralization will remain critical.

But these challenges are not unique.

They are the same hurdles every payment network must face.

The Road Ahead

Looking forward, Plasma’s roadmap centers around expansion rather than reinvention.

Support for additional stablecoins such as USDC is expected. Cross-chain connectivity will deepen. Developer tooling will mature.

Enterprise integrations are likely to increase as stablecoin regulation becomes clearer across regions.

As adoption grows, Plasma’s role may shift from alternative infrastructure to foundational settlement layer.

If stablecoins become the default method for global digital payments, networks like Plasma become indispensable.

A Quiet Shift in Crypto’s Purpose

When I step back and think about Plasma, I don’t see a typical blockchain narrative.

There’s no promise of revolution overnight.

No claim to replace everything.

Instead, there’s a quiet understanding that money must move efficiently before anything else can matter.

Speculation can exist on top of infrastructure.

But infrastructure must come first.

Plasma seems built with that humility.

If crypto truly becomes part of everyday finance, it won’t be through flashy applications alone. It will happen through invisible systems that move value reliably, cheaply, and constantly.

Plasma doesn’t ask for attention.

It simply tries to make money work the way it always should have.

And sometimes, the most important technologies are the ones people don’t notice at all because they just work, silently carrying value forward into whatever financial world comes next.