Most traders don’t lose because they can’t read charts.

They lose because they can’t read themselves.

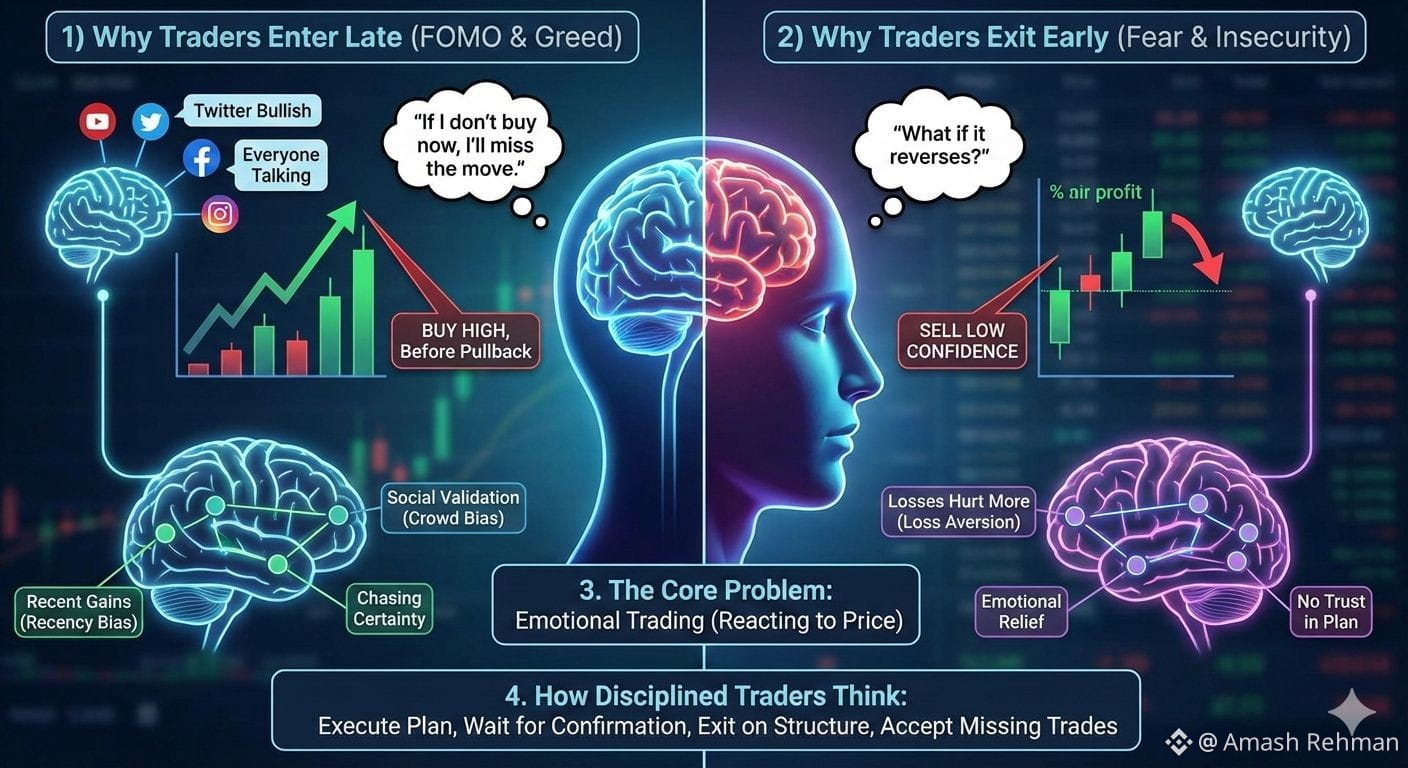

Let’s break down the two most common mistakes and the psychology behind them.

1) Why Traders Enter Late:

Emotion: FOMO (Fear of Missing Out)

Price starts pumping.

Twitter is bullish.

Volume spikes.

Everyone is talking about it.

Your brain says: “If I don’t buy now, I’ll miss the move.”

So you enter after the big move right where smart money is taking profits.

What’s really happening psychologically?

The brain seeks social validation (crowd bias).

Recent gains feel more important than risk (recency bias).

You chase certainty instead of probability.

Result: You buy high, right before a pullback.

2) Why Traders Exit Early:

Emotion: Fear of Losing What You Have:

You enter a good trade.

Price moves slightly in profit.

Suddenly your mind says: “What if it reverses?”

So you close early, small profit, no confidence.

Then price continues without you.

What’s really happening psychologically?

Losses hurt more than gains feel good (loss aversion).

You want emotional relief, not. maximum return.

You don’t trust your plan.

Result: You sell low confidence, not based on structure.

3. The Core Problem: Emotional Trading:

Late entries come from greed and FOMO.

Early exits come from fear and insecurity.

Both mean one thing:

You are reacting to price, not executing a plan.

4. How Disciplined Traders Think:

They wait for confirmation, not hype.

They enter where risk is low, not where excitement is high.

They exit based on structure, not emotions.

They accept missing trades but never miss discipline.

Final Thought:

The market doesn’t punish bad people.

It punishes undisciplined minds.

Control your psychology, and your strategy will finally work.

Missed trades are better than bad trades.

Patience pays what emotions steal.

Trade smart. Stay patient. Let the market come to you.

#Binance #BinanceSquare #Write2Earn #Tradingphycology #CryptoNews