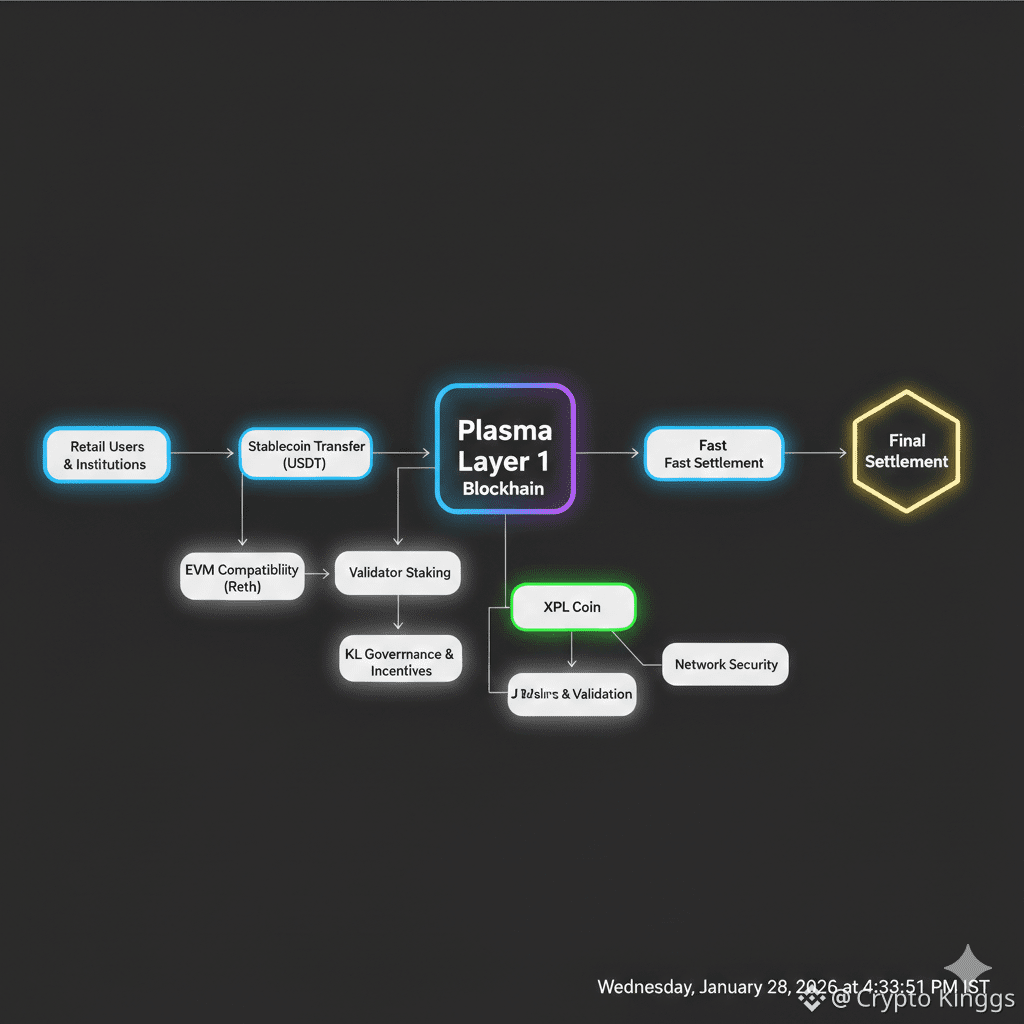

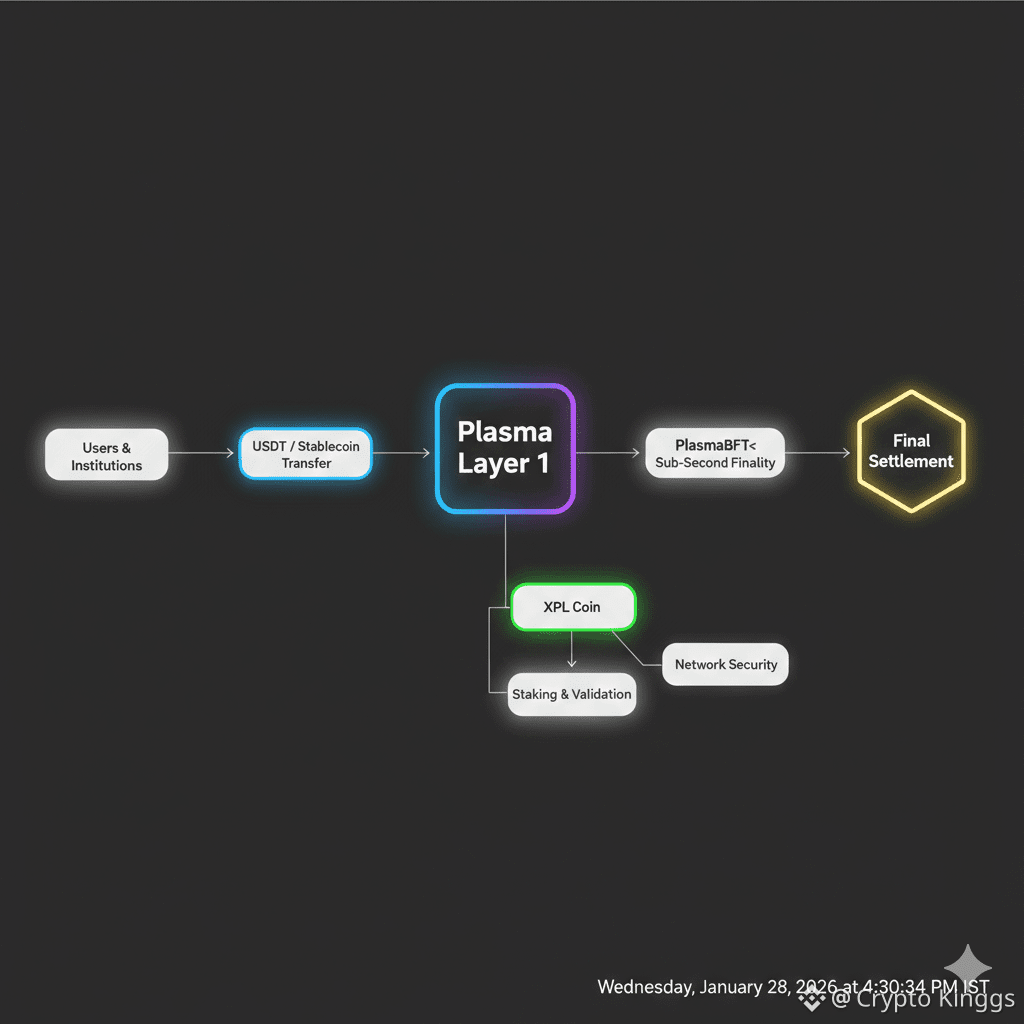

As blockchain technology continues to mature, the industry is moving beyond experimentation toward infrastructure that solves real financial problems. Plasma is a Layer 1 blockchain created with this shift in mind. Instead of trying to support every possible use case, Plasma is tailored specifically for stablecoin settlement, a sector that already underpins a large portion of real-world crypto activity. At the center of this ecosystem is the XPL coin, which powers network security, validation, and long-term sustainability.

Stablecoins such as USDT have become essential tools for payments, remittances, trading, and cross-border finance. Millions of users rely on them daily, especially in regions with high inflation or limited access to traditional banking. However, many existing blockchains were not designed with stablecoins as a primary focus. Plasma addresses this gap by building a network where stablecoins are not an afterthought, but the core use case.

From a technical perspective, Plasma offers full EVM compatibility through Reth, making it easy for developers to deploy Ethereum-based smart contracts without rewriting code. This compatibility lowers the barrier to entry for builders and allows existing decentralized applications to expand into stablecoin-focused use cases with minimal friction. For users, it means access to familiar tools, wallets, and interfaces.

Transaction speed and reliability are handled through PlasmaBFT, a consensus mechanism that delivers sub-second finality. This is a critical feature for payments and financial settlement, where delays can reduce trust and usability. With Plasma, transactions feel instant and predictable, bringing blockchain-based payments closer to the experience users expect from traditional financial systems.

One of Plasma’s most important differentiators is its stablecoin-centric design. Features such as gasless USDT transfers and stablecoin-first gas remove one of the most common pain points in crypto. Users no longer need to hold a separate volatile token just to pay transaction fees. Instead, they can transact using the stablecoins they already understand and trust. This design choice significantly improves accessibility, especially for non-technical users and retail participants in high-adoption markets.

Security and neutrality are also core principles of the Plasma network. By incorporating Bitcoin-anchored security, Plasma aims to strengthen censorship resistance and long-term trust. Anchoring elements of security to Bitcoin aligns Plasma with one of the most battle-tested and neutral networks in the crypto space. This approach is particularly attractive for institutions that require dependable, politically neutral settlement infrastructure.

The XPL coin plays a foundational role behind the scenes. Validators stake XPL to secure the network, earn rewards, and participate in governance. XPL also supports ecosystem incentives and future upgrades, ensuring that Plasma remains decentralized and resilient as usage grows. While stablecoins dominate the user-facing experience, XPL quietly ensures the network operates efficiently and securely.

Plasma’s target users span both retail and institutional participants. Retail users benefit from fast, low-cost, and easy-to-use stablecoin transfers, while institutions in payments and finance gain access to a blockchain designed for settlement efficiency, security, and scalability. This balanced approach gives Plasma a realistic path toward long-term adoption.

In a crowded Layer 1 landscape, Plasma stands out by focusing on what crypto is already doing well: moving stable value globally. By combining speed, usability, EVM compatibility, and Bitcoin-anchored security, Plasma XPL positions itself as practical infrastructure for the future of stablecoin-driven finance.@Plasma #Plasma $XPL