A Complete, Practical Guide to Starting Safely and Confidently

A Complete, Practical Guide to Starting Safely and Confidently

Cryptocurrency trading can feel overwhelming at first.

Charts move fast. Prices fluctuate constantly. Terminology sounds unfamiliar. And advice online often jumps straight into strategies without explaining the foundation. For beginners, this creates confusion rather than confidence.

Binance is one of the most widely used cryptocurrency platforms in the world, and for good reason. It combines accessibility for beginners with depth for advanced users. But to use it effectively, new traders need more than a signup guide — they need context, structure, and realistic expectations.

This guide is written for complete beginners who want to understand how Binance works, how trading actually happens, and how to approach it responsibly.

Understanding What Binance Really Is

At its core, Binance is a cryptocurrency exchange — a digital marketplace where buyers and sellers trade crypto assets with one another. Unlike traditional stock markets that operate during fixed hours, cryptocurrency markets run 24 hours a day, seven days a week.

Binance allows users to:

Buy cryptocurrencies using fiat currency (like USD, EUR, or INR)

Trade one cryptocurrency for another

Store digital assets securely

Access market data, charts, and analytics

Explore advanced tools as experience grows

What makes Binance especially suitable for beginners is its tiered experience. You can start simple and gradually unlock more complexity as your understanding improves.

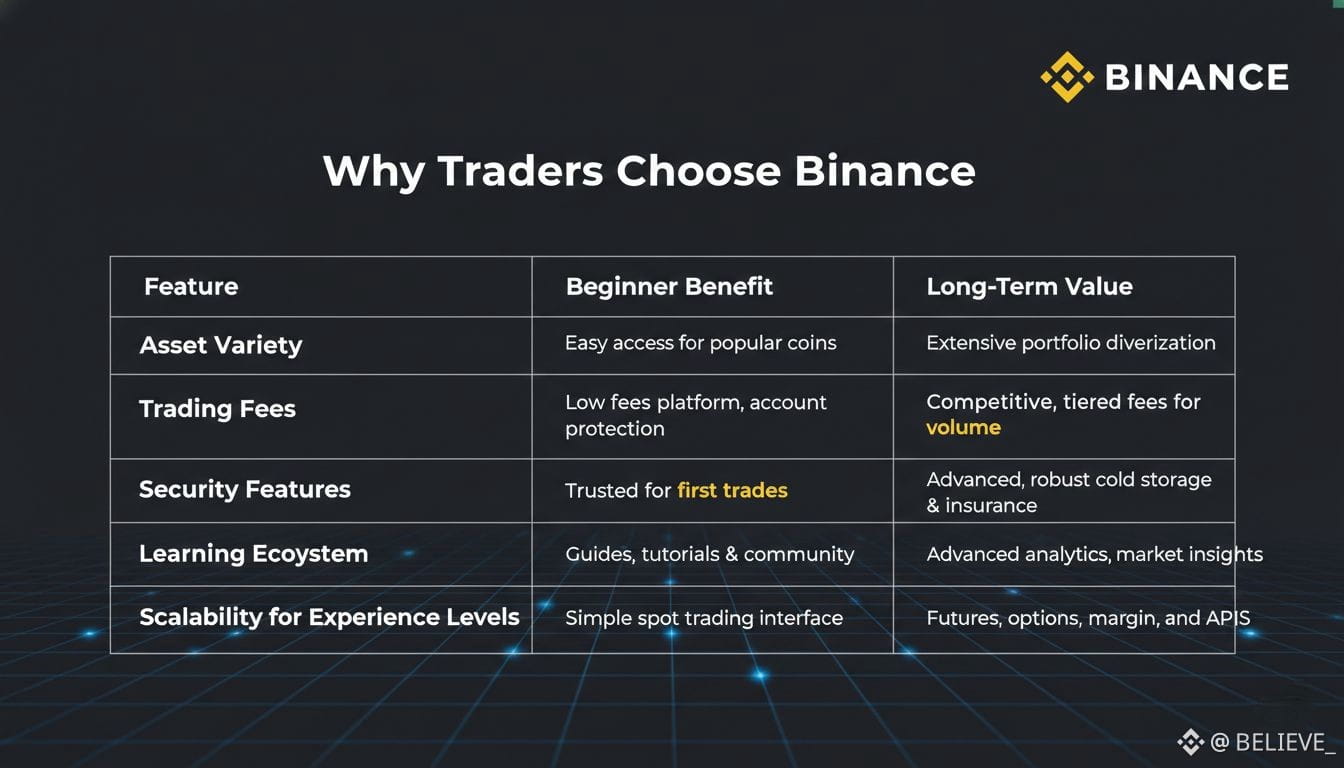

Why Binance Is Popular Among Beginners and Professionals

Binance’s popularity is not accidental. Several factors make it appealing across experience levels:

Wide Asset Selection

Binance supports hundreds of cryptocurrencies, from major assets like Bitcoin and Ethereum to newer projects. Beginners are not limited to just a few options.

Competitive Fees

Trading fees on Binance are among the lowest in the industry. This matters because frequent trading with high fees can quietly erode profits.

Strong Security Infrastructure

Features like two-factor authentication (2FA), withdrawal confirmations, device management, and cold storage significantly reduce risk when used properly.

Integrated Ecosystem

Binance is not just an exchange. It includes learning resources, staking options, market insights, and community features such as Binance Square.

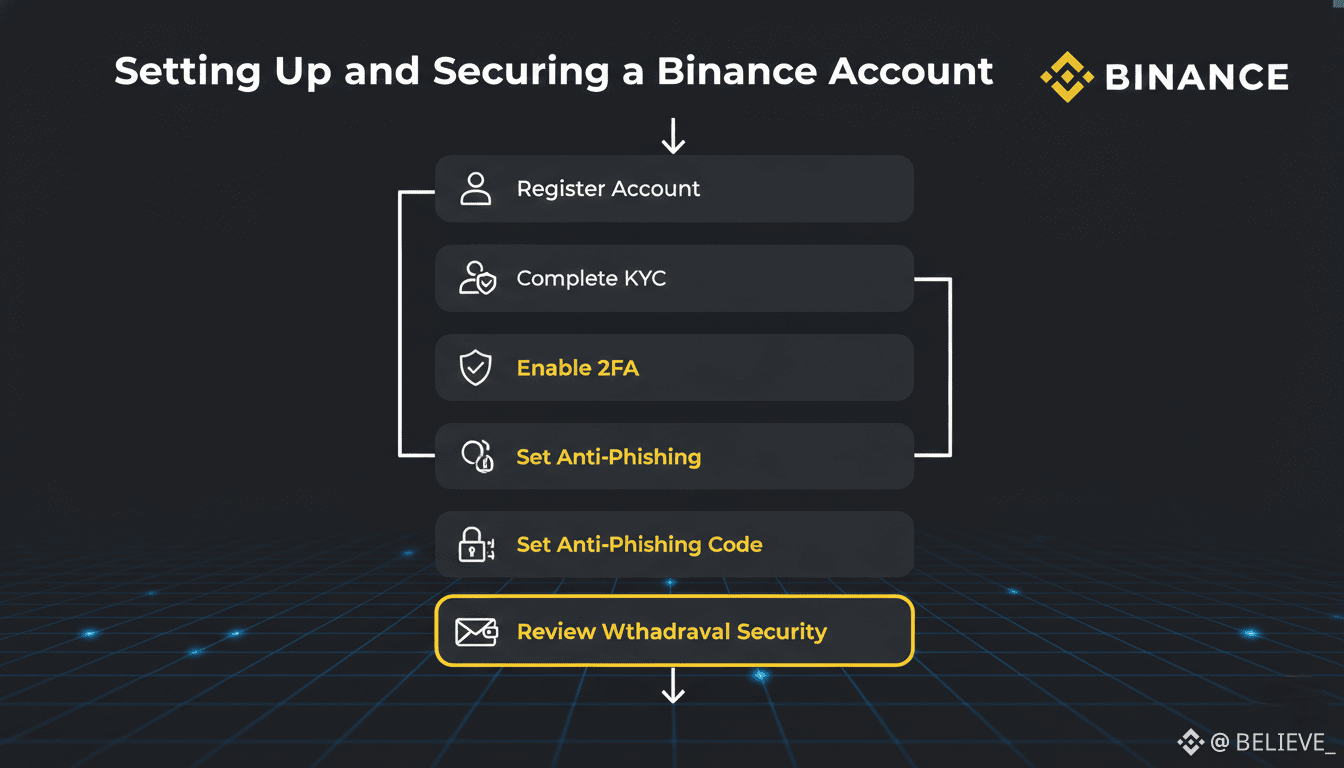

Creating and Securing Your Binance Account

Step 1: Account Registration

You can create a Binance account using an email address or mobile number. Choose a strong password — unique, long, and not reused anywhere else.

Step 2: Identity Verification (KYC)

To comply with global regulations, Binance requires identity verification. This typically includes:

Government-issued ID

Facial verification

Basic personal information

Completing KYC unlocks higher withdrawal limits and full platform functionality.

Step 3: Account Security Setup

Security is not optional in crypto. Immediately after registration:

Enable two-factor authentication (2FA)

Set up anti-phishing codes

Review device management settings

Restrict withdrawal permissions if available

Most losses among beginners happen due to poor security, not bad trades.

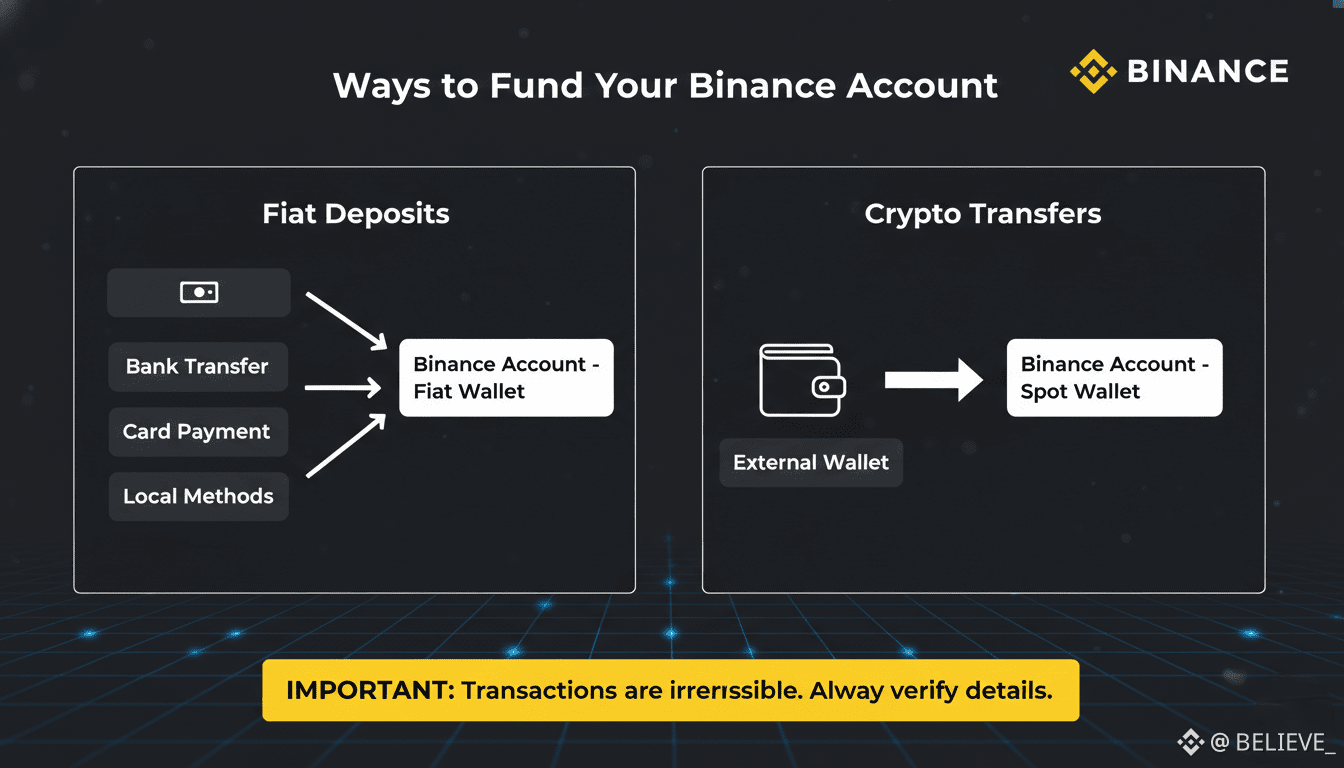

Funding Your Binance Account

Before trading, you need funds in your account. Binance offers several options depending on region:

Fiat Deposits

You can deposit money via:

Bank transfer

Debit or credit card

Local payment methods (availability varies)

Crypto Transfers

If you already own cryptocurrency elsewhere, you can transfer it to your Binance wallet using the appropriate blockchain network.

Always double-check wallet addresses and networks before sending funds. Crypto transactions are irreversible.

Understanding the Basics of Trading on Binance

Trading on Binance involves pairs. A trading pair shows which asset you are buying and which asset you are using to pay.

Example:

BTC/USDT means buying Bitcoin using USDT

ETH/BTC means buying Ethereum using Bitcoin

Order Types Every Beginner Must Understand

Market Orders

A market order executes immediately at the best available price.

Simple and fast

Useful for beginners

Less control over exact price

Limit Orders

A limit order lets you specify the price at which you want to buy or sell.

Offers price control

May not execute if price never reaches your level

Stop-Limit Orders

Used primarily for risk management.

Automatically triggers an order when price reaches a certain level

Helps limit losses or protect gains

Beginners should master these three order types before exploring anything else.

Reading Price Charts Without Overcomplicating

Charts intimidate many beginners, but you don’t need advanced indicators to start.

Focus on:

Price direction (up, down, sideways)

Recent highs and lows

Volume changes during price moves

Avoid adding multiple indicators early. Too many signals create confusion and emotional decisions.

Understanding Market Volatility

Cryptocurrency markets are volatile by nature. Prices can move significantly within minutes.

This volatility:

Creates opportunity

Increases risk

Beginners must accept that losses are part of learning, and no strategy eliminates risk completely.

The goal early on is survival and education, not maximum profit.

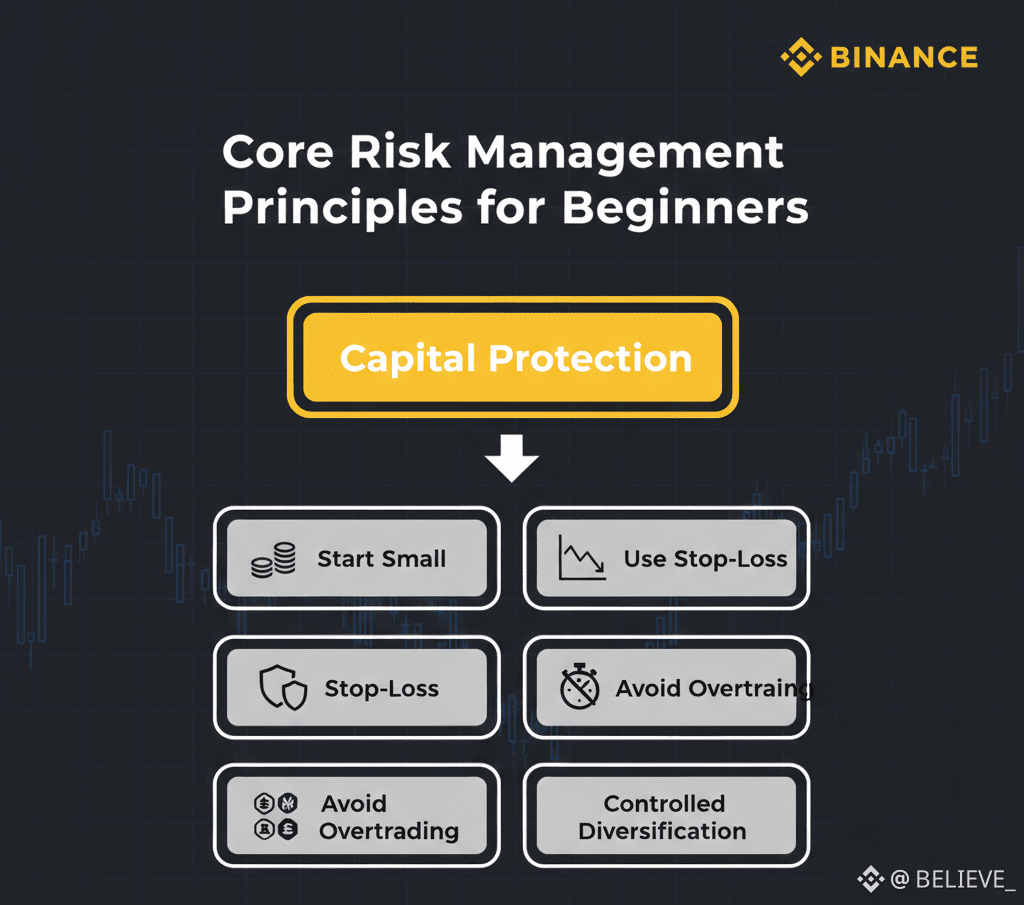

Risk Management: The Most Important Skill

Many beginners focus on how to make money. Professionals focus on how not to lose too much.

Start Small

Trade with amounts that do not affect your emotional state. Stress leads to poor decisions.

Use Stop-Loss Orders

Stop-losses automatically exit trades when price moves against you. This protects your capital and prevents emotional panic.

Avoid Overtrading

More trades do not mean more profit. Quality decisions matter more than frequency.

Diversify Carefully

Holding multiple assets can reduce risk, but over-diversification creates management issues. Balance is key.

Understanding Binance Trading Fees

Binance charges a small fee on each trade, usually around 0.1%.

Ways to reduce fees:

Use Binance Coin (BNB) to pay fees

Increase trading volume over time

Avoid unnecessary trades

Fees seem small but compound over time, especially for active traders.

Common Beginner Mistakes to Avoid

Trading without understanding the asset

Following social media hype blindly

Ignoring risk management

Using leverage too early

Letting emotions control decisions

Most losses come from behavioral mistakes, not technical ones.

Using Binance as a Learning Environment

Binance is not just a trading platform — it’s a learning ecosystem.

Beginners should:

Observe markets before trading

Read discussions and commentary

Study how price reacts to events

Track trades and reflect on outcomes

Learning happens faster when observation comes before action.

Building Confidence Over Time

Confidence in trading doesn’t come from winning one trade.

It comes from:

Understanding why you entered

Knowing how you managed risk

Accepting outcomes without emotional extremes

Progress in trading is gradual. There are no shortcuts.

Final Thoughts

Binance provides beginners with powerful tools, but tools alone are not enough. Success depends on how thoughtfully they are used.

Start slow. Focus on learning. Protect your capital. Let experience accumulate naturally.

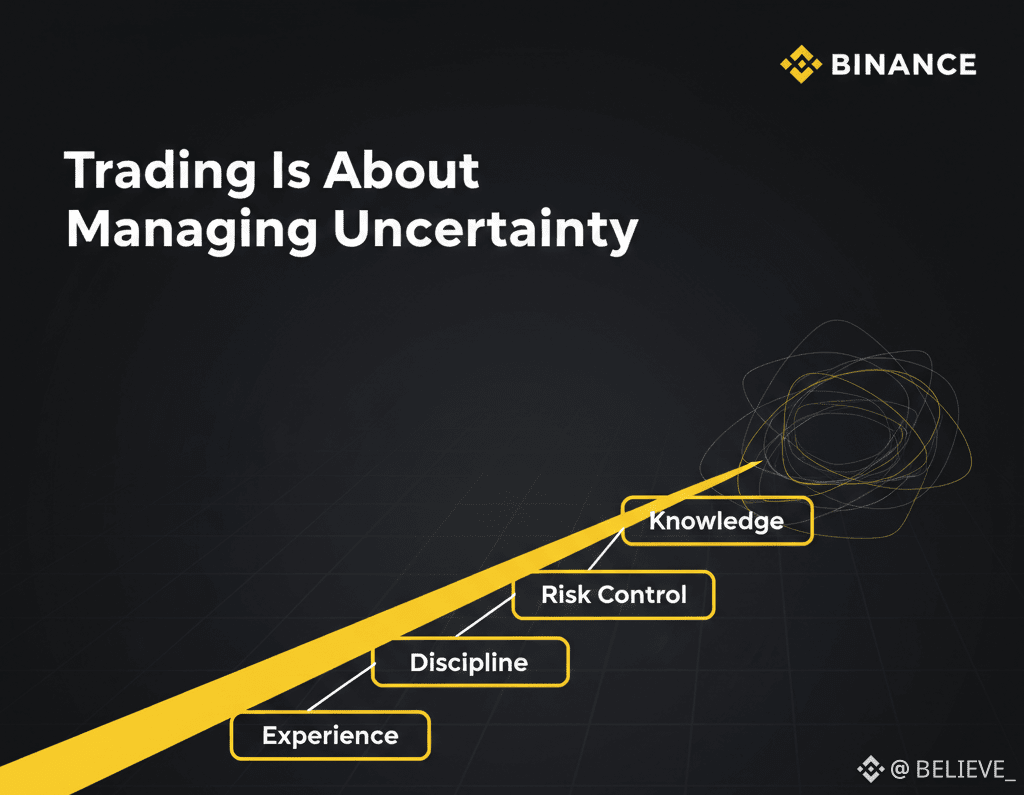

Trading is not about predicting the future — it’s about managing uncertainty with discipline.

Used responsibly, Binance can be a strong foundation for anyone entering the world of cryptocurrency trading.