Many crypto initiatives discuss the idea of taking

real-world assets on-chain, yet most of the readers are not aware of what it

actually looks like in practice. Real markets are not just dealings. They need

documents of issues, investors, transfer limitations, corporate practices,

settlement regulations, reporting obligations, and protection of liability. In

case any of these items are not present, the asset is not really a tokenized

one; it is just a token that has disguised itself as a security.

Privacy is not the most outstanding contribution made by

Dusk. It provides a blockchain in which the regulations are stored within each

asset, and sensitive data are not disclosed. The emphasis puts Dusk nearer to

market infrastructure compared to the usual DeFi.

The chain is a privacy blockchain, which is regulated

finance, and it is meant to take institutional workflows to the blockchain

without compromising compliance or performance.

The aspect that most people overlook is the angle of asset

standard: XSC is meant as the template of the contract regulating securities.

A lot of chains compete to lure issuers using illusory

sales. The evening lures them with a strict criterion.

The Confidential Security Contract (XSC) by Dusk is a

structure of developing and issuing privacy-enabled tokenized securities. This

is important since securities are not mere tokens; they have regulations on

ownership, transfer, and on how the dividends or votes will be paid out or the

redemption.

The even greater insight is that compliance is not an

external process only. You minimize off-chain enforcement by coding rules of

transfer and disclosure into asset contract logic. The compliance rules coexist

within the protocol layer, and not an add-on as indicated in the messaging of

Dusk.

Consider that XSC will be like ERC-20, except that it

contains privacy and solid regulations designed into the core.

Why this is important: regulated markets are based on

privacy and not publicity.

Equity markets do not publish the balance of all investors

and their wallet address. Complete disclosure by default would make

surveillance be on a strategic position.

According to the Dusk system of confidential securities,

asset-level confidentiality rather than transfers-only confidentiality is

required to get serious issuers and investors on-chain. It is not the crypto

promise of everything always open that it has.

That is why Dusk continues to insist on the markets in which

the asset can be exchanged and stored on-chain and the sensitive information is

maintained. It is not all about secrecy as an end in itself, it is about the

privacy inherent in normal finances, and yet providing the necessary proofs.

The infrastructure aspect: Dusk has a modular stack, where

DuskDS is the bottom

Another interesting change in the documentation is the

documentation of the architecture as being modular.

They introduce DuskDS as the settlement, consensus as well

as data-availability layer to the layer of several execution environments.

DuskVM and DuskEVM are constructed using it. It is an institutional approach

rather than a technical choice.

Organisations do not wish to put all their eggs in one

virtual machine. Their desires are permanent settlement and adherence at the

base, engines of executions capable of evolving with the change of tools. This

is provided by DuskDS, along with some fundamental constituents such as Rusk

(node implementation) and Kadcast (networking) as well as transfer and staking

genesis contracts.

Speaking of the most recent addition to Dusk, this modular

strategy is a good indication: they are constructing a financial platform, and

not a one-purpose chain.

Security is not an advisory, rather a necessity

Reliability in the context of DeFi culture is usually not a

requirement until something goes wrong. Such tolerance is not tolerated in

institutional systems. Buggy validator or a deployment failure is not an

inconvenience, but a legal and operational crisis.

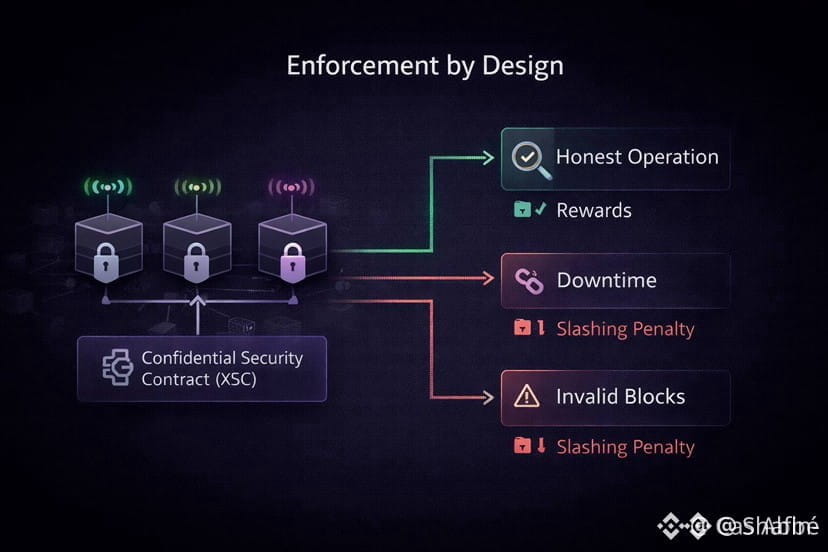

The operator documentation of Dusk explains that slashing is

an actual punitive mechanism with the threat of receiving less stake by

submitting invalid blocks or going dead. The network update describes slashing

hard and soft which is meant to discourage unproductive behavior.

Such a change takes Dusk out of the rubric of friendly

staking and into the realm of professional responsibility. It is structured to

penalize low performance, which fits the target market of Dusk: the financial

processes which cannot withstand unreliable infrastructure.

The long-term security planning, not the hype.

The documentation which Dusk provides is grounded in one of

the most sensible ways, its supply plan.

They declare an initial supply of 500M DUSK (previously an

ERC-20/BEP-20 token before the migration), with additional 500M issued over 36

years due to staking rewards and the maximum supply is 1 billion DUSK.

You may like inflation or not, the form is clear: Dusk will

fund its security long, not short and aggressive bursts. That is what

constitutes a market infrastructure. The stock exchanges and settlement systems

do not operate on a twelve week cycle, but on a twenty-five year basis.

In case Dusk really wants to host controlled issuance and

secondary trading, its security model should not be isolated to a specific hype

cycle. An extended emission plan conveys that clearly.

The angle of adoption that is real: the concept of

controlled exchange partnerships are not a desirable good but an end.

The most practical advancement of Dusk in the real world is

its association with controlled securities markets.

In March 2024, it was announced by VentureBeat that Dusk and

the Dutch Exchange NPEX are working together to establish a blockchain-based

securities exchange which will be regulated and be interested in tokenized

securities. A year later, in April 2025, Dusk announced it would collaborate

with 21X, which was granted a DLT-TSS license under the European regulations,

allowing an all-tokenized securities market, and the partnership is packaged as

regulation-oriented.

Such collaborations are significant as they represent the

messiness of the regulated adoption: the purchase of licenses, the negotiation

of exemptions, and the interaction with the real market players. It is not just

the launch of a dApp and the expectation of liquidity to emerge. The adoption

is being done slowly, in a procedural manner, and based on credibility.

In this case, assuming Dusk is successful, it will probably

do so by treading along orthodox paths: controlled venues, compliant issuers of

assets and settlement processes that may not appear to be exciting, but gets

the actual value moving.

You may have a real-life image in the form of a personal

bond that you can issue on-chain and have the list of investors that is not on

the internet.

Suppose that it is a small or medium-sized company wishing

to issue a bond. In conventional finance, a list of investors remains

confidential, coupon payments are made on a regular basis, transfers can only

take place among qualified individuals, regulators may demand records and

accountants may check accounting.

The direction of the company Dusk, dubbed as the direction

towards confidential securities, should enable the entire workflow to be native

to a blockchain environment. The asset can have embedded compliance rules

provided using a security contract standard, such as XSC. The network has a

base layer that is designed based on the settlement and compliance requirements

to offer finality and reliability and also offer various execution environments

based on the application requirements.

It is that mix that is the actual new story to tell. Dusk is

not attempting to put everyone nameless.

It is attempting to enable regulated issuance and trading

in-chain without transform all those sensitive details into entertainment and

make them public.

The actual question of future is easy; will the ecosystem

create the market products in support of the infrastructure?

Dusk has numerous features that go hand in hand with what

projects purport to desire: a place in regulated finance, a security token

standard story, a modular architecture story, a staking enforcement mechanism

and partnerships to compliant marketplaces.

The next stage now is the performance, the only thing that

matters: actual products, actual issuance, actual trading, actual settlement.

When Dusk can assist institutions and issuers to issue

assets acting like real securities, where privacy is needed, provable when

policy requires proving, then it ceases to be a crypto privacy project and is a

rarer animal: a blockchain which resembles financial infrastructure.

It is more difficult than following trends, but it is the

type of path that is more likely to be long-lasting if it succeeds.