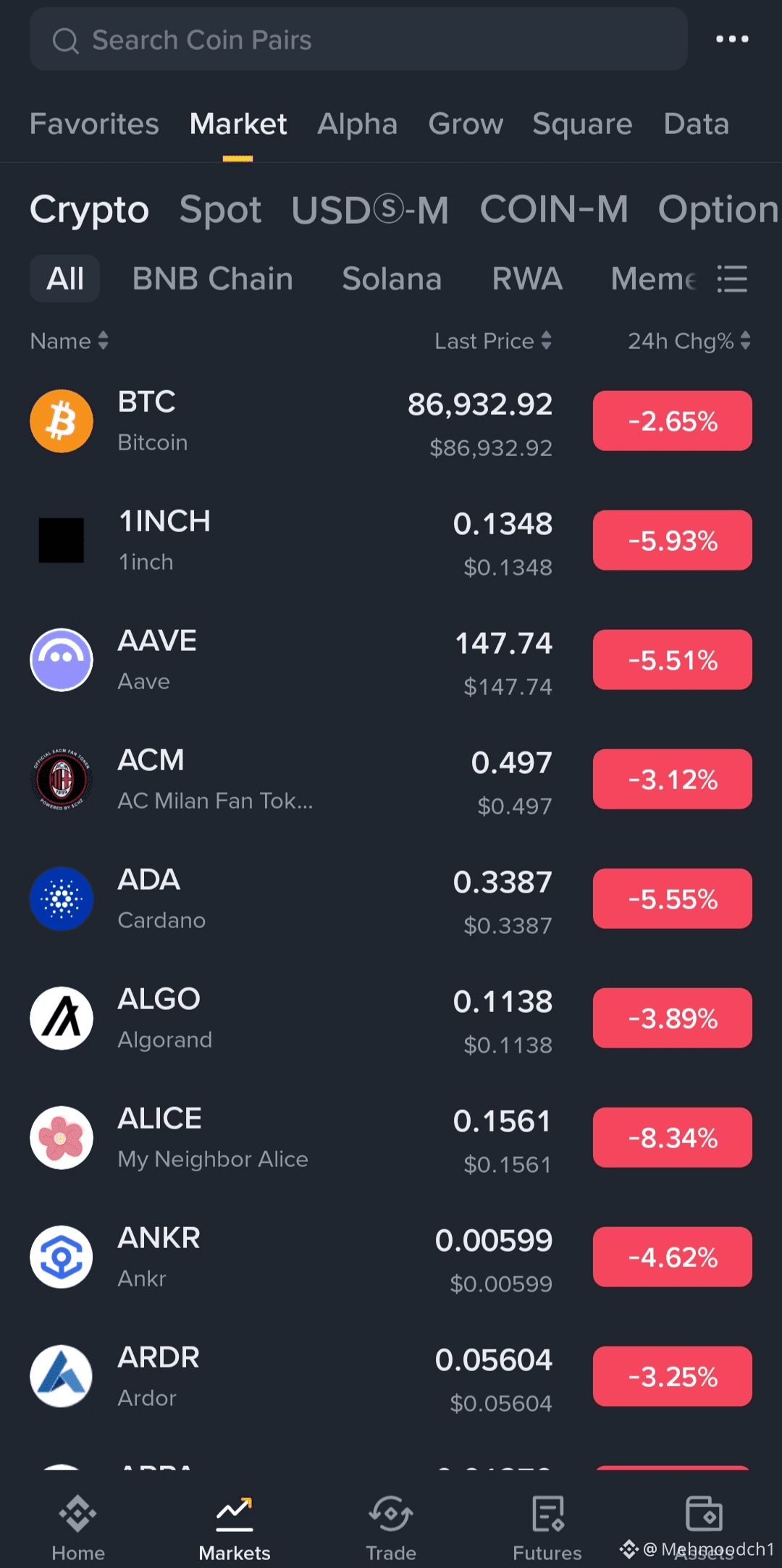

The cryptocurrency market is currently experiencing a prolonged period of downward pressure, as evidenced by the sea of red across major asset prices.  Flagship assets like $BTC (Bitcoin) have seen significant retracements, dragging down the broader market including decentralized finance (DeFi) tokens like $SOL AAVE and $1INCH , as well as layer-1 platform tokens such as ADA (Cardano) and (Algorand). This persistent negative trend is not an isolated event but the result of a confluence of macroeconomic and market-structure factors.

Flagship assets like $BTC (Bitcoin) have seen significant retracements, dragging down the broader market including decentralized finance (DeFi) tokens like $SOL AAVE and $1INCH , as well as layer-1 platform tokens such as ADA (Cardano) and (Algorand). This persistent negative trend is not an isolated event but the result of a confluence of macroeconomic and market-structure factors.

Primary drivers include global economic uncertainties and a "risk-off" sentiment among institutional investors. Concerns over persistent inflation and the Federal Reserve's future interest rate policies have led capital to rotate out of high-risk asset classes, including crypto. This correlation with traditional tech stocks has amplified volatility. Furthermore, significant liquidations of leveraged positions have exacerbated downward price movements, creating a feedback loop of selling pressure that affects everything from established tokens to newer projects like $ALICE and fan tokens like $ACM.

Looking ahead, the near-term outlook remains cautious. The market appears to be in a consolidation phase, with investor confidence remaining fragile. A sustained recovery will likely depend on a stabilization of the macroeconomic landscape and clearer regulatory frameworks. However, some analysts point to long-term adoption trends and the growth of sectors like Real-World Assets (RWA) as potential catalysts for a future turnaround once the current headwinds subside

#SouthKoreaSeizedBTCLoss #USIranMarketImpact #ETHMarketWatch #TrumpCancelsEUTariffThreat .