,

Stablecoins are now that dominant use case, and they place

very different demands on a network.Plasma takes a specialized approach.

Instead of asking how many things it can support, it asks how well it can

support one thing: stablecoin settlement. Specialization allows tighter

optimization, clearer performance targets, and fewer trade-offs. In finance,

specialization is normal. Payment networks, clearing houses, and settlement

systems all exist for specific roles.As stablecoins continue to absorb more real

systems all exist for specific roles.As stablecoins continue to absorb more real

world value flows, the infrastructure behind them will need the same clarity of

purpose. Plasma's design reflects a shift in thinking from building flexible

platforms to building dependable systems. That shift may not look exciting, but

it's often how lasting financial infrastructure is built.

Every emerging infrastructure project eventually faces a

paradox: the more fundamental the role it plays, the harder it is to explain

its value in simple terms. Plasma sits squarely inside this paradox.

Unlike consumer-facing applications, Plasma does not compete

for attention through flashy features or immediate user growth. Instead, it

operates in a layer where relevance is defined by dependence, not popularity.

This raises a set of recurring questions from investors and builders alike —

questions that are often dismissed as impatience, but are in fact structural

concerns worth addressing.

This article examines the key issues surrounding Plasma

today, why they exist, and how Plasma attempts to resolve them.

1. If Plasma Is Critical Infrastructure, Why Isn’t Adoption

Obvious Yet?

One of the most common doubts is straightforward:

If Plasma solves a real problem, why aren’t applications

rushing to use it?

This question assumes that infrastructure adoption behaves

like consumer adoption. It doesn’t.

Infrastructure adoption is reactive, not proactive. Builders

do not migrate to new primitives because they are novel, but because existing

systems begin to fail under real operational load. Most chains and layers

appear “good enough” early on. Pain only emerges at scale — sustained

throughput, persistent storage, and predictable costs over time.

Plasma is designed for that second phase: when

inefficiencies stop being theoretical and start appearing on balance sheets.

Until applications reach that point, Plasma looks optional. When they do, it

becomes unavoidable.

This delay is not a weakness. It is a structural feature of

infrastructure cycles.

2. Is Plasma Competing With Existing Layers or Replacing

Them?

Another frequent concern is positioning. Investors often ask

whether Plasma is attempting to displace existing L1s, L2s, or data layers — or

whether it simply adds more fragmentation.

Plasma’s design suggests a different intent: complementarity

rather than displacement.

Instead of replacing execution layers, Plasma focuses on

providing an environment where persistent performance remains stable regardless

of execution volatility. It assumes that execution environments will continue

to change, fragment, and compete. Plasma positions itself as a stabilizing

layer beneath that chaos.

In that sense, Plasma is not competing for narrative

dominance. It is competing for irreversibility — becoming difficult to remove

once integrated.

3. Why Does Plasma Appear More Relevant in Bear Markets Than

Bull Markets?

This is not accidental.

Bull markets reward optionality. Capital flows toward what

might grow fast, not what must endure. In those conditions, infrastructure

optimized for long-term stability is underappreciated.

Bear markets reverse the incentive structure. Capital

becomes selective. Costs matter. Reliability matters. Projects that survive are

those whose infrastructure assumptions hold under reduced liquidity and lower

speculative throughput.

Plasma is implicitly designed for this environment. Its

relevance increases as speculative noise decreases. That does not make it

immune to cycles, but it aligns its value proposition with the phase where

infrastructure decisions become irreversible.

4. Is $XPL Just Another Utility Token With Limited Upside?

Token skepticism is justified. Many infrastructure tokens

have failed to accrue value beyond short-term speculation.

The key distinction with $XPL lies in where demand

originates. If token demand is driven by incentives alone, it decays once

emissions slow. If demand is driven by dependency — applications requiring the

network to function — value accrual becomes structural rather than

narrative-driven.

Plasma’s thesis is that sustained usage, not transaction

count spikes, will determine demand for $XPL. This is slower to materialize,

but harder to unwind once established.

That does not guarantee success. But it defines a clearer

failure mode: if applications never become dependent, Plasma fails honestly

rather than inflating temporarily.

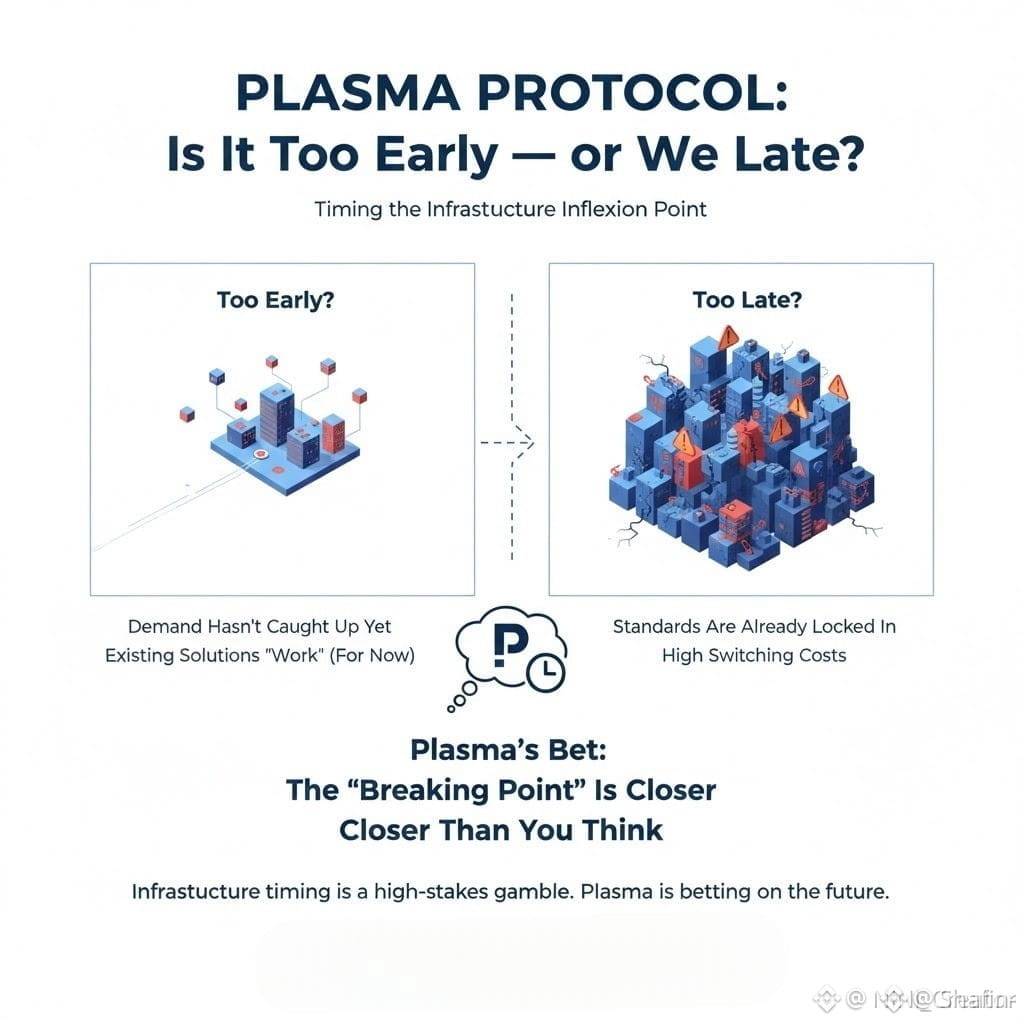

5. Is Plasma Too Early — or Already Too Late?

Timing is perhaps the most uncomfortable question.

Too early means building before demand exists. Too late

means entering after standards are locked in. Plasma sits in a narrow window

between these extremes.

On one hand, many applications have not yet reached the

scale where Plasma’s advantages are mandatory. On the other, existing solutions

are showing early signs of strain under sustained usage. Plasma is betting that

the transition from “working” to “breaking” will happen faster than most expect

— and that switching costs will rise sharply once it does.

This is not a safe bet. But infrastructure timing never is.

6. Who Is Plasma Actually Built For?

Retail narratives often obscure the real audience.

@Plasmais not built for short-term traders, nor for

speculative users chasing early yields. It is built for application teams

planning multi-year roadmaps, predictable costs, and minimized operational

risk.

That audience is smaller, quieter, and less vocal — but also

more decisive once committed. Plasma’s design choices make more sense when

viewed through that lens.

Conclusion: The Cost of Asking the Wrong Questions

Most debates around Plasma focus on visibility, hype, and

near-term metrics. These questions are understandable — but they are also

incomplete.

The more important questions concern dependency,

persistence, and long-term risk allocation. Plasma does not attempt to win

attention. It attempts to remain useful after attention moves elsewhere.

Whether it succeeds depends less on market sentiment and

more on whether applications eventually reach the limits Plasma was designed

for.

Infrastructure rarely looks inevitable at the beginning. It

only becomes obvious after it is already embedded.

Plasma is betting on that moment.