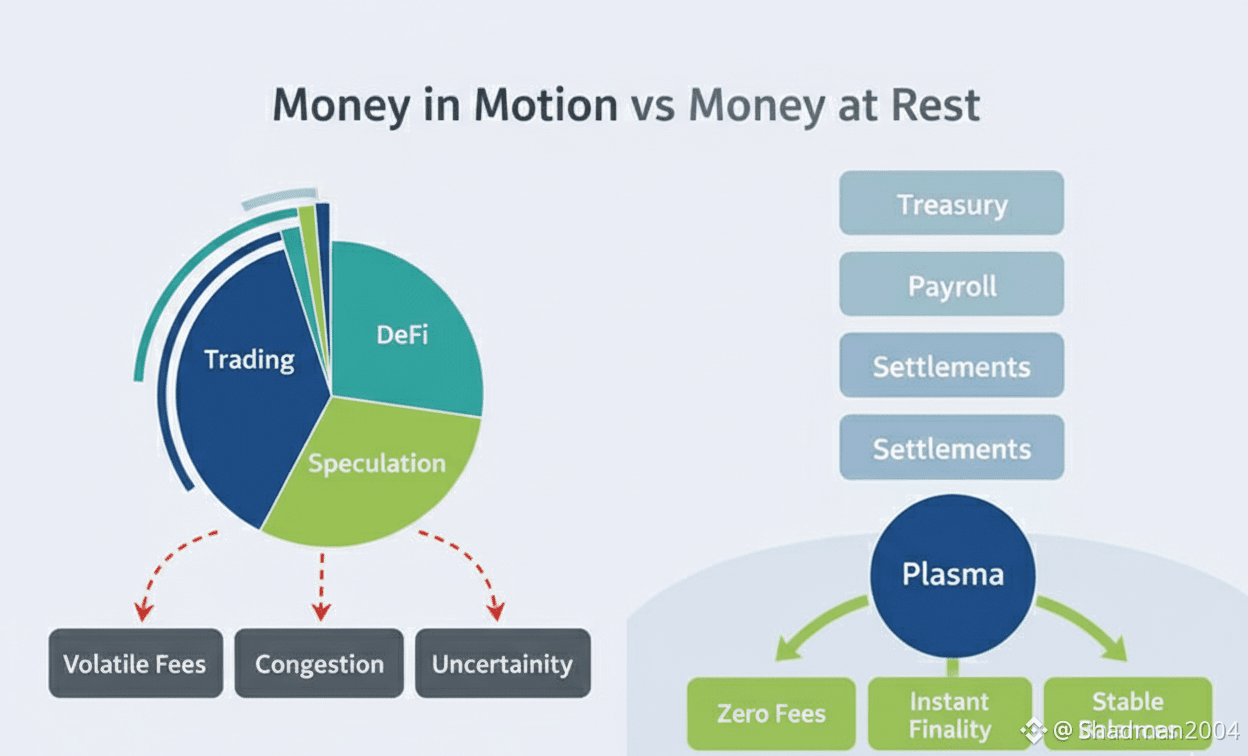

Most blockchain chatter obsesses over speed—faster txns, insane TPS, non-stop action. But flip that script: what keeps money still? Real finance thrives on idle cash in treasuries, payroll buffers, merchant floats, savings vaults. Banks, payment rails, accounting ledgers? Built for that dormancy. Plasma flips crypto's game by embracing stillness over frenzy. $XPLOne tweak changes it all. Typical chains treat you as a trader: fees spike with congestion, finality's a dice roll. Finance teams hate that uncertainty—auditors demand proof. Plasma sees users as balance-sheet operators. No market pumps, just boring reliability: predictable costs, ironclad finality. PlasmaBFT seals txns forever—no reorgs, no prob stats.It splits economic risk from activity. Other chains? More use = more fees, network strain, settlement roulette. Plasma? Zero-fee stablecoin zips (USDT shines here), usage never warps costs. Businesses win: payroll won't glitch on "network busy" excuses. Regulators nod at steady accounting. No TradFi flaws like central chokepoints.Plasma's the neutral spine linking chains. Settle balances legible here, park assets elsewhere. Think clearinghouses, not app-hosting arenas. Borrows Bitcoin's trust (slow but solid) for efficiency underneath. Faith in BTC, action on Plasma—rare crypto alchemy.Privacy? Not dark-web hiding, but noise reduction. Finance hides salaries, vendor pays, internal shifts. Plasma defaults confidential, verifies on demand. Compliance-friendly, not combative.Cognitive ease is underrated. Gas guesses? Bridge hell? Liquidity splits? Gone. Plasma just works—adoption sneaks in.

One payroll hook spreads like treasury ivy. Slow burn, sticky growth. No airdrop hype, pure infra creep.Decentralization reimagined: not every app, but financial truth. Verifiable balances/settles, flexible apps atop. Internet-style: base protocols, wild UIs.Anti-fragile too. Thrives on low buzz, not txn floods. Bear markets? Plasma hums while spec chains crash.Real-time pulse (Jan 30, 2026): XPL at ~$0.14, $288M cap, 2B circ supply. Mainnet beta live since Sep '25, $3.4B TVL via zero-fee USDT/sub-sec finality. #2 on-chain lending. USDT moat (81% dominance) crushes. Rain's 150M merchants? Payments king. Italy VASP license, MiCA push—compliance edge. Vs. Base/OPMainnet: stablecoin TVL lead. Arc/Tempo loom, but first-mover + Tether ties hold.Predictions? 2026: $0.10-0.39 range, avg ~$0.15 . Up 5% short-term to $0.144 . Optimists eye €0.12+ . Stablechain pioneer, not L1 racer or DeFi zoo.Maturity marker: value in trust, quiet, endurance. No overnight bank kill—erodes friction silently. Fees vanish. Finality absolute. Accounting? Cakewalk. Feel seamless money, rest feels broken.Radical? Hell yes. Plasma ain't app platform or scaler. It's decade-proof financial plumbing: predictable, auditable, eternal.#Plasma $XPL —stillness wins.$XPL