@Plasma : Stablecoins have quietly become the most widely used and impactful application in crypto powering everything from remittances and payments to DeFi liquidity and on-chain savings. While many blockchains support stablecoins, very few are actually designed around them.

This is where @undefined stands apart. Plasma is a Layer 1 blockchain built specifically for stablecoin settlement, with the clear goal of making digital dollars and other stable assets move as efficiently as possible across borders, applications and financial systems.

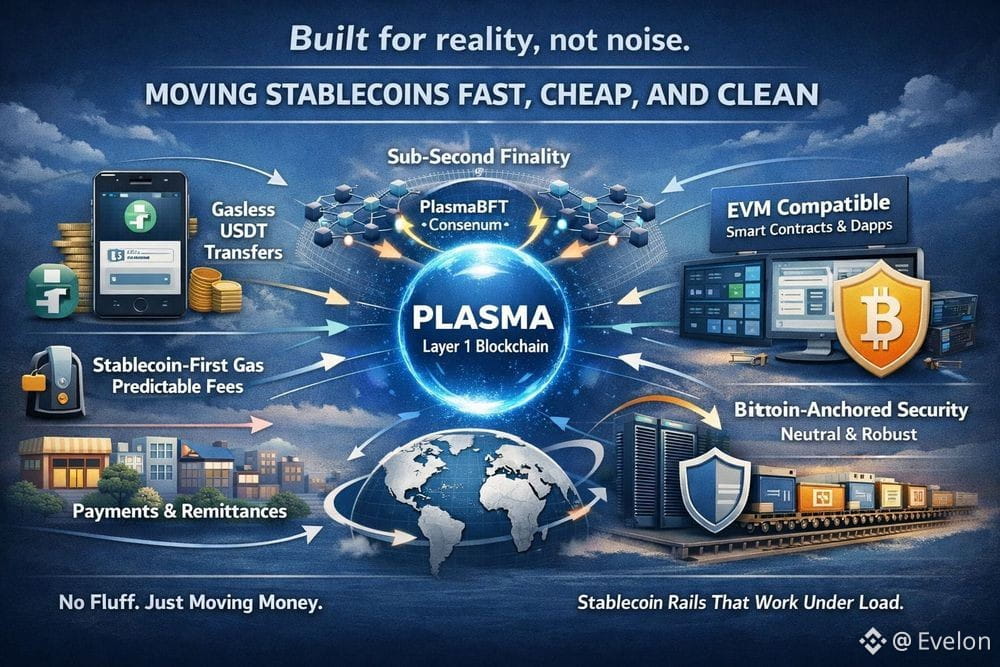

At a technical level, Plasma combines full EVM compatibility through Reth with sub-second finality using PlasmaBFT. This means developers can deploy familiar Ethereum smart contracts while users experience near-instant transaction confirmations. For DeFi and payment use cases, speed and predictability are not optional features; they are essential. Plasma’s architecture ensures that decentralized exchanges, lending protocols and payment applications can operate smoothly without the congestion and fee volatility that often plague general-purpose chains.

One of the most important design choices behind Plasma is its stablecoin-first philosophy. Instead of forcing users to hold a volatile native token just to pay for gas, Plasma enables stablecoin-based gas and even gasless USDT transfers. This dramatically improves usability, especially for non-crypto-native users and businesses. For someone using stablecoins for payroll, merchant payments or cross-border transfers the experience feels closer to traditional fintech apps while still benefiting from blockchain transparency and programmability.

Ecosystem growth on Plasma is being driven by this strong alignment with real-world needs. In DeFi, stablecoins are the primary unit of account for lending, borrowing, yield strategies and liquidity provision. By optimizing the chain for stablecoin settlement.

Plasma becomes a natural home for DeFi protocols that prioritize efficiency, capital stability, and composability. Developers can build products where users are insulated from volatility while still earning yields, accessing credit, or providing liquidity across markets.

Payments are another core pillar of Plasma’s ecosystem expansion. Sub-second finality and low-cost transfers make it viable for everyday use cases such as remittances, peer-to-peer payments and merchant settlement. In high-adoption regions where stablecoins are already used as a hedge against inflation or currency instability, Plasma offers an infrastructure layer that can scale to millions of users without sacrificing speed or reliability. This is where blockchain moves beyond speculation and into daily economic activity.

Cross-chain functionality further strengthens Plasma’s position. Modern crypto users and institutions do not operate within a single chain; liquidity and assets flow across multiple ecosystems. Plasma is designed to act as a settlement hub enabling stablecoins and other assets to move efficiently between chains. Its Bitcoin-anchored security model adds an additional layer of neutrality and censorship resistance, leveraging Bitcoin’s proven security guarantees while enabling more expressive smart contract functionality on Plasma itself. This combination appeals not only to DeFi users but also to institutions that require strong security assumptions and long-term reliability.

Institutional adoption is a clear focus for Plasma as well. Financial institutions, payment providers and fintech companies care about predictable fees, fast settlement, and regulatory-aligned infrastructure. Plasma’s stablecoin-centric design, combined with its performance and security model, makes it suitable for handling large transaction volumes and enterprise-grade payment flows. This creates a bridge between on-chain finance and traditional financial systems, allowing institutions to experiment with blockchain technology without compromising on efficiency or user experience.

At the center of this growing ecosystem is the $XPL token, which plays a key role in network security, validator incentives, and protocol alignment. As activity across DeFi, payments, and cross-chain settlement grows, $XPL becomes increasingly tied to the health and usage of the Plasma network. Rather than existing purely as a speculative asset, it supports the infrastructure that enables real economic activity on-chain.

Plasma’s long-term vision is clear to become the foundational settlement layer for stablecoins in a multi-chain, global financial system. By focusing on usability, performance, and real-world adoption from day one.

#Plasma is positioning itself as more than just another Layer 1. It is building the rails for a stablecoin-powered economy where value can move instantly, cheaply, and securely across borders and applications. As DeFi matures and stablecoins continue to dominate on-chain volume.

Plasma’s ecosystem growth could play a major role in shaping the future of blockchain-based finance.