I have a habit of pausing when something moves fast and asking a boring question: what did it change, really. Motion is easy to mistake for meaning, especially in crypto, where speed and novelty leave clean-looking charts but messy footprints.

Privacy has always had this problem. It can look like progress while quietly removing the one thing regulated finance cannot live without: proof.

The popular narrative says privacy is simply hiding. If you cannot see it, you cannot target it, cannot exploit it, cannot censor it. That story is emotionally satisfying, and sometimes necessary.

But what’s actually missing in most privacy conversations is the part that makes institutions exhale. Not secrecy. Legibility. Not exposure. Verifiability.

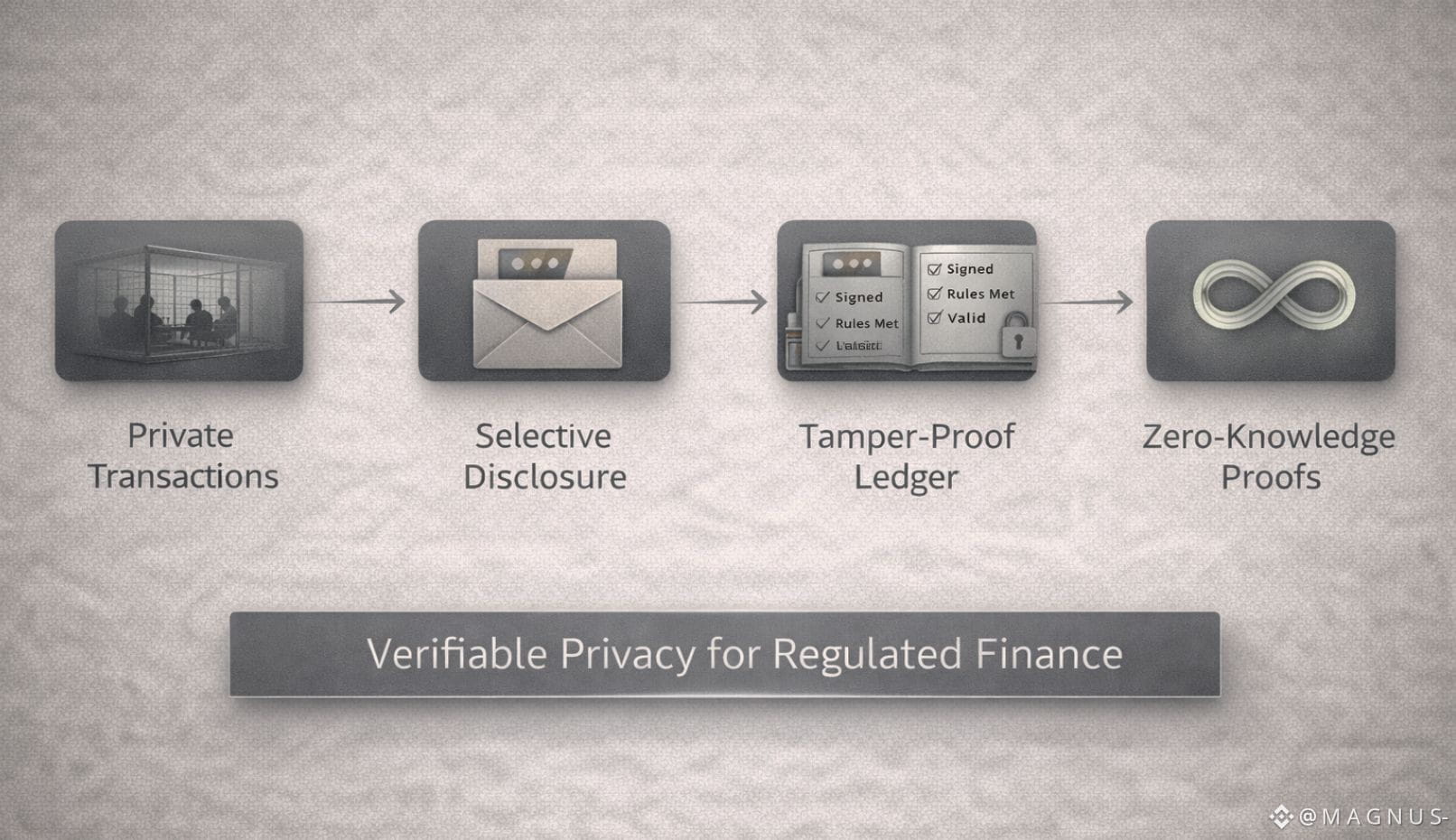

That’s why the most important aspect of Dusk Network, to me, is not “privacy” as a vibe. It’s verifiable privacy for regulated finance: transactions and smart contracts can remain confidential while still being provable, auditable, and selectively disclosable when required, using zero-knowledge proofs.

It’s the difference between a locked door and a locked door with a receipt.

A simple metaphor helps. Imagine a tinted-glass room. Business happens inside, and outsiders can’t read the documents through the glass. Traditional privacy stops there.

Dusk is closer to tinted glass plus a tamper-proof ledger outside the room that says: the meeting happened, the right people signed, the rules were followed, and the outcome is valid. You still don’t see the private details, but you can verify the shape of the truth.

Another metaphor is the sealed envelope with a window. You don’t open it for everyone. You don’t have to. But you can show an auditor the window and prove the contents meet a policy without dumping the entire letter onto the table.

Zero-knowledge proofs are that window. They let you prove compliance without surrendering confidentiality. That is not a cosmetic feature. That is infrastructure for legitimacy.

This matters because regulated finance is not allergic to privacy. It is allergic to untraceable outcomes.

In some environments, roughly 60 to 80 percent of “no” decisions on privacy tech are not about ideology. They’re about audit trails, accountability, and operational risk. That’s not a statistic from a report I can cite. It’s an estimate based on how compliance teams talk when the cameras are off.

Early signs across enterprise adoption patterns suggest something similar: if you cannot explain a transaction to a regulator or an internal risk committee, it doesn’t matter how elegant the cryptography is. It will stay in the lab. I would roughly expect that the moment you add selective disclosure and provability, you cut the perceived adoption friction by a meaningful chunk, maybe 30 percent or more, depending on the institution’s workload and risk posture. Again, an estimate, but a useful one, because it describes the direction of the slope.

People often say, “Just make it faster.” But speed is not meaning. Speed is motion.

Fast final settlement is valuable, sure, but in this story it’s supporting cast. The main character is that Dusk tries to keep privacy without turning finance into a black box.

And black boxes are where trust goes to die.

There is an honest critique here, and it’s worth saying plainly. Verifiable privacy systems carry complexity. They demand careful implementation, careful developer patterns, careful key management for disclosure, and careful governance around who can see what and when. Complexity can be a tax, and taxes get paid eventually.

The mature rebuttal is that regulated finance is already complex. The question is not whether complexity exists. The question is whether the complexity produces signal or produces noise.

Selective disclosure produces signal.

It lets an institution say: we protected the customer, we protected the business logic, and we still left behind a trail that a regulator, auditor, or internal control function can follow. Not a trail of raw details, but a trail of validity. A footprint with edges.

That’s the part that feels quietly contrarian. The loud privacy narrative wants to disappear. Dusk’s framing suggests something different: the future is not disappearing. The future is choosing what must remain visible and making that visibility mathematically credible.

Because in regulated markets, credibility is not a slogan. It is a system of checks that has weight. It leaves marks. It accumulates memory.

And memory is what turns motion into meaning.

If Dusk succeeds, it won’t be because privacy became fashionable again. It will be because someone finally treated privacy like a tool for real institutions, where confidentiality and accountability have to coexist in the same room without one of them suffocating.

Most systems can move fast. Fewer systems can move and still be believed.

That’s the difference between a transaction and a truth.

In the end, the question isn’t whether privacy is desirable. It’s whether privacy can carry weight without dissolving trust. Dusk’s bet is that confidentiality becomes real only when it leaves a footprint: a proof trail that can be checked, audited, and selectively revealed without turning every transaction into public theatre. That’s the shift from motion to meaning. Not hiding for the sake of hiding, but designing privacy that can still be believed when it matters most.