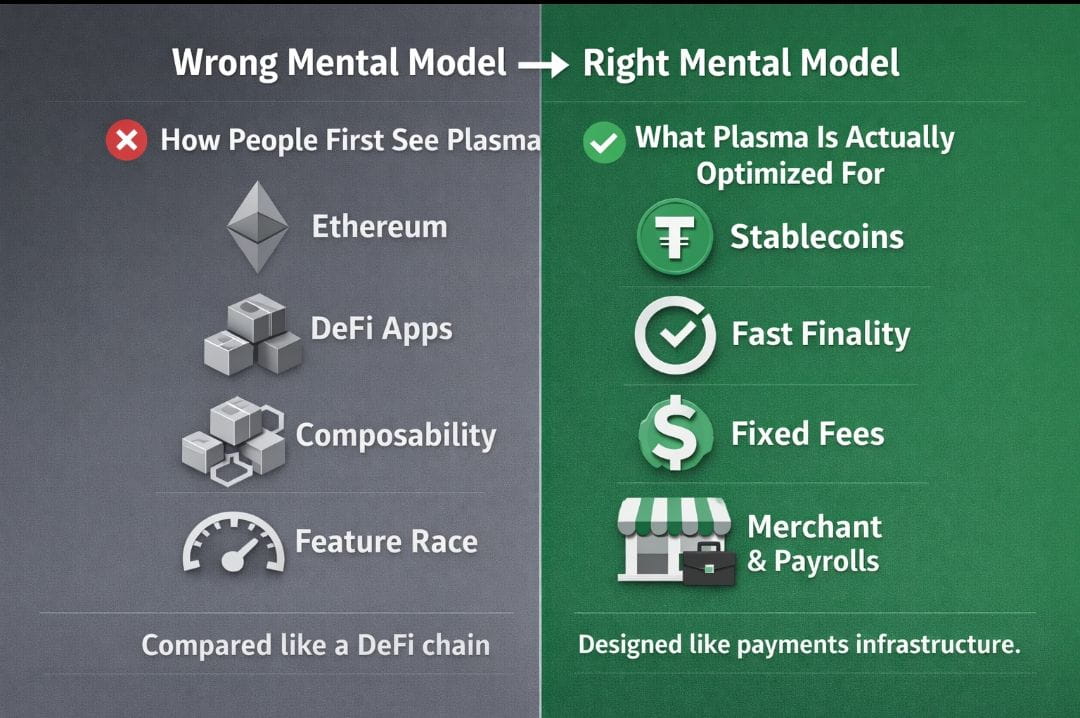

When I first spent real time looking at Plasma, I realized I was approaching it with the wrong mental model. I was doing what most people in crypto do by default: comparing it to Ethereum, measuring it against DeFi throughput, composability, and feature density. Plasma doesn’t break under that comparison—it simply refuses to play the same game. And once you notice that, the entire project makes more sense.

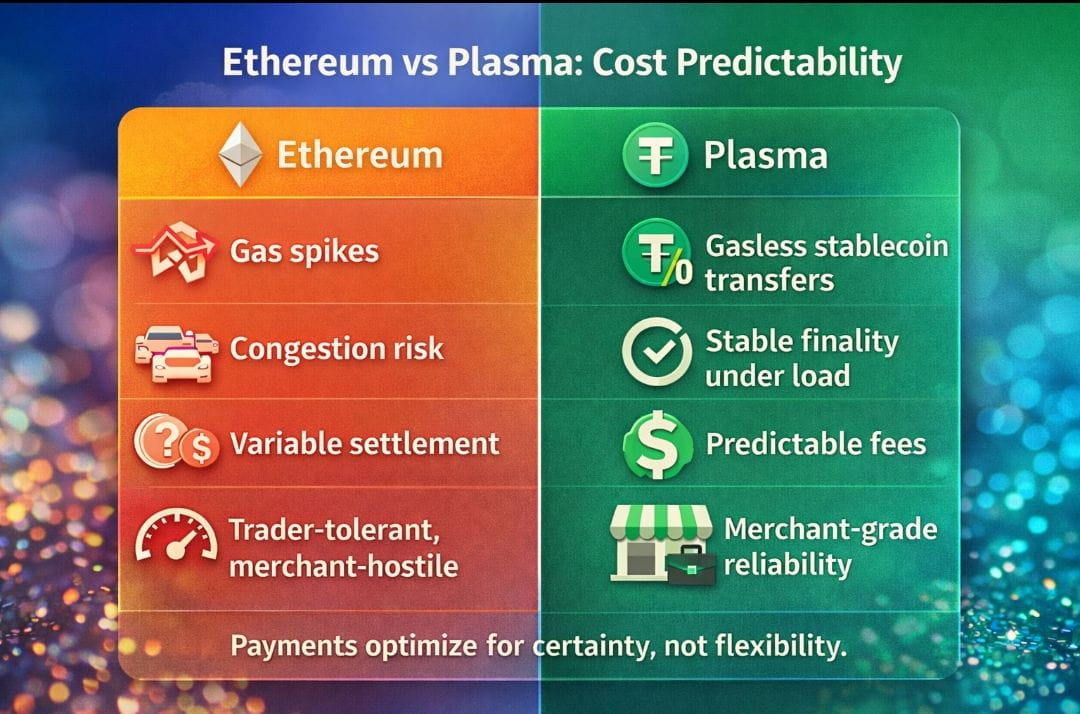

Ethereum is extraordinary at what it does. It moves over a trillion dollars in stablecoin value every year, and it enables a financial playground that didn’t exist a decade ago. But it also carries costs that payments infrastructure cannot tolerate. Gas fees fluctuate. Congestion appears suddenly. A transaction that costs a few cents can cost several dollars minutes later. That unpredictability is survivable for traders. It is unacceptable for merchants, payroll systems, remittance providers, or treasury operations. Real-world payments don’t optimize for optionality. They optimize for certainty.

Plasma seems built around that single observation. Not how to out-innovate Ethereum, but how to remove the friction that makes stablecoins hard to use at scale. The architecture reflects this priority clearly. Blocks are optimized for throughput and simple value transfer, not for deeply nested contract interactions. Finality remains steady under load because the system isn’t trying to be everything at once. That trade-off is deliberate. Plasma gives up some composability to gain predictability, and in payments, that’s often the correct exchange.

This is where the comparison to Visa becomes useful, not as marketing, but as framing. Visa doesn’t succeed because it’s programmable or expressive. It succeeds because merchants know what a transaction costs, when it settles, and how it behaves during peak demand. Plasma appears to be chasing that same operational reliability, but using stablecoins as the settlement layer instead of fiat rails. Gasless USDT and stablecoin-first fee design push cost volatility out of the user experience entirely. Fees exist, but they don’t demand attention.

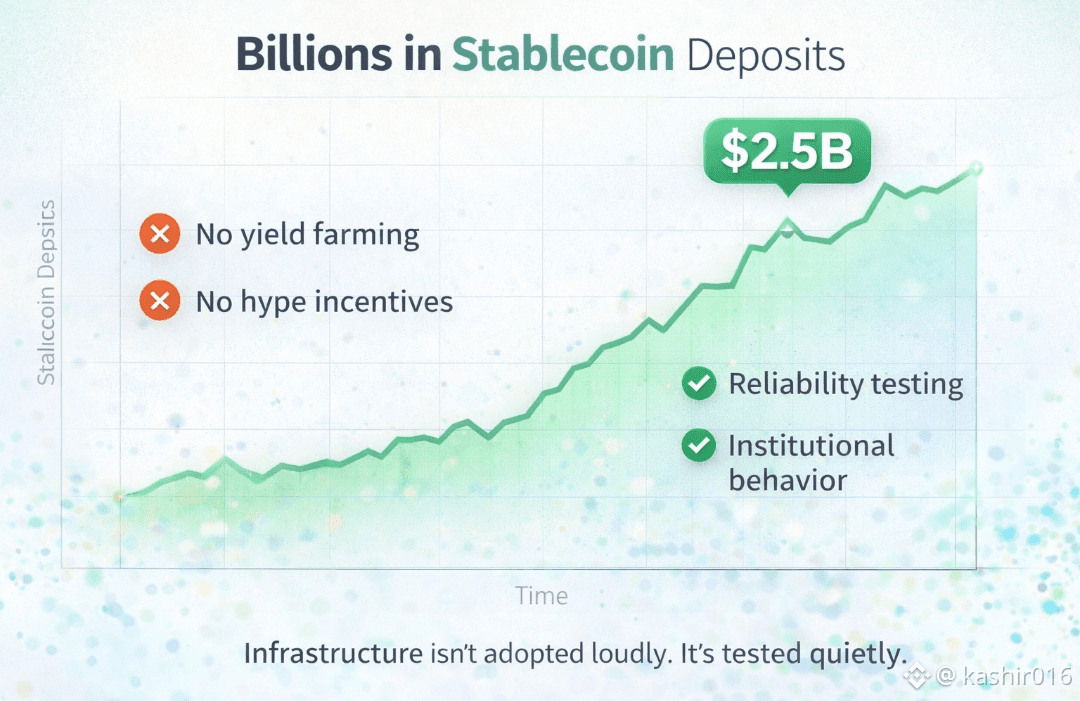

What caught my attention most wasn’t the design, though. It was the early behavior around Plasma. Billions in stablecoin deposits during rollout didn’t come from yield incentives or speculative loops. They came from users and institutions testing reliability. That’s a very different signal. It suggests Plasma is already being evaluated less like a crypto product and more like infrastructure.

The risk is obvious. Payments infrastructure is unforgiving. Trust is earned slowly and lost quickly. Competing with systems like Visa or SWIFT isn’t about launch hype or short-term traction. It’s about uptime, compliance, and consistency across years of uneventful operation. Plasma will have to prove it can handle that kind of pressure without drifting from its core discipline.

If it succeeds, Plasma probably won’t be celebrated the way most blockchains are. It won’t dominate headlines or trend weekly. It will simply work. And in financial infrastructure, that’s the highest compliment possible.