Privacy has always sounded like freedom to me in crypto. Early on, the idea that money could move without anyone watching felt revolutionary. But after watching multiple cycles come and go, I started noticing something uncomfortable. In real financial systems, disappearing completely is not what builds trust. What actually matters is proof. And that is where Dusk quietly starts to make a lot of sense.

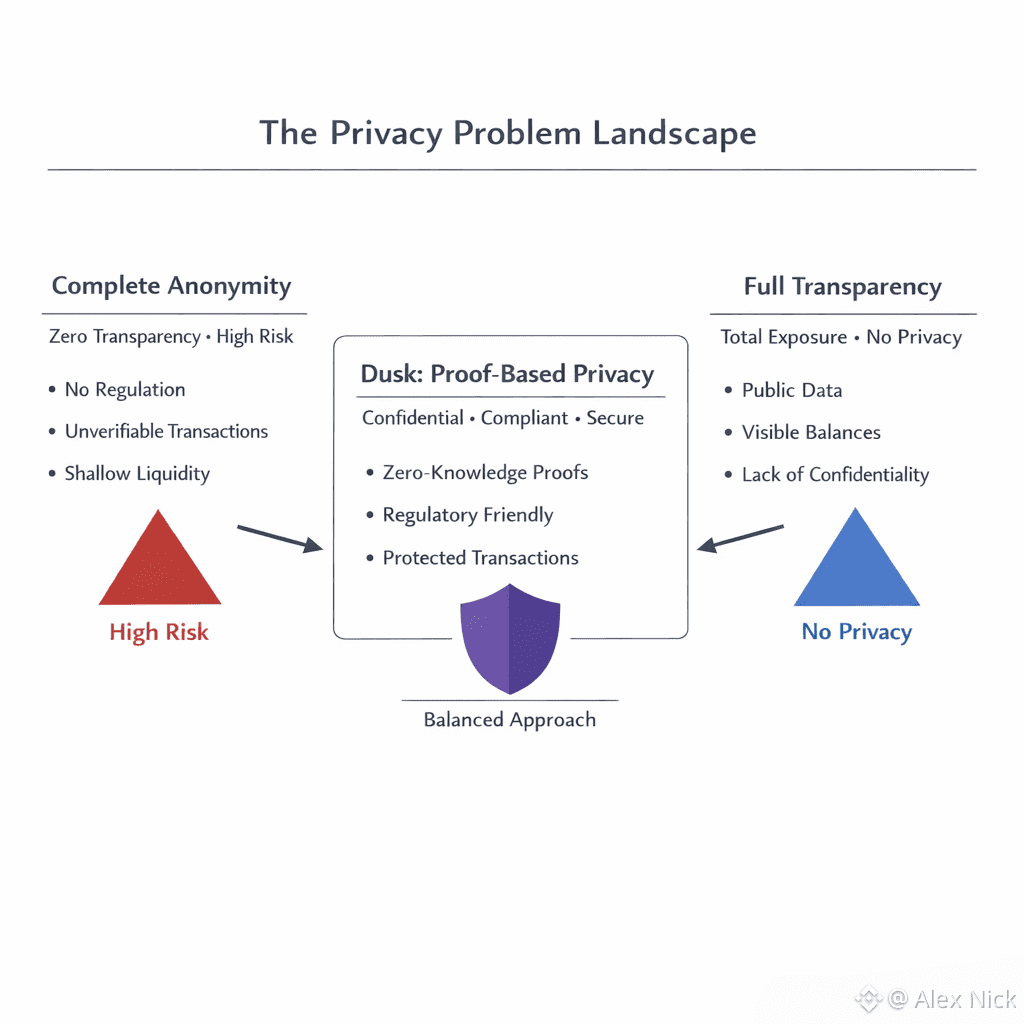

Most blockchains were built on the belief that full transparency was enough. Every transaction visible. Every wallet traceable. At first, that worked well for speculation and open experimentation. But once real money and serious participants entered the picture, the cracks became obvious. Institutions do not want their strategies exposed. Funds do not want their positions tracked in real time. Even long term investors do not want their activity turned into public data forever. At the same time, regulators are not willing to accept systems that cannot demonstrate basic legitimacy. That tension has stopped many privacy focused projects in their tracks.

Complete anonymity sounds powerful until it begins limiting who can participate. When a network cannot show that transactions follow financial rules without revealing sensitive information, major platforms hesitate. Exchanges become cautious. Institutions stay away. Liquidity struggles to grow. Over time, people drift off not because the technology fails, but because the ecosystem never matures. I have seen this pattern repeat more than once.

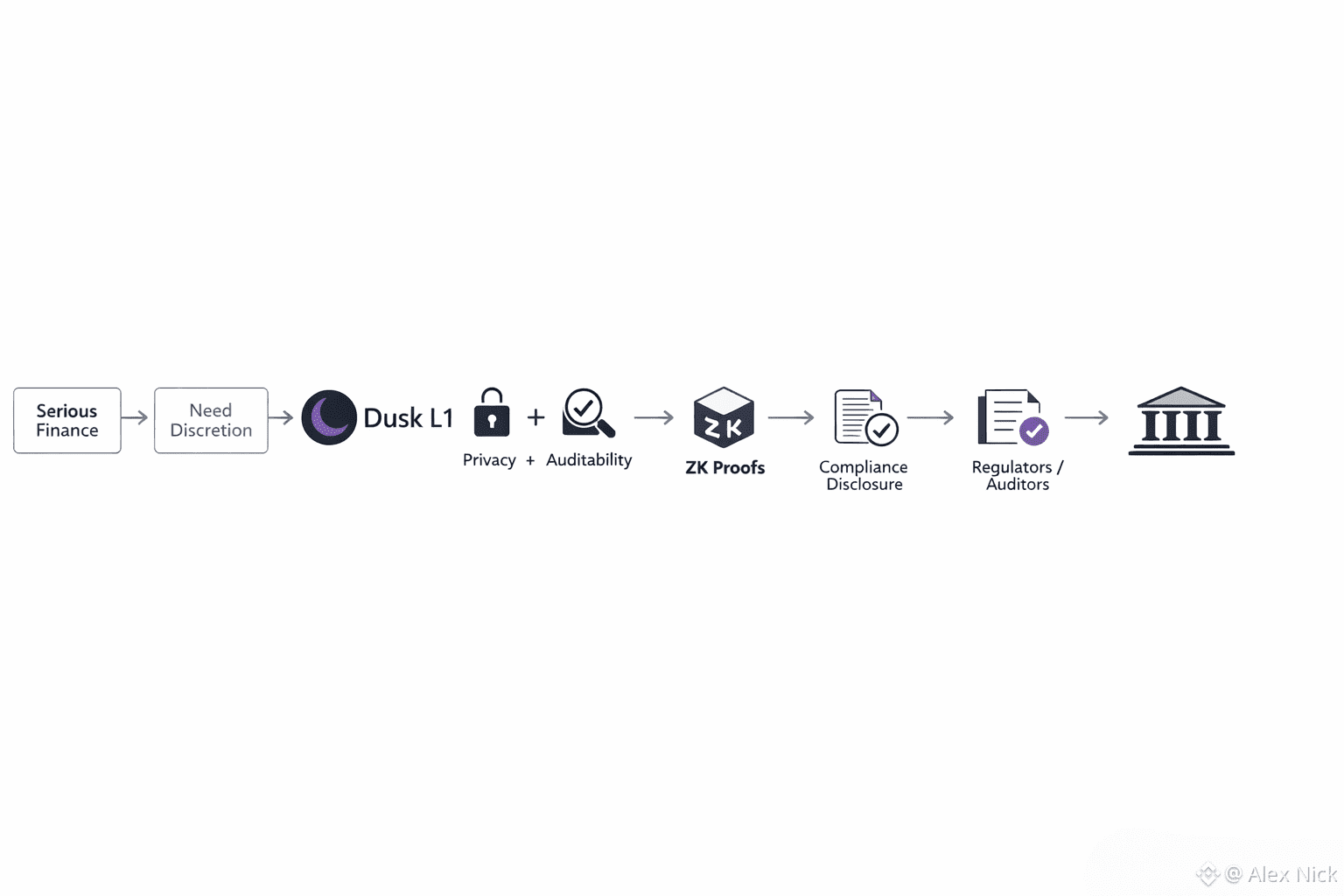

Dusk takes a different path. Instead of trying to hide everything permanently, it focuses on cryptographic proof. Transactions remain confidential, but the system can still demonstrate that rules are followed. That difference may sound small at first, but it changes the entire conversation. By using zero knowledge proofs at the core level, Dusk allows someone to prove that a transaction is valid, compliant, and correctly structured without exposing identities or financial details.

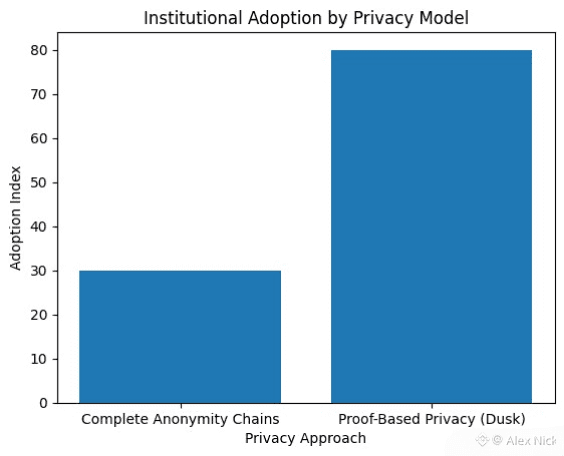

This matters more than many traders realize. Markets are not only driven by price. They are built on trust. Liquidity grows where participants feel safe operating at size. When institutions look at a blockchain, they are not asking whether it is private in theory. They are asking whether it can protect sensitive data while surviving audits, oversight, and legal review. Dusk was designed specifically to answer that question without forcing users to give up privacy.

The architecture reflects this mindset clearly. Privacy is not added later as a feature. It is native to the system. Confidential smart contracts, private asset issuance, and selective disclosure are built into the foundation. Instead of forcing people to choose between privacy and legitimacy, Dusk treats proof as the bridge between the two.

I often think about it using a simple comparison. Imagine two marketplaces. In the first, no one can be identified and nothing can be verified. Activity may look exciting at first, but serious participants eventually leave. In the second, participants remain private, yet the system can prove that every trade follows accepted rules when required. Over time, that second marketplace attracts deeper liquidity, more stable usage, and long term users. Dusk is clearly trying to become that second environment.

Recent developments across the network reinforce this direction. The ecosystem has been expanding toward real financial use cases rather than temporary speculation. Privacy preserving asset issuance, regulated trading frameworks, and compliance ready infrastructure are no longer abstract ideas. They are being actively tested and refined. That tells me the project is aiming for endurance, not attention.

From an investment perspective, this approach quietly reduces risk. Networks that rely on absolute anonymity face constant uncertainty around listings, access, and legal pressure. Networks built around proof have room to adapt. They can interact with traditional finance without abandoning their principles. That flexibility is often what decides which projects survive multiple market cycles.

There is also an emotional side to this shift. Many early crypto users associate regulation with loss of freedom. I understand that fear. But proof is not surrender. It is evolution. It means building systems that protect individuals while allowing the broader economy to interact safely. Dusk does not reject privacy values. It reshapes them into something that can last.

Retention is where this becomes visible. People stay where liquidity grows. Developers build where rules are clear. Capital flows where risks can be understood. Privacy chains that ignore this reality struggle to maintain momentum. Dusk’s emphasis on proof creates an environme nt where users can remain private without isolating themselves from the financial world.

nt where users can remain private without isolating themselves from the financial world.

The larger trend is becoming clearer each year. Markets are moving toward privacy with accountability. It may not appear on daily charts, but it shows in who is building, who is partnering, and who is willing to commit long term resources. Dusk sits directly in that transition, not chasing extremes, but addressing the problem many projects avoid.

If you are evaluating privacy focused networks, it helps to look beyond slogans. I always ask how privacy is achieved. I look at whether the system can prove compliance without exposing users. I think about whether institutions could realistically operate there years from now. Those questions matter far more than catchy narratives.

Dusk points toward a future where privacy is not about hiding from the world, but participating in it on your own terms. That idea may not drive instant excitement, but it is exactly the kind of foundation that tends to outlast market cycles.

In an industry where many projects promise invisibility, Dusk quietly prioritizes credibility. And in real financial systems, credibility is what keeps people coming back.