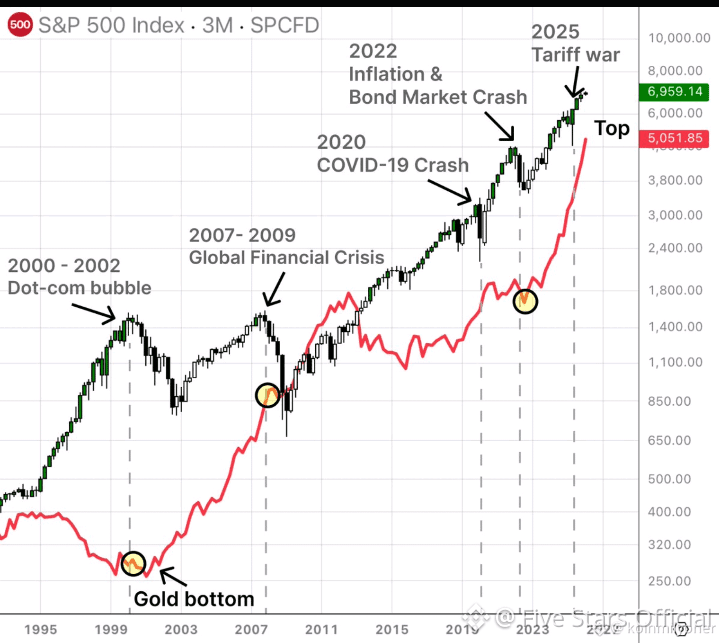

Gold Has Never Pumped Before a Market Crash ⚠️🪙

Gold doesn’t run before the damage happens — it reacts after the crash. Let’s slow down and look at the facts, not the fear. 👇

Every day, headlines scream:

💥 “Financial collapse is coming”

💥 “Dollar is doomed”

💥 “Markets will crash”

💥 “War, debt, instability everywhere”

What do people usually do after reading this nonstop?

👉 Panic

👉 Rush into gold

👉 Abandon risk assets

Sounds logical… but history tells a different story. 📉

How Gold Actually Behaved During Crashes:

📉 Dot-Com Crash (2000–2002)

S&P 500: -50%

Gold: +13%

➡️ Gold rose after stocks were already collapsing.

📈 Recovery Phase (2002–2007)

Gold: +150%

S&P 500: +105%

➡️ Post-crisis fear pushed people into gold.

💥 Global Financial Crisis (2007–2009)

S&P 500: -57.6%

Gold: +16.3%

➡️ Gold performed during panic phases.

🪤 2009–2019 (No Crash, Just Growth)

Gold: +41%

S&P 500: +305%

➡️ Gold holders were sidelined while stocks surged.

🦠 COVID Crash (2020)

S&P 500: -35%

Gold: -1.8% initially

Then, after panic hit:

Gold: +32%

Stocks: +54%

➡️ Again, gold pumped after fear, not before.

⚠️ What’s Happening Now?

People are scared of:

▪ US debt 💰

▪ Budget deficits 📉

▪ AI bubble 🤖

▪ War risks 🌍

▪ Trade tensions 🚢

▪ Political chaos 🗳️

As a result, many are panic-buying metals before a crash.

🚫 The Real Risk

If no crash occurs:

❌ Capital gets stuck in gold

❌ Stocks, real estate, and crypto continue to grow

❌ Fear-driven buyers miss years of upside

🧠 Final Rule:

Gold is a reaction asset, not a prediction asset. It reacts to fear — it doesn’t anticipate it.

#FedWatch #TokenizedSilverSurge #FedHoldsRates #GoldOnTheRise