Dusk Network isn’t trying to be loud, flashy, or viral and that’s exactly the point. Since its founding in 2018, Dusk has been carefully built for one very specific mission: bringing real, regulated finance onto the blockchain without sacrificing privacy. In a world where most blockchains either ignore regulation or abandon privacy, Dusk is walking a harder path and that’s what makes it interesting.

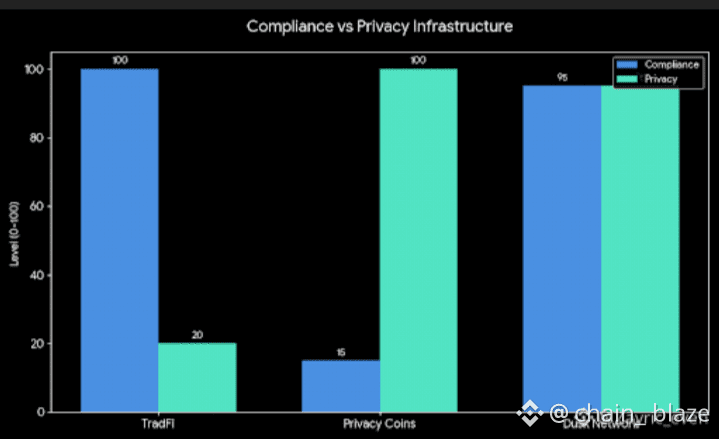

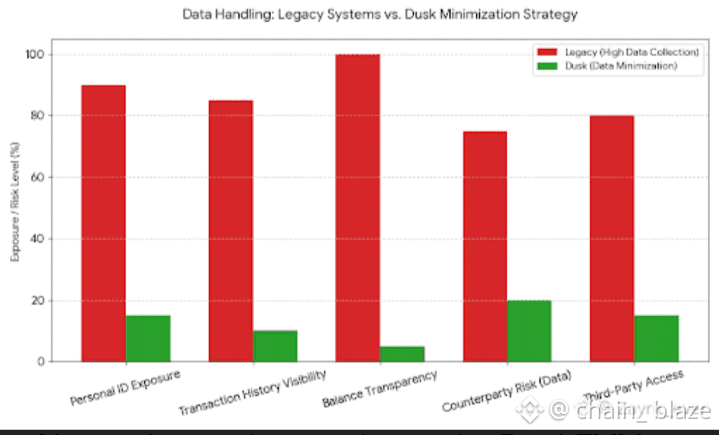

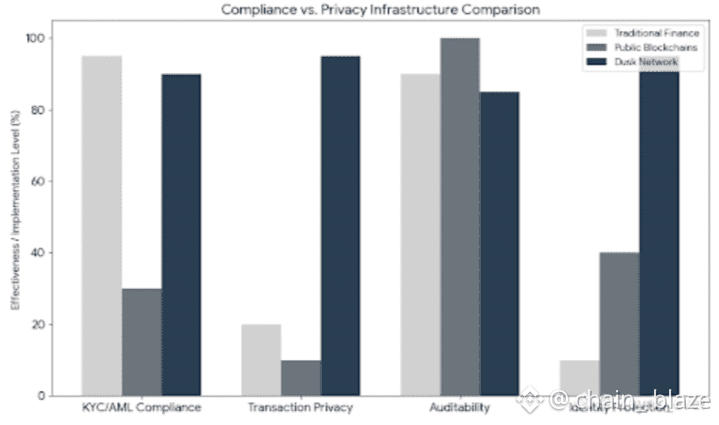

At its core, Dusk is a Layer-1 blockchain designed for financial institutions, not just crypto natives. Think banks, exchanges, security issuers, and regulators the kind of players who need transparency when required, privacy when necessary, and rules baked directly into the system. On Dusk, transactions are private by default, but they are also auditable. That means sensitive financial data stays hidden from the public, while regulators can still verify compliance when legally required. This balance between confidentiality and accountability is what Dusk calls “auditable privacy,” and it sits at the heart of the network.

Technically, Dusk is built in a modular way. Instead of cramming everything into one layer, it separates settlement and data availability from execution. This makes the network more flexible, easier to upgrade, and better suited for complex financial applications. The blockchain uses a Proof-of-Stake consensus system designed for fast finality, because in finance, slow settlement is not an option.

After years of research and development, Dusk reached a major turning point in January 2025 with the launch of its mainnet. This wasn’t just a symbolic launch it marked the transition into a fully operational blockchain capable of hosting real financial activity. Since then, the network has been steadily upgraded, improving performance, strengthening its data layer, and preparing the ground for broader developer adoption.

One of the biggest steps forward came with cross-chain connectivity. Dusk introduced a two-way bridge that allows DUSK tokens and other assets to move between Dusk and EVM-compatible chains like Ethereum. What makes this different from typical bridges is the use of zero-knowledge technology, which helps preserve privacy even when assets move across ecosystems. This matters because institutions don’t want their entire transaction history exposed just because they interact with DeFi.

The momentum accelerated further in early 2026 when Dusk announced a strategic collaboration with Chainlink and NPEX, a regulated Dutch stock exchange. This partnership is a strong signal of where Dusk is heading. By integrating Chainlink’s CCIP, Dusk gains industry-standard cross-chain interoperability. With Chainlink Data Streams and DataLink, real-time, regulated market data can flow directly on-chain. And with NPEX, Dusk is no longer just talking about tokenized securities it’s working with a real exchange that already operates under European financial law. Together, these pieces form a bridge between traditional markets and blockchain settlement, something very few networks can credibly claim.

For developers, Dusk has also opened its doors. The launch of the DuskEVM testnet in late 2025 allows Ethereum developers to deploy familiar smart contracts while benefiting from Dusk’s privacy and compliance infrastructure underneath. This lowers the barrier to entry and makes it easier for existing DeFi teams to experiment with regulated, privacy-aware applications.

Tokenization of real-world assets is where all of this comes together. Dusk is not chasing meme coins or speculative NFTs. Its focus is on equities, bonds, and regulated financial instruments assets that already exist in the real economy. Through partnerships like NPEX, hundreds of millions of euros worth of assets are expected to move on-chain, with compliance, reporting, and settlement handled directly by the protocol itself. This is slow, careful work but it’s also how real financial systems are built.

The DUSK token plays a central role in all of this. It’s used for transaction fees, staking, governance, and network security. Through Chainlink’s cross-chain standards, DUSK can move across ecosystems while still respecting compliance controls. The token already exists on multiple chains, making it accessible while remaining tightly connected to the core network.

Of course, the path forward isn’t without challenges. Regulation outside Europe remains complex, and institutional adoption always takes longer than retail hype cycles. Security audits, legal clarity, and trust will continue to matter more than speed. But Dusk seems comfortable with that trade-off. It’s not trying to win overnight it’s trying to last.

In a crypto industry often driven by noise, Dusk Network feels different. It’s quiet, methodical, and deeply focused on a future where blockchains don’t replace finance, but become part of it. If tokenized securities, compliant DeFi, and privacy-preserving markets are truly the next phase of crypto, Dusk isn’t chasing the trend it’s already building the foundation