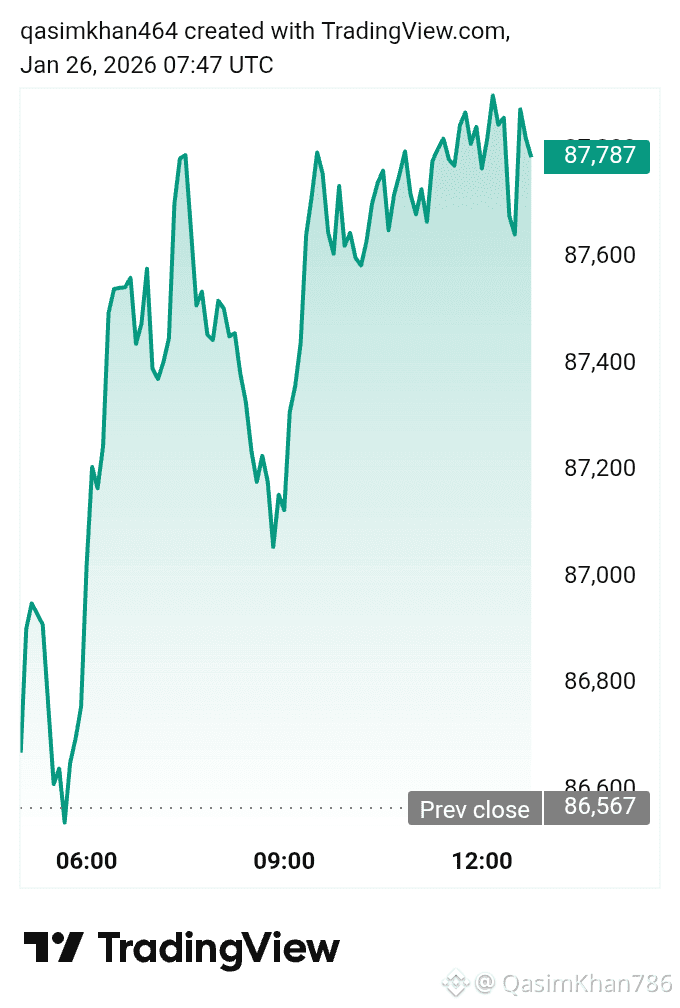

$BTC Bitcoin fell below the $88,000 mark as global investors reacted to rising political and economic uncertainty in the United States. The decline comes amid growing concerns over a possible government shutdown, which could disrupt federal operations and further weaken market confidence. At the same time, traders are positioning cautiously ahead of the Federal Reserve’s first interest rate decision of the year, a key event that could shape monetary policy expectations for the months ahead.

Market participants are increasingly risk-averse, leading to profit-taking across major cryptocurrencies. Bitcoin, which recently touched record highs, has struggled to maintain momentum as liquidity thins and volatility rises. Analysts note that uncertainty around U.S. fiscal stability and the Fed’s policy stance is prompting investors to move funds into safer assets, temporarily reducing demand for digital currencies.

The upcoming Fed meeting is being closely watched, as any hints of prolonged high interest rates could put additional pressure on risk assets, including Bitcoin. Higher rates generally strengthen the U.S. dollar and make traditional fixed-income investments more attractive, which can draw capital away from cryptocurrencies. Conversely, signs of a dovish shift could help Bitcoin regain lost ground.

Despite the short-term pullback, long-term sentiment around Bitcoin remains broadly positive. Institutional adoption, growing ETF inflows, and increasing recognition of Bitcoin as a store of value continue to support its overall outlook. However, experts caution that near-term price swings are likely as markets digest macroeconomic developments.

In the days ahead, Bitcoin’s direction will largely depend on political developments in Washington and the tone of the Federal Reserve’s policy statement. Until clearer signals emerge, traders should be prepared for continued volatility and rapid price movements in the crypto market.