@Dusk For a long time, “tokenized securities” felt like a concept that could never quite survive contact with regulators. The pitch was simple: put shares, bonds, and funds on a blockchain so they can move faster, settle sooner, and leave a clearer record. The reality was messier. Capital markets run on permissions, liability, and decades of hard-earned caution, and most crypto infrastructure wasn’t built for that world. What’s changing now isn’t just enthusiasm. It’s the slow emergence of venues that are actually licensed to do the job, plus a small set of networks being shaped around the uncomfortable requirements regulated markets bring.

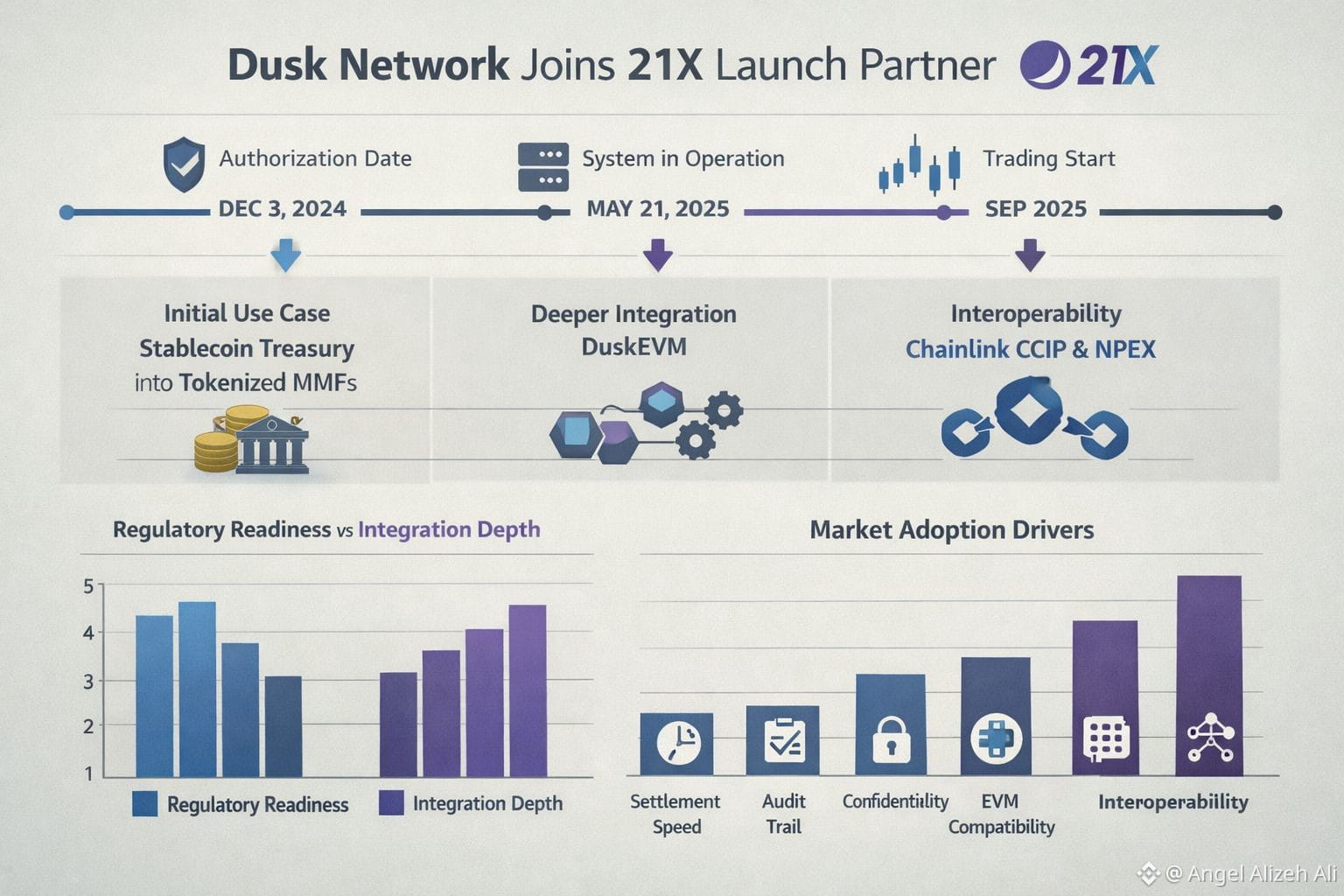

That’s why Dusk Network joining 21X as a launch trade participant matters more than it might sound at first glance. When 21X described Dusk onboarding “at launch,” the initial focus wasn’t on flashy new products. It started with something intentionally plain: routing Dusk-related flows into 21X, beginning with stablecoin treasury investment into tokenized money market funds. If you’re expecting fireworks, you won’t find them there. But if you’re looking for where institutions are genuinely willing to move first, that’s almost the point. Treasurers and finance teams don’t need a revolution; they need a safe place to park liquidity, with clear rules and familiar risk profiles.

The deeper relevance of Dusk is that it isn’t trying to be a generic chain that later gets awkwardly “adapted” for securities. Its whole posture is closer to a financial network with crypto rails than a crypto network hoping to attract finance. The key question it’s trying to answer is simple to say and hard to execute: can regulated assets move on a public network without forcing every participant to publish every balance, trade detail, and counterparty relationship to the world? In markets, confidentiality is not automatically suspicious. It’s often how you protect clients, prevent copycat trading, and keep commercial terms from becoming public ammunition.

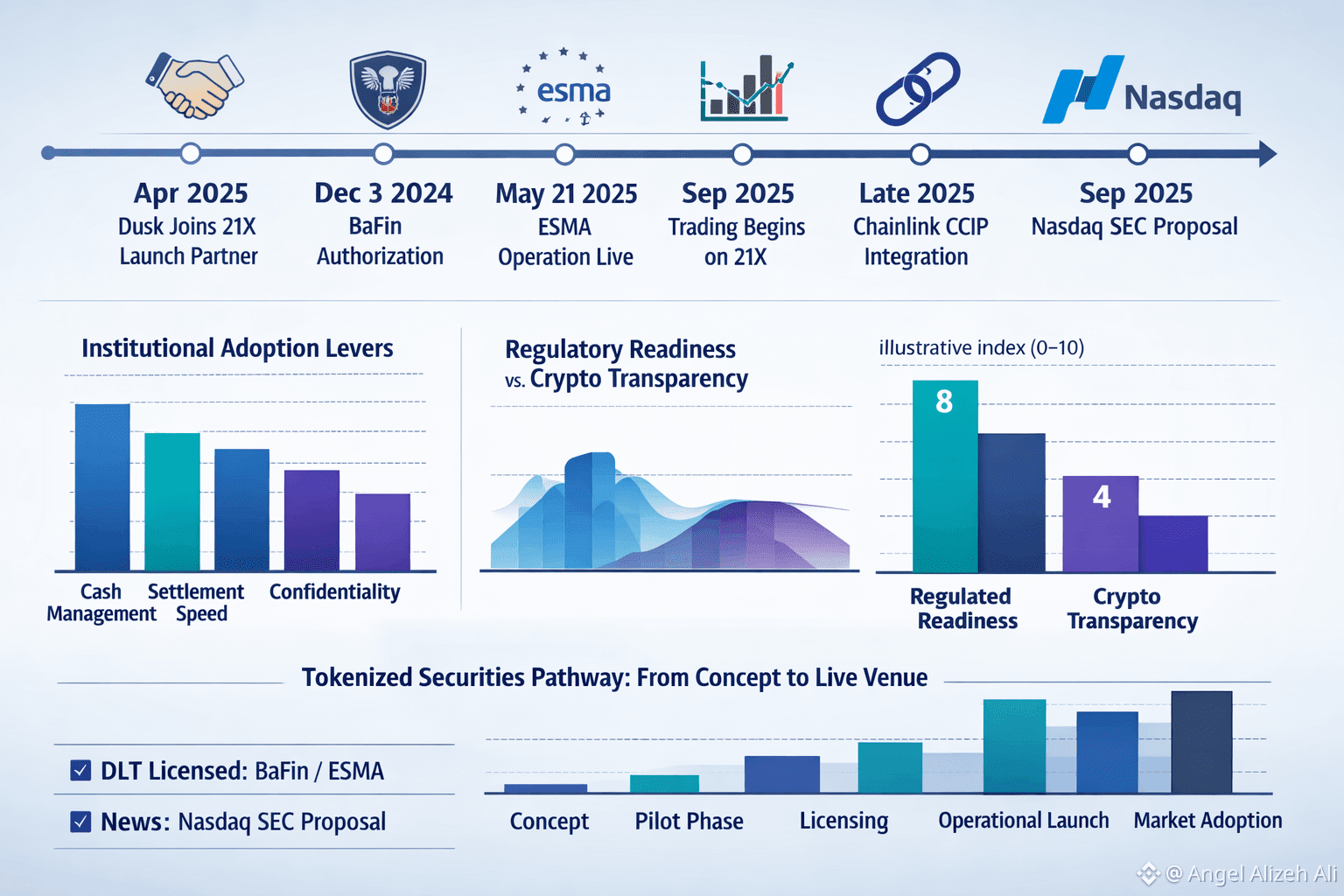

That’s where the partnership with 21X starts to look like more than a logo swap. 21X operates within the EU’s DLT Pilot Regime, and it received authorization from Germany’s BaFin as a DLT trading and settlement system in December 2024. That authorization isn’t just a badge. It’s a constraint that forces the venue to behave like market infrastructure, not a tech demo. When a platform is expected to combine trading with settlement under oversight, it needs systems that can support supervision, rules, and recourse without turning the whole marketplace into a glass box where everyone’s business model is exposed.

Dusk’s choices sit right in the middle of that uncomfortable trade-off. Privacy in finance is complicated because it can be abused, and it would be naïve to ignore that. But the real question isn’t philosophical. It’s practical: can you keep sensitive information private while still making the system accountable and the rules enforceable? That’s the direction Dusk has been leaning into, and it’s why its role here feels foundational rather than decorative. If tokenized securities are going to be more than a niche product, the infrastructure has to respect the realities of how regulated participants actually operate.

The talk of deeper technical integration adds weight to that. Both sides have pointed to 21X integrating DuskEVM, which sounds like plumbing until you consider what it enables. Compatibility with the EVM world can reduce adoption friction because teams already know the tooling, the security patterns, and the ways smart contracts can fail. In a regulated setting, familiarity isn’t laziness; it’s risk management. It’s also a way to avoid reinventing every operational wheel before you’ve even proved there’s real volume.

Timing matters too. 21X has been moving from “licensed” to “operating,” and by September 2025 it announced that trading had started. That shift changes the tone around everything. Once trading is live, partnerships stop being aspirational and become operational. Integrations turn into deadlines. Legal reviews become gatekeeping. And credibility becomes less about vision statements and more about whether the system runs, day after day, under supervision.

Dusk’s broader strategy reinforces the same theme. Rather than chasing every trend, it has been building connective tissue for regulated assets, including interoperability work with Chainlink CCIP alongside NPEX. “Interoperability” can sound like a slogan, but in regulated markets it boils down to a blunt requirement: can assets move between environments without losing compliance controls, breaking custody expectations, or creating a reporting mess that nobody wants to own? If Dusk can make cross-network movement feel controlled and accountable, that’s not a side quest. It’s a prerequisite for scale.

Zooming out, the bigger backdrop is that tokenized securities are increasingly treated as a serious agenda item, not a fringe experiment. When mainstream market operators start exploring how tokenized instruments could trade within existing regulatory frameworks, the center of gravity shifts. The “why now?” becomes less about crypto momentum and more about institutions trying to modernize plumbing without compromising safeguards.

There are still risks, and they’re not small. Liquidity remains a chicken-and-egg problem, and a regulated venue can feel like an empty room if instruments are too limited or too bespoke to trade actively. But if tokenization becomes ordinary infrastructure, it will likely arrive through boring wins: shorter settlement cycles, fewer reconciliations, cleaner audit trails, and better control over who can see what. That’s where Dusk’s relevance becomes hard to ignore. Its value isn’t that it makes securities “more crypto.” It’s that it’s trying to make regulated markets on-chain survivable—confidential enough to be usable, structured enough to be supervised, and familiar enough to be built on without reinventing everything from scratch.