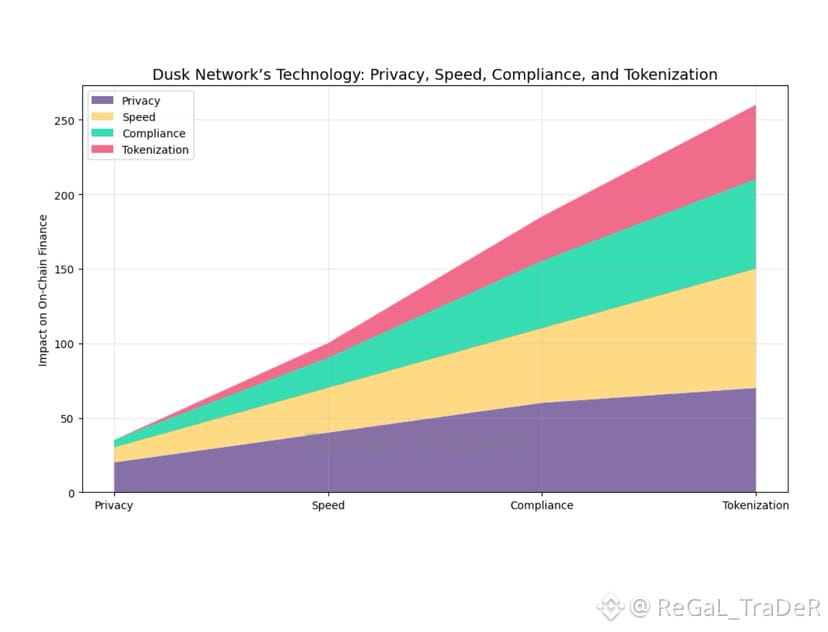

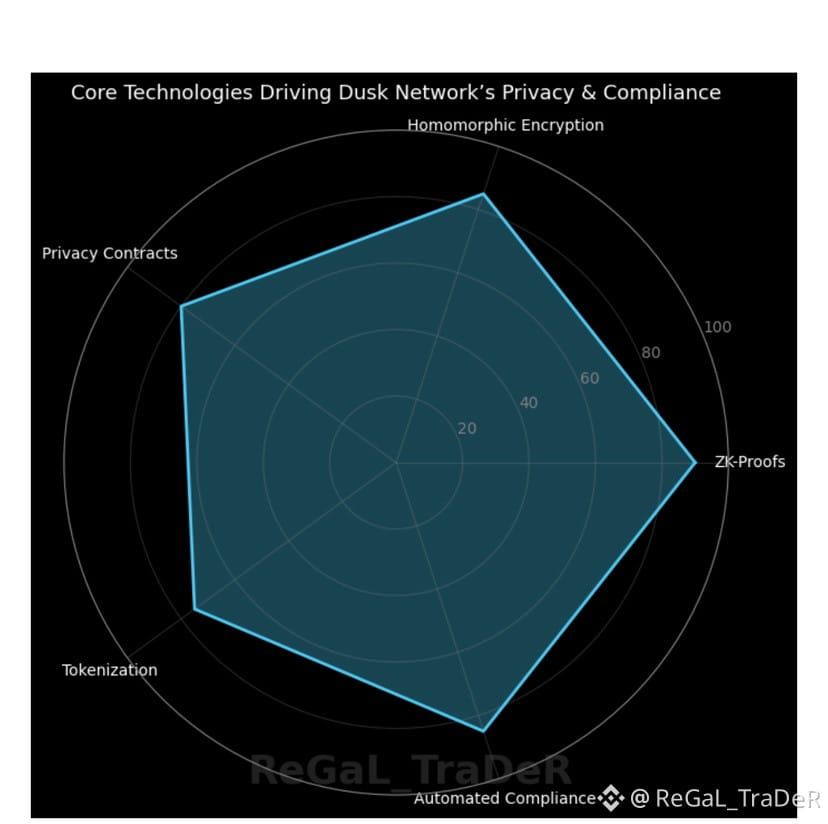

In today’s rapidly evolving world of finance, privacy and compliance are more than just buzzwords; they’re essential building blocks for the next generation of financial systems. Dusk Network is carving out a path in this space with its Layer 1 blockchain, designed to offer privacy in a way that aligns with global financial regulations. At the heart of its strategy is an elegant fusion of cutting-edge technologies, like Zero-Knowledge Proofs (ZK-Proofs) and Homomorphic Encryption, which allow for privacy and compliance without compromise.

Imagine you’re making a transaction—one that’s important, but also requires a degree of discretion. In traditional finance, this process often involves layers of intermediaries, each adding their own level of scrutiny and oversight. Dusk Network, however, flips this model by using privacy-preserving smart contracts. These contracts ensure that the details of a transaction remain shielded, while still validating that all parties are meeting the necessary conditions. In essence, you can make secure transactions without anyone peeking into the specifics of your deal.

What makes this even more impressive is the speed. Transactions on Dusk are settled instantly. You don’t have to wait for hours, or even days, as you might with traditional banks or some other blockchain platforms. With Dusk’s technology, the financial process feels almost seamless—like pulling a lever in a well-oiled machine and watching the gears turn effortlessly.

What makes this even more impressive is the speed. Transactions on Dusk are settled instantly. You don’t have to wait for hours, or even days, as you might with traditional banks or some other blockchain platforms. With Dusk’s technology, the financial process feels almost seamless—like pulling a lever in a well-oiled machine and watching the gears turn effortlessly.

Yet, privacy and speed would be meaningless if they weren’t paired with compliance. Dusk understands that privacy isn’t just about hiding information; it’s about ensuring that the information that is shared adheres to the right standards. That’s where automated compliance comes into play. Instead of relying on human intervention or external audits, Dusk’s network automates the process of ensuring that each transaction meets the requirements set forth by regulators.

For example, it uses bulletin boards for transparency—public ledgers where anyone can check high-level, non-sensitive transaction details. This creates a balance between confidentiality and openness, making sure that all transactions comply with both local and global regulations. It’s like a ledger where the details are encrypted, but the oversight is still visible to ensure that everything is in order.

One of the most intriguing aspects of Dusk’s technology is how it facilitates the tokenization of real-world assets (RWAs). Imagine you want to invest in a piece of property, but the traditional path is tangled with paperwork, legalities, and long waiting periods. With Dusk, these hurdles fade away. Through tokenization, real-world assets like real estate or precious commodities are represented digitally, enabling them to be bought, sold, and traded on the blockchain.

What’s even more compelling is how Dusk ensures that all this is done in compliance with existing laws. Unlike other platforms that may operate in a more grey area, Dusk works directly with financial regulators to ensure that tokenized assets meet the legal requirements of various jurisdictions. This opens up new possibilities for cross-border finance, where assets can be transferred without the usual complexities and delays, all while adhering to the laws that govern them.

Dusk’s technology isn’t just theoretical—it’s already being put to work in real-world use cases. From financing to trading to automation, Dusk enables a range of activities that can help businesses and investors alike. For example, by utilizing Dusk’s platform, companies can engage in financial activities with a degree of privacy and automation that wasn’t previously possible.

Investor backing plays a key role in this, with entities like Bitfinex and Blockwall Management lending their support. These investors see the potential in Dusk’s ability to bridge the gap between traditional finance and the burgeoning world of blockchain, providing the backing necessary for the platform’s growth.

As we look toward the future, the shift to on-chain markets seems not only inevitable but essential. Traditional finance systems have long been burdened by inefficiencies and regulations that can stifle innovation. Dusk’s technology, with its combination of privacy, speed, compliance, and tokenization, positions it as a leader in this transition. It’s a shift that feels like a natural progression—an evolution that blends the best of both worlds.

Of course, there are risks. The regulatory landscape is still evolving, and there’s always the potential for unforeseen changes. But what Dusk offers isn’t just a solution for today—it’s a forward-thinking approach to finance that anticipates tomorrow’s needs. By focusing on a balance between privacy and compliance, Dusk is not just building a product for the current market; it’s shaping the future of finance.

In this ever-changing landscape, Dusk’s technology serves as a quiet yet powerful reminder that the future of finance doesn’t have to be at odds with privacy or compliance. Rather, it can be a harmonious blend of both, moving us toward a more secure, efficient, and inclusive financial world.