Most blockchain projects talk about finance as if money were just data that needs to move faster. In the real world, money has rules, obligations, and consequences. It lives inside controls. It gets audited. It breaks things when it behaves in unexpected ways. That is why DUSK is interesting to watch. Not because it is loud, but because it keeps returning to the boring parts of finance that actually matter.

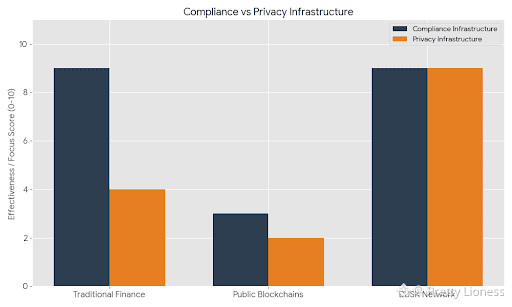

DUSK starts from a simple assumption: financial systems cannot choose between privacy and transparency. They have to support both at the same time, depending on who is asking and why. Regulators need visibility. Institutions need confidentiality. Users need assurance that neither side is improvising. That assumption quietly shapes everything else, including how the network thinks about issuance, fees, and long-term sustainability.

The inflation and deflation mechanics of DUSK are not designed to excite traders. They are designed to keep the network operational over long periods, under regulatory pressure, and with predictable incentives. Inflation exists primarily to pay for security. Validators are compensated for running infrastructure, staying online, and following the rules. That inflation is not framed as a growth hack. It is treated as an operating cost, similar to how traditional systems pay for clearing, settlement, and oversight.

Deflation, where it appears, is tied to usage rather than narrative. Transaction fees are not just tolls. They are part of a feedback loop that links network activity to supply discipline. When the system is used, value is recycled or removed in a controlled way. When it is quiet, it does not pretend otherwise. This is closer to how real financial infrastructure behaves: costs scale with activity, not with promises.

The underlying architecture supports this restraint. Execution and settlement are clearly separated. Privacy is handled at the protocol level, not bolted on through optional tools. Zero-knowledge proofs are used to protect sensitive transaction data while still allowing verification where required. This matters because inflation and fee mechanics only work if participants trust that rewards are earned honestly and that supply changes are verifiable without exposing private positions.

Developer tooling reflects the same mindset. The system is not optimized for rapid experimentation at the expense of safety. Changes move slowly. Parameters are adjusted cautiously. When assumptions are wrong, the response is usually to pause, not to push forward and explain later. That posture does not attract hype cycles, but it reduces the risk of supply mechanics being distorted by short-term behavior.

There have been moments where the network chose restraint over momentum. Delays in upgrades, conservative validator requirements, and incremental changes to economic parameters have frustrated some observers. From a financial operations perspective, those decisions signal maturity. In regulated environments, slowing down is often the correct response when uncertainty increases. It is a way of protecting both users and the system itself.

The DUSK token, in this context, functions less like a speculative asset and more like a coordination tool. It secures the network. It pays for services. It absorbs costs. Its supply mechanics are there to keep those functions viable over time, not to engineer scarcity for its own sake. Sustainability here means the network can keep doing its job without constantly rewriting its economic rules.

What this shows, quietly, is what real on-chain finance actually requires. It requires accepting trade-offs. It requires mechanisms that behave predictably under stress. It requires token economics that look boring in a bull market and sensible in a risk meeting. DUSK is not trying to escape the rules of finance. It is trying to operate inside them. That is why it matters.