We think of banks as buildings vaults wrapped in marble, institutions projecting permanence. In much of the world, this is a comforting fiction. For the street vendor in Lagos balancing her naira against a plummeting exchange rate, for the factory worker in Manila losing a fifth of his remittance to fees, for the shop owner in Buenos Aires watching inflation outrun any savings account, the bank is not a sanctuary. It is a bottleneck. A system that asks for faith in currencies built on crumbling ground.

We think of banks as buildings vaults wrapped in marble, institutions projecting permanence. In much of the world, this is a comforting fiction. For the street vendor in Lagos balancing her naira against a plummeting exchange rate, for the factory worker in Manila losing a fifth of his remittance to fees, for the shop owner in Buenos Aires watching inflation outrun any savings account, the bank is not a sanctuary. It is a bottleneck. A system that asks for faith in currencies built on crumbling ground.

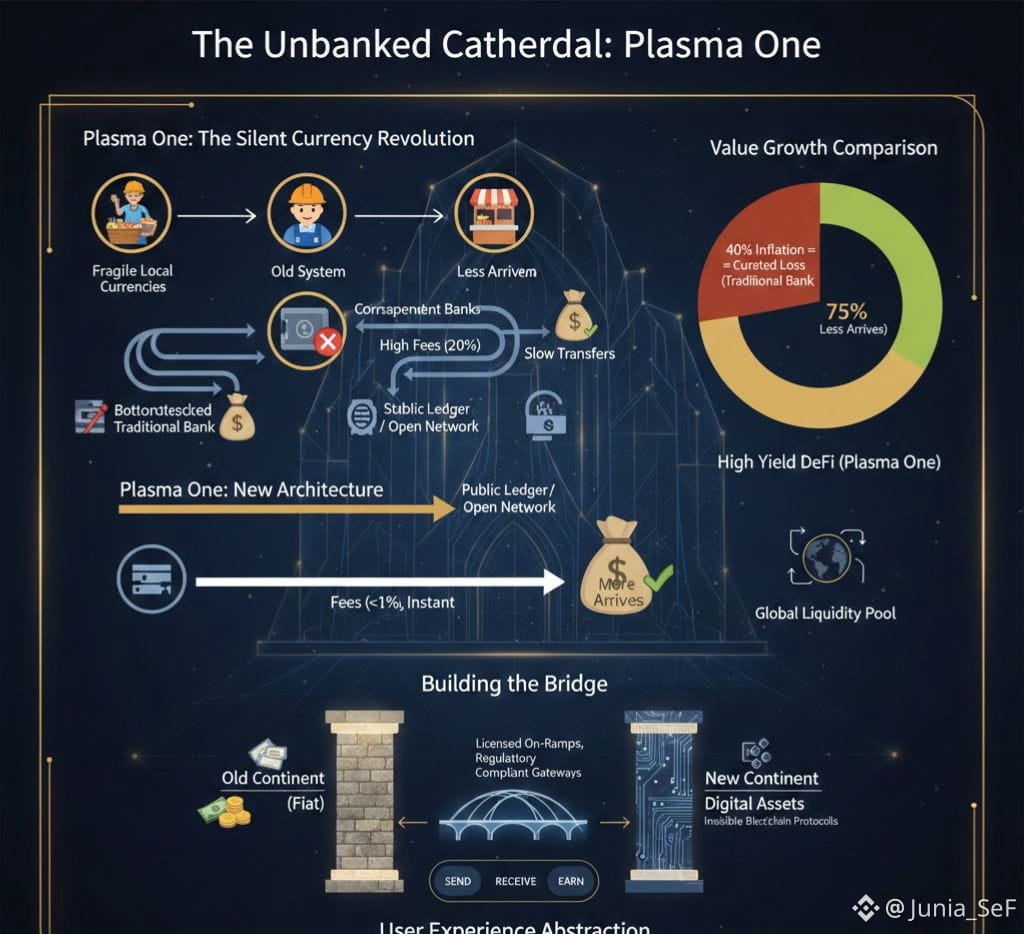

Into this landscape arrives a different architectural idea. Not a new façade on an old structure, but a foundation laid in a new material: the stablecoin. @Plasma One and the emerging class of neobanks it represents poses a quiet, radical question: What if we built a financial home not on the shifting soil of local fiat, but on the bedrock of a globally recognized, digitally native dollar?

This is not about speculation or trading. It is about the daily, unglamorous work of preservation and transaction. It is about constructing a cathedral for value, brick by digital brick, where the architecture itself becomes the source of trust.

The magic deeply unromantic and technical lies in bypassing the old plumbing. The global financial system runs on a creaking web of correspondent banks, a relay race where money is the baton and every handoff costs time and fees. A digital dollar on an open ledger changes the geometry entirely. Sending value becomes less like shipping a crate through ten customs checks and more like sending an email.

Here, the “bank” is not a tollbooth on a proprietary highway. It is a clean interface to a public square. Costs are not extracted by layers of middlemen; they collapse toward the cryptographic minimum required to update a shared record. For the user, the experience is disarmingly simple: more arrives. More of the money sent home actually reaches home. The revolution is measured not in slogans, but in percentage points that stay in a mother’s pocket.

Preservation, however, is only half the story. In economies with unstable currencies, the dream is not merely to stop money from vanishing—it is to see it grow. Traditional banks often offer a cruel parody of yield: a 5% interest rate in a country with 40% inflation is not a return; it is a managed loss.

Plasma One’s proposed “high yield” is not a gift. It is the byproduct of a different ecosystem. Pooled digital dollars can be programmatically deployed within the maturing world of decentralized finance, providing liquidity to global, automated markets and earning returns that reflect real utility. The analogy is agricultural: the difference between storing grain in a locked silo and allowing it to circulate securely and for a fee through a vast, efficient exchange.

For the saver in Turkey or Egypt, this marks a first. From a phone screen, they become a participant in a global capital market. No longer just a depositor, they are a small but essential cog in the machinery of global liquidity and they are compensated accordingly.

None of this is inevitable. The challenges are grounded, physical, and political. The first is the bridge between worlds: turning tangible local cash into pristine digital dollars, and back again. This demands more than code. It requires regulated, compliant on- and off-ramps partners willing to operate with a transparency the old system often resists. Plasma One must build legitimate, guarded gateways between the continent of fiat and the frontier of digital assets.

The second challenge is abstraction. Users cannot be asked to become cryptographers. Seed phrases, gas fees, wallet addresses—these must disappear from view. The interface must speak only in verbs humans understand: send, receive, earn. The blockchain must fade into the background, as invisible as TCP/IP is when we send a message. No one should have to understand the internet to use it; no one should have to understand blockchains to buy groceries.

The long-term implications are subtle but profound. This is not just a new app—it is a new gravitational force. If enough individuals choose to save and transact in a stable digital dollar, a silent discipline emerges. It is dollarization without decree, enforced not by governments but by consumer choice. Local currencies are compelled to compete not with dollars locked in distant vaults, but with a fluid, accessible digital alternative in every pocket.

At the same time, these digital trails immutable records of saving, spending, and reliability—can become the seeds of future credit. The unbanked begin to grow a financial identity of their own, a root system anchored in new digital soil.

Plasma One’s true promise, then, is not to “kill” banks, but to seed them. It suggests that in the fertile, chaotic ground of emerging markets, a new financial organism can take hold one that draws nutrients directly from the global economy, shelters its users from inflationary storms, and connects them not to a single fragile national system, but to an open, resilient network.

This cathedral is not built from marble or decree. It rises quietly, transaction by transaction, balance by balance. Its success will not announce itself in headlines. It will be felt in the steady calm of a growing account and in the relieved breath of a migrant worker who finally gets to send the full amount home.