Is the dollar's pain becoming crypto's gain? As we head into today's FOMC meeting, the narrative is shifting from fear to a calculated 'bargain hunt'. 📈

Here is the strategic breakdown of the current market recovery:

📉 The Dollar Pivot: Recent comments from the administration regarding the strength of the greenback have exerted downward pressure on the dollar, effectively reallocating capital into risk assets like bitcoin and ether.

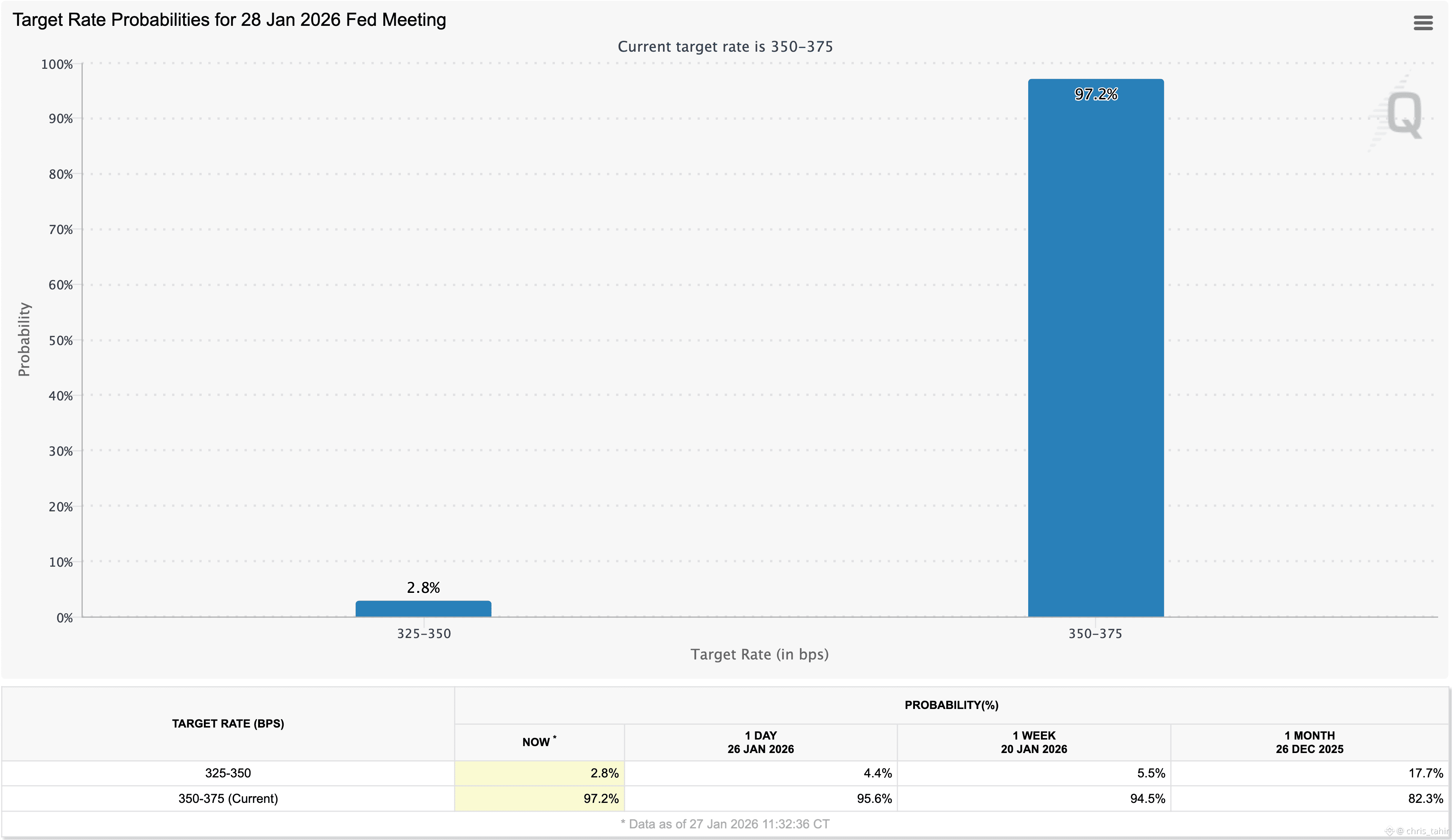

🏛️ Fed Certainty: The CME FedWatch tool shows that a rate hold is now fully priced in at over 97%. With no immediate rate cut on the horizon, the market is looking toward currency devaluation as the primary driver.

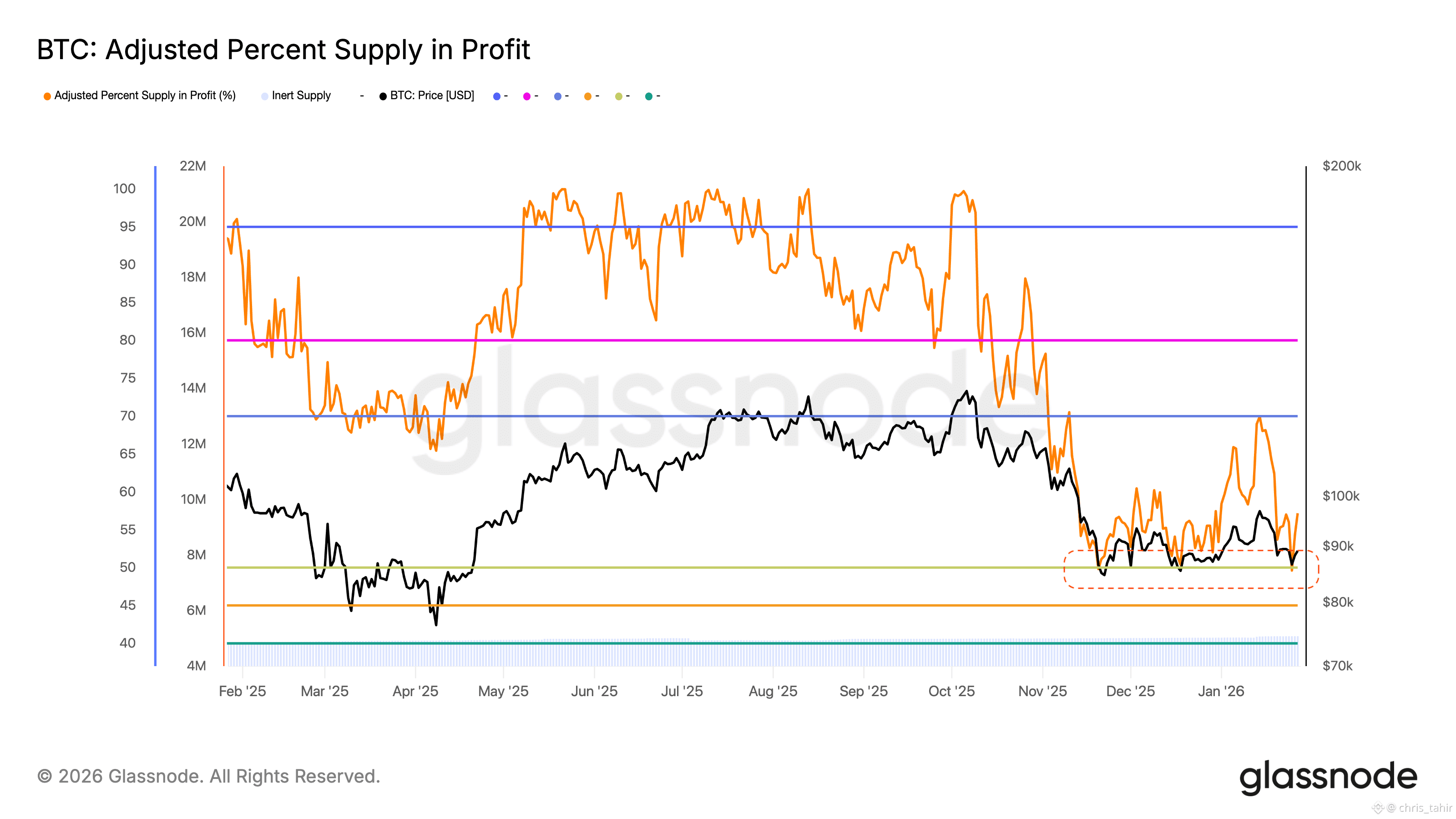

📊 Technical Correction: The recent bounce perfectly coincided with the 'Adjusted Percent Supply in Profit' hitting the 50% mark. This level historically acts as a magnet for bargain hunters speculating on a cycle recovery.

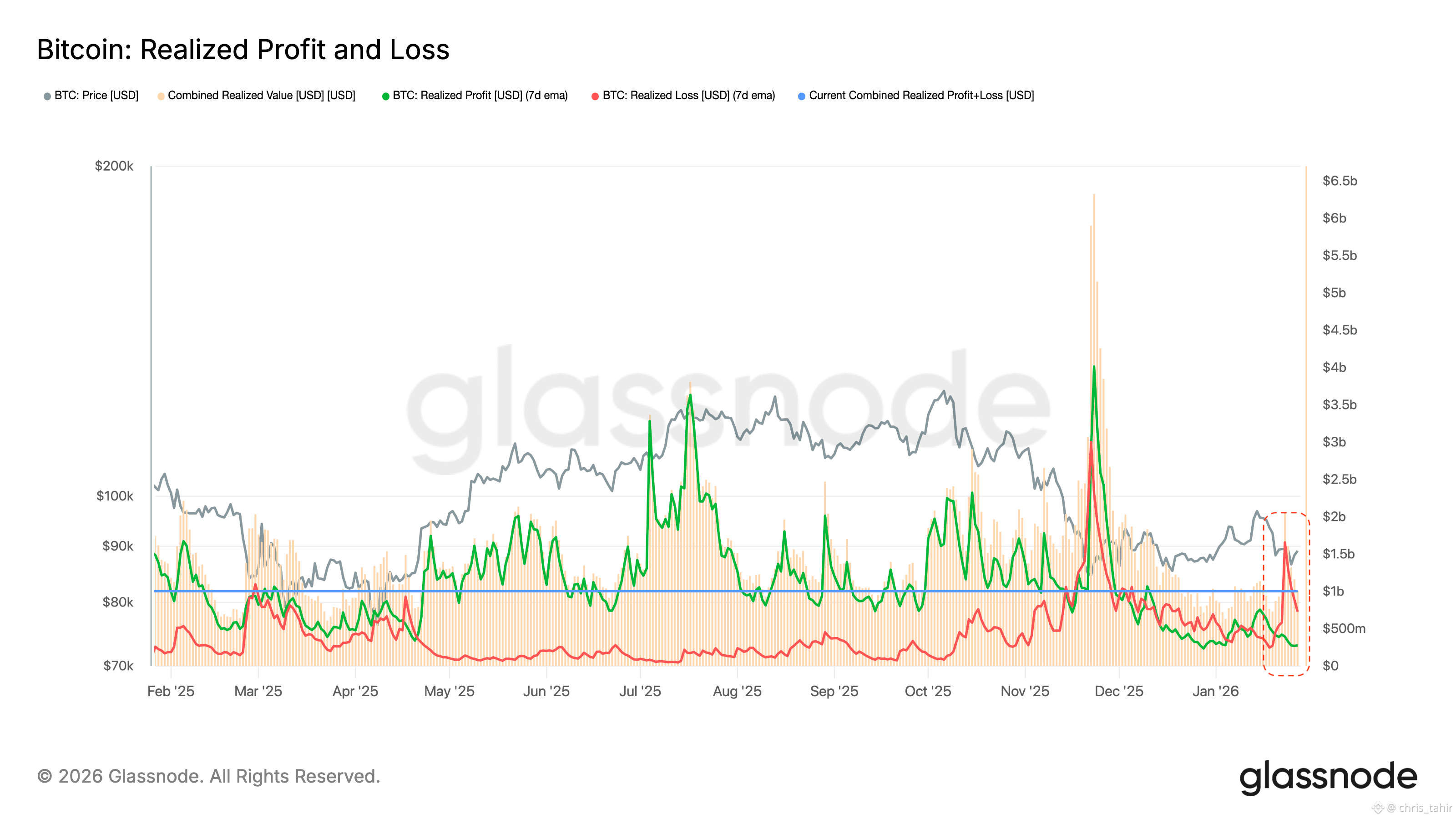

⚠️ A Market in Pain: Despite the green candles, the Net Realized Profit and Loss (NRPL) reveals a sobering reality. Market participants recorded 729 mln USD in losses against only 276 mln USD in profits, suggesting that many are still looking for an exit.

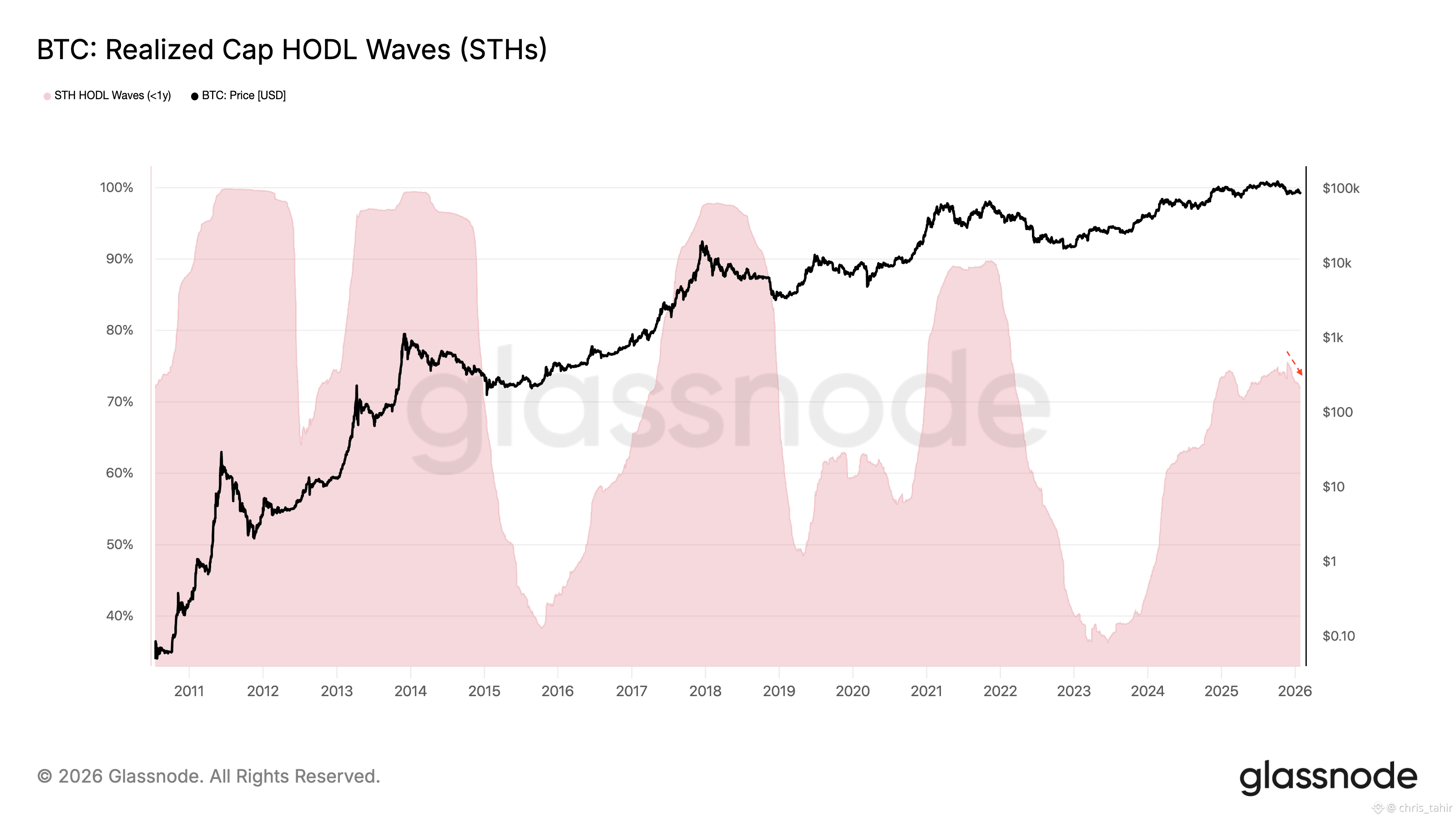

⚖️ Cycle Peak Signals: We are seeing a decline in 'Short-Term Holder Realized Cap HODL Waves'. While subtle, this shift—combined with distribution from long-term holders—suggests the explosive phase of this cycle may be cooling.

The Bottom Line: We are seeing a recovery fueled by dollar weakness rather than fundamental economic strength. Until the NRPL shifts back into net-profit territory, this bounce remains a 'speculative' move.

Are you holding for a full recovery, or is this the 'exit liquidity' you’ve been waiting for?