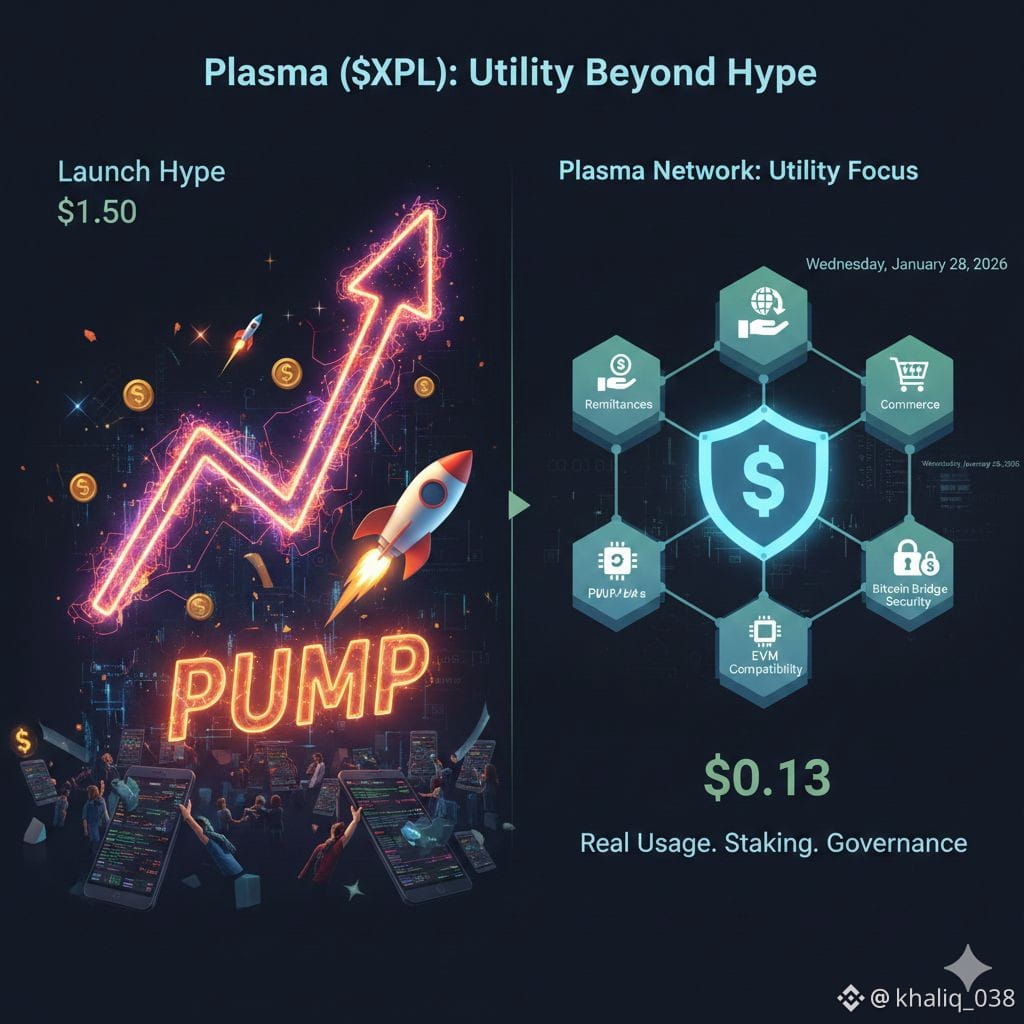

A lot of people treated Plasma and its $XPL token like a quick-win trade when it launched. They saw a new Layer‑1 chain with a stablecoin angle get listed on big exchanges, liquidity poured in, and the price pumped. That frame—token as short‑term bet—ignores what the protocol is really trying to do and where it is in the adoption curve. What’s left now is more about utility and less about hype.

Plasma is a purpose‑built blockchain that puts stablecoin transfers at the center. It’s not trying to be another generic smart contract host first—it’s optimised for dollar‑pegged assets, especially USDT, with gasless transfers on simple sends and an EVM‑compatible environment so existing tooling and contracts can run without major rewrites. Behind the scenes there’s a consensus mechanism called PlasmaBFT, sub‑second block finality in theory, and integration with Bitcoin through a trust‑minimised bridge to anchor security.

The native token $XPL plays roles you’d expect in a PoS chain: it’s the gas token for transactions and complex operations, the staking token that secures the network, and a governance asset for protocol decisions. There’s a fixed supply of 10 billion, with allocations split across public sale, ecosystem incentives, team, and investors under vesting schedules meant to align long‑term incentives. Inflation starts at around 5 per cent and tapers to about 3 per cent, with fee‑burn mechanisms inspired by EIP‑1559 to counterbalance dilution over time.

Looking at how people use it now, the early exuberance has worn off. After debuting with a market cap well into the billions and prices that reached around $1.5 on launch, XPL has dropped substantially from those highs as network activity hasn’t matched the initial narrative and speculative demand waned. Actual throughput according to explorers is far below the touted thousands per second, and utility beyond stablecoin transfers and a large lending vault remains muted. Major on‑chain activity and product hooks like staking are still in the pipeline.

From a practical standpoint, Plasma’s thesis only makes sense if stablecoin rails actually get used for real economic activity at scale—not just yield chasing or token trading. Zero fee USDT transfers matter for remittances or commerce only if there’s merchant integration and predictable settlement flows. The network’s EVM compatibility and tooling support mean developers can deploy familiar code, but a chicken‑and‑egg problem persists: without differentiated demand for stablecoin settlement, there’s little reason for builders to prioritise Plasma over existing L2s or even rival chains.

There’s also a community‑level friction point around messaging and transparency. Allegations about market maker behaviour and big wallet moves have circulated alongside price drops, and while founders have publicly denied insider selling and pointed to locked tokens, these narratives stick because liquidity and activity are low relative to initial expectations.@Plasma