If you spend enough time around real financial systems, one thing becomes obvious very quickly: power rarely operates in public. Big decisions aren’t made on open dashboards or social feeds. They happen quietly, inside processes designed to limit who sees what, and when. That isn’t secrecy for its own sake. It’s risk management. And that’s the environment Dusk is clearly built for.

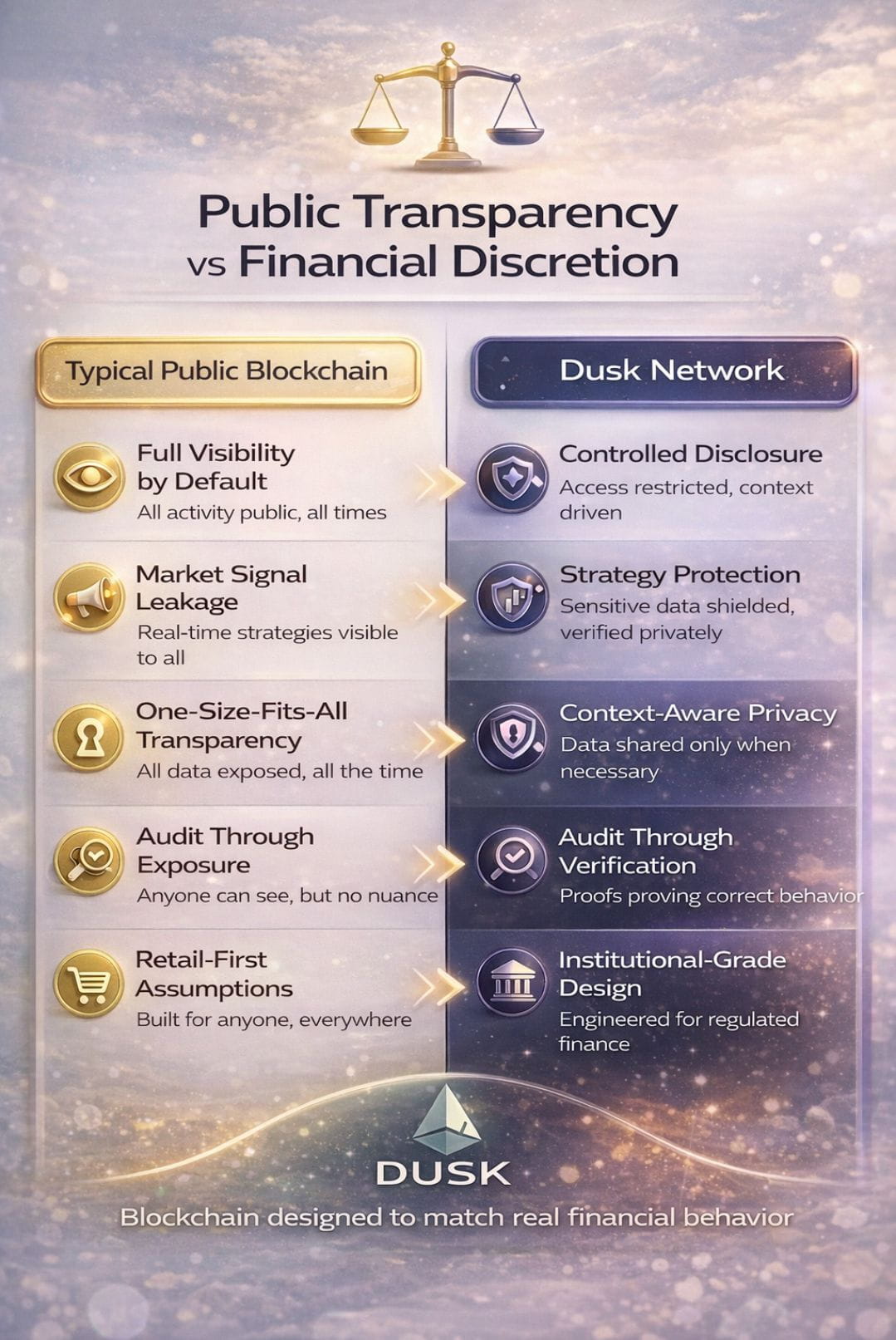

Dusk has been around since 2018, and from the beginning it feels like the team understood something many crypto projects still wrestle with. Institutions don’t avoid transparency because they’re hiding wrongdoing. They avoid unnecessary visibility because exposure itself creates risk. A trading desk doesn’t want competitors reading its strategy in real time. A treasury doesn’t want its internal flows turning into market signals. At the same time, none of these actors can escape oversight. Audits, compliance checks, and regulatory reviews are part of daily life.

@Dusk doesn’t try to fight that reality. It designs around it.

The network’s modular structure reflects how finance already works off-chain. Settlement is treated as something stable and predictable. Execution layers sit above it, where applications can evolve without constantly destabilizing the base. That separation might look boring compared to monolithic “do everything” chains, but it’s intentional. Financial infrastructure survives by changing slowly at the core and more flexibly at the edges.

Privacy on $DUSK isn’t framed as disappearing into the shadows. It’s framed as limiting information leakage. Transactions can be verified as correct without broadcasting sensitive details to the entire world. That matters more than it sounds. In finance, information is leverage. Leaking it at the wrong time can move markets, distort behavior, or expose participants to unnecessary risk.

What makes Dusk different from privacy-first chains of the past is that it doesn’t stop at concealment. It leaves room for accountability. Disclosure isn’t impossible; it’s controlled. Authorized parties can check on behavior when they need to, without making all transactions public all the time. That balance mirrors how regulated systems already function. Regulators don’t need constant visibility. They need assurance and evidence when it’s required.

This becomes especially important as tokenized assets move from theory to practice. Tokenized equities, funds, and real-world assets can’t live on ledgers where every position and movement is public by default. But they also can’t exist in systems that dodge scrutiny. Dusk sits between those extremes, offering a structure institutions can actually work with.

Even the role of the DUSK token fits this mindset. It isn’t presented as a hype engine. It secures the network, pays for execution, and aligns validators over long time horizons. The design assumes adoption will be slow, regulated, and cumulative—not explosive and speculative.

As the industry matures, the conversation will change. The question won’t be “how transparent can we be?” It will be “how much visibility is appropriate?” Dusk’s answer is simple and very traditional: discretion first, verification when required. In serious finance, that’s how trust has always been built.