The digital asset market is showing signs of resilience this week. Despite a hawkish macro environment, bitcoin and ether have clawed back toward the 90,000 USD and 3,000 USD milestones, respectively. While the 'higher-for-longer' Fed narrative persists, the return of the institutional bid is providing a much-needed floor. 🛡️

Here is a breakdown of the current market shift:

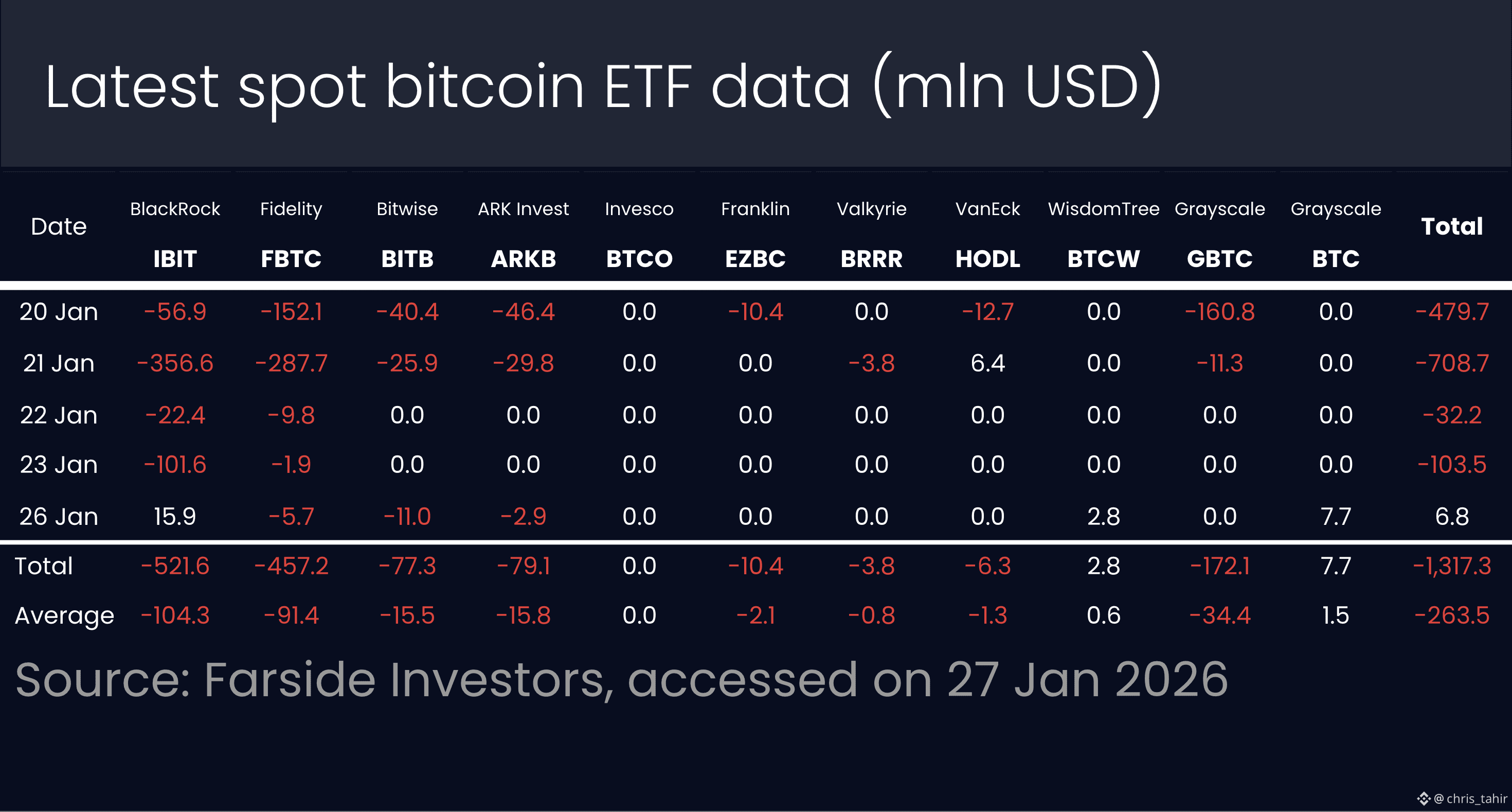

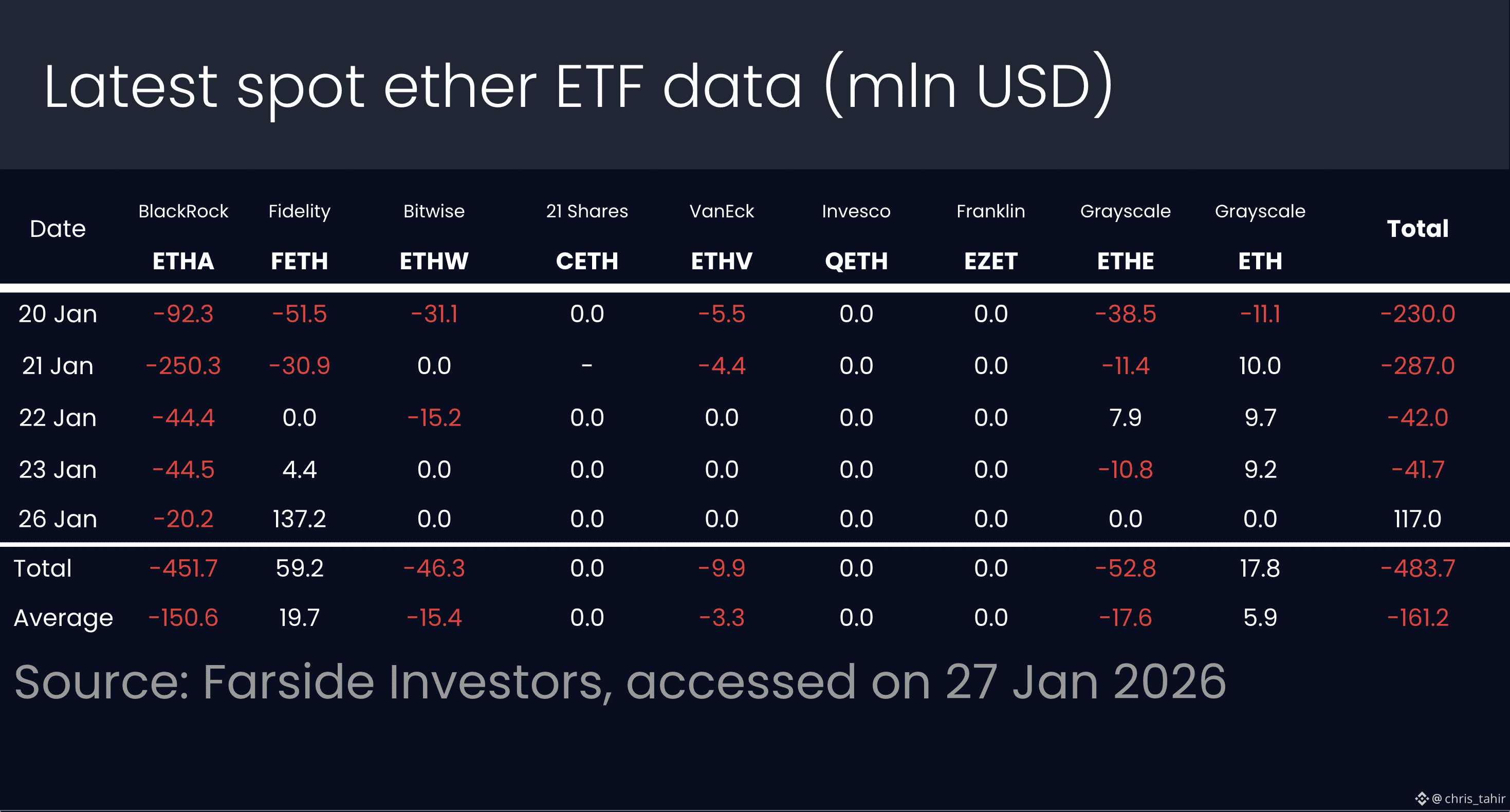

📈 ETF Reversal: After a period of heavy redemptions, US-listed ETFs saw a net inflow of 123.8 mln USD. Interestingly, ether ETFs led the charge with 117 mln USD in fresh capital, spearheaded by Fidelity’s FETH.

🏦 ETF Dynamics: BlackRock’s IBIT continues to maintain a steady presence, while the broad recovery in ETF demand suggests that professional investors are buying the dip as safe-haven assets undergo a correction.

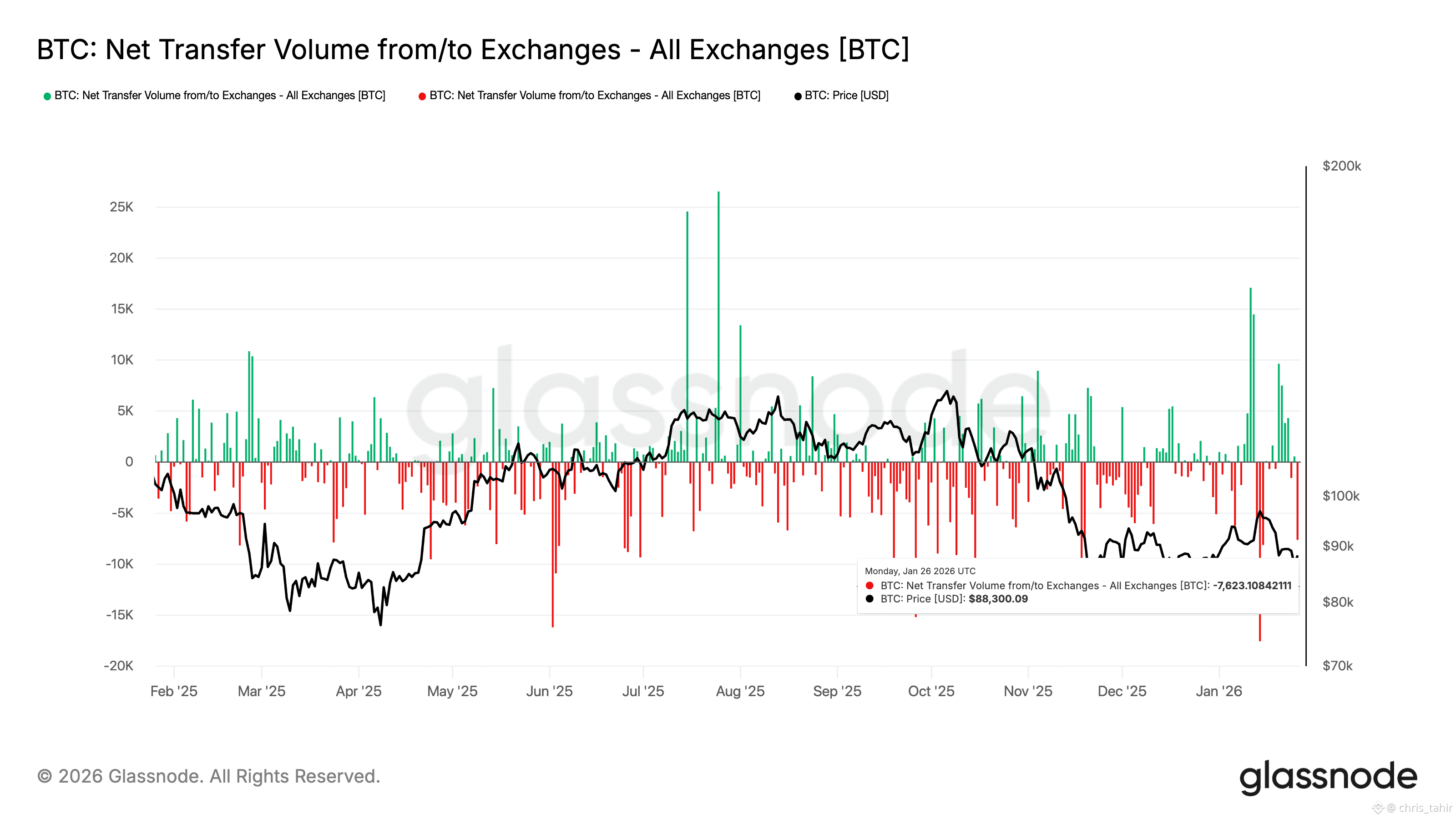

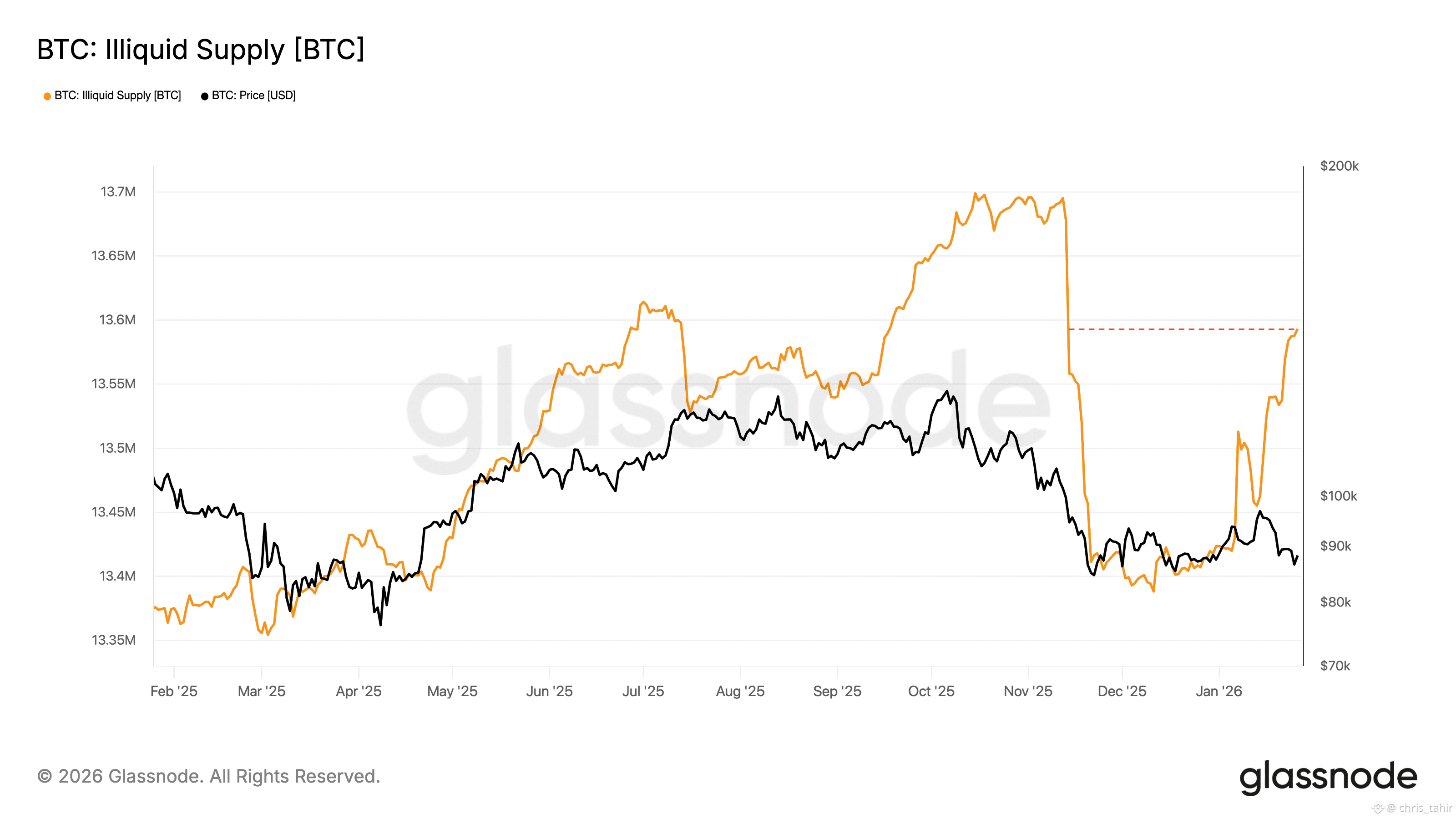

🏜️ Liquidity Drought: Onchain data shows investors withdrew over 7.6k BTC from exchanges, pushing 'Illiquid Supply' to its highest level since mid-November. While this is structurally bullish, it often acts as a double-edged sword by amplifying near-term volatility.

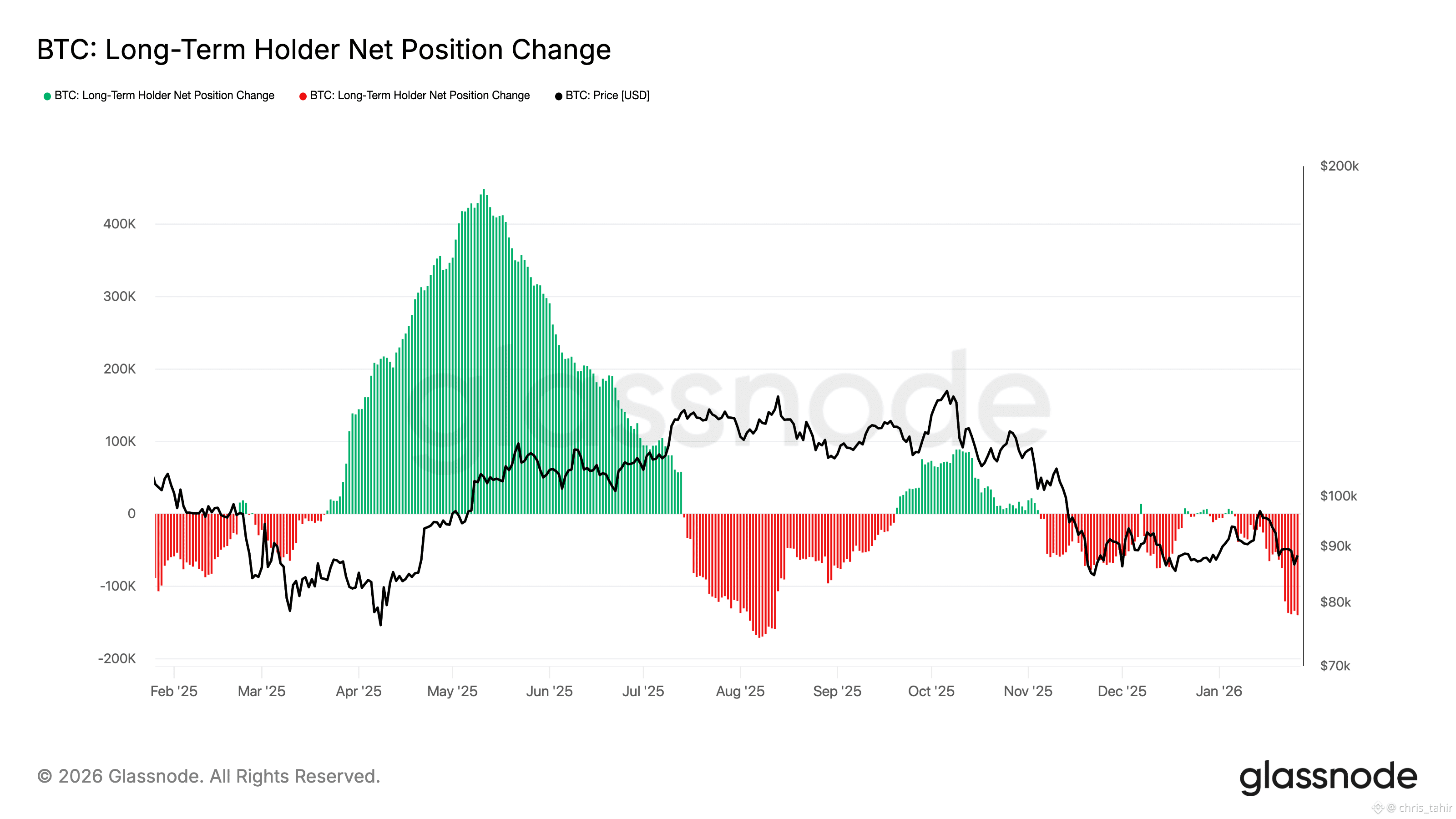

⚖️ The LTH Headwind: Long-term holders (LTHs) aren't convinced yet. Distribution from these seasoned wallets has accelerated to levels not seen since mid-August, creating a persistent supply overhang that may cap rapid gains.

The Bottom Line: We are witnessing a classic battle between institutional accumulation and long-term holder distribution. While the "liquidity vacuum" on exchanges could trigger sharp moves, the return of ETF inflows is the stabilizing force to watch.

Do you think the return of the ETF investments is enough to offset the selling pressure from long-term whales?