When people talk about Plasma, they often jump straight to speed. How fast are blocks? How much throughput? How does it compare to other L1s? I think that misses the point. Plasma doesn’t feel like it’s chasing bragging rights. It feels like it’s trying to solve a much quieter problem: how blockspace should behave when it’s used for payments, not speculation.

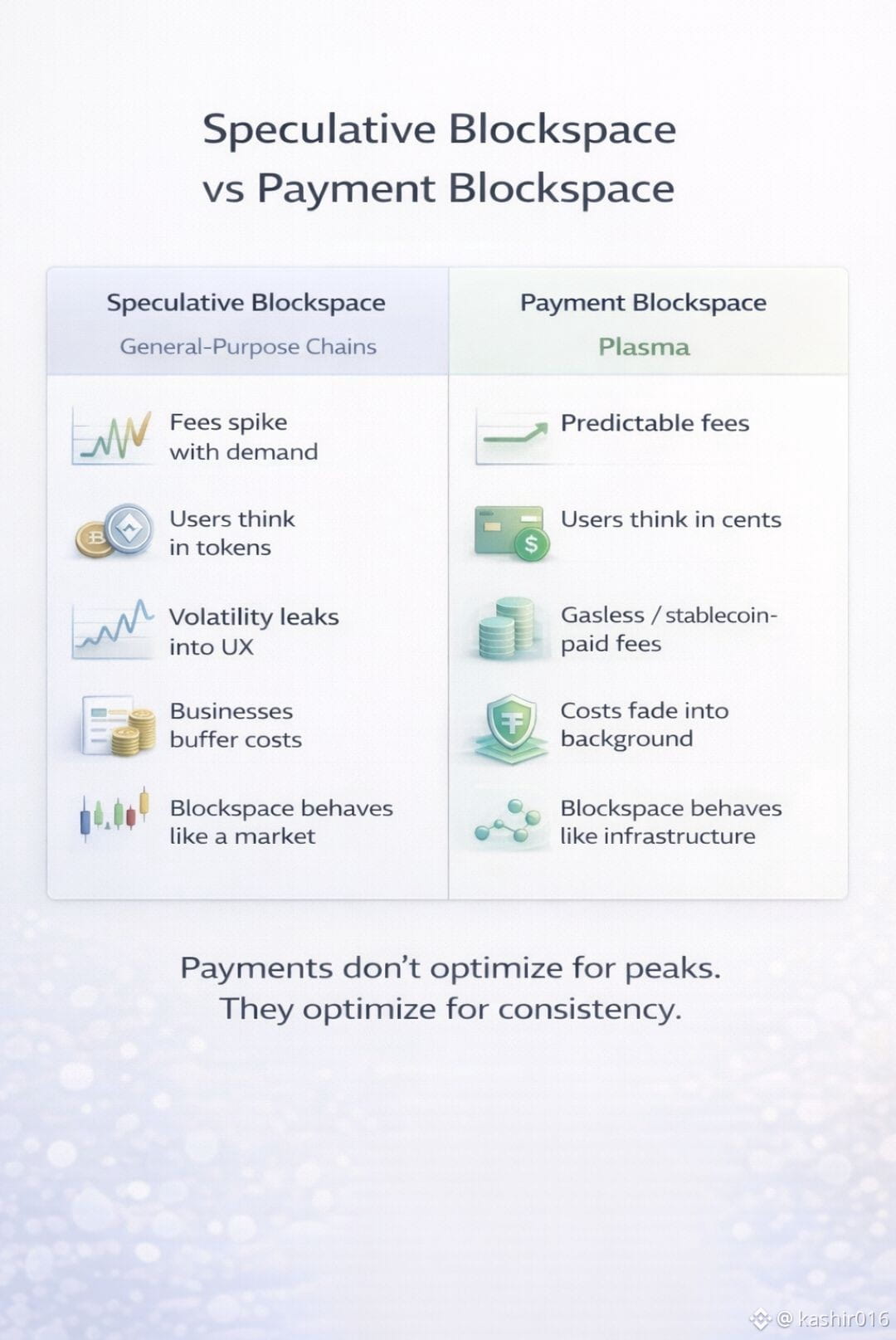

Most chains price blockspace through demand pressure. When markets are hot, fees explode. When activity dies, fees collapse. That works fine if you’re trading or farming yield. It breaks down completely if you’re trying to run something boring but real, like merchant payments, payroll, or routine stablecoin transfers. No business wants to guess what a transaction will cost in the next hour.

Plasma’s gasless USDT transfers and stablecoin-paid fees change that experience in a very simple way. Users don’t think in tokens or volatility. They think in cents. That sounds small, but it’s a big mental shift. Once fees stop pulling your attention, the network starts behaving more like infrastructure and less like a market.

That’s why Plasma reminds me less of DeFi chains and more of payment rails. Not because it’s copying Visa or banks, but because it’s optimizing for the same thing they care about: predictability. When payments work, nobody talks about them. They just expect them to go through, even when conditions are bad.

But this design choice comes with trade-offs that are easy to ignore if you’re only looking at the surface.

If users aren’t directly paying volatile gas fees, then someone else is absorbing that complexity. Fees don’t disappear, they get abstracted. That shifts influence toward relayers and entities managing payment flow. It makes the system smoother, but it also raises a quiet question about control. In practice, whoever manages that layer can shape how the network is accessed and used.

Bitcoin anchoring adds an important counterweight here. Tying settlement to Bitcoin brings a level of neutrality and external trust that many payment-focused systems lack. It’s a signal that Plasma wants a solid, non-negotiable base beneath the smoother user experience.

Still, anchoring doesn’t fully answer the question of who holds power day to day. In traditional payments, intermediaries matter more than most users realize. Plasma has to prove it can avoid recreating that same structure in a new form.

For me, Plasma’s real test isn’t speed, features, or even listings. It’s whether stablecoin transfers stay boring when the market isn’t. Whether fees remain predictable during stress. Whether access stays open without quietly becoming permissioned by infrastructure operators.

If Plasma succeeds, it probably won’t feel exciting. It won’t trend every week. But it might earn something rarer in crypto: trust built through repetition. Sending USDT again and again, across different market conditions, and seeing it just work.

That’s not a loud success. But for payments, it’s the only one that matters.