@Dusk There’s a quiet contradiction at the heart of bringing finance on-chain: the more valuable the activity gets, the less anyone wants it to be public. Traders don’t want strategies copied in real time. Corporates don’t want payroll and treasury moves mapped by competitors. Banks don’t want client positions broadcast to the world. For a long time, crypto shrugged and said, “That’s the point.” But the closer you get to regulated markets, the more that attitude reads like a category error. Transparency is useful. Total transparency is often incompatible with how real finance is run.

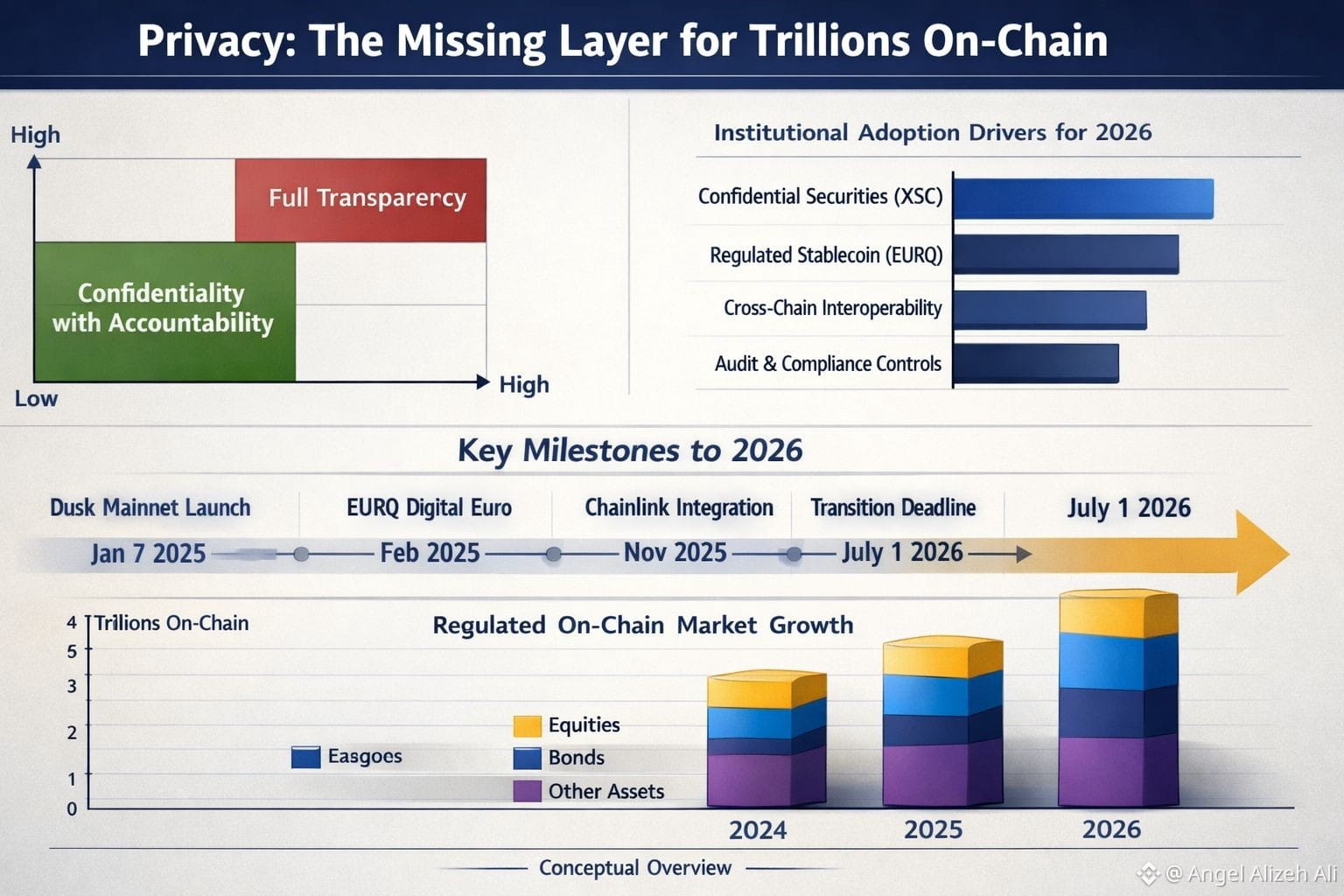

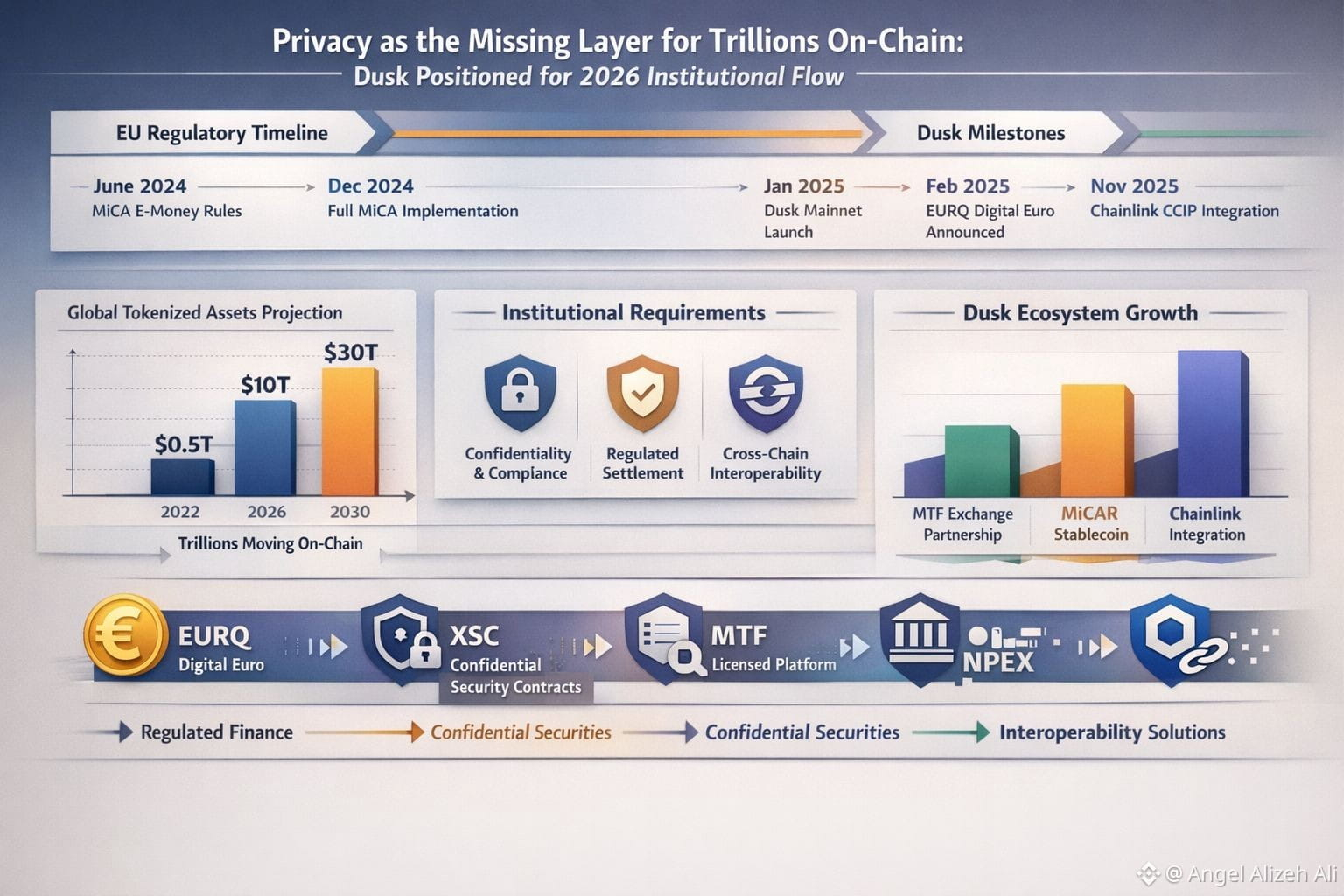

Timing is doing a lot of the work here. In Europe, the Markets in Crypto-Assets Regulation has moved past the “someday” stage and into everyday reality. The rules for e-money tokens and asset-referenced tokens kicked in on 30 June 2024, and the wider framework followed on 30 December 2024. Some firms also have a runway: the transition period for certain existing providers can stretch to 1 July 2026, and ESMA has laid out how different member states are handling that grandfathering window. Meanwhile, ESMA is reviewing the EU’s DLT Pilot Regime and openly discussing whether it should be extended, expanded, amended, or made permanent—language you simply don’t use if you think on-chain market infrastructure is a hobby.

In this environment, “privacy” stops meaning “make it untraceable” and starts meaning something more boring and more important: confidentiality with accountability. Institutions don’t need a chain that hides everything; they need a chain that keeps sensitive terms confidential while still proving compliance, ownership, and settlement outcomes to the parties who are allowed to know. A public ledger that leaks every trade and every position isn’t a neutral design choice for a broker or an issuer. It’s a business risk. You can’t really blame institutions for hesitating when the default architecture turns market activity into a live public feed.

This is exactly where Dusk becomes relevant in a way that many privacy projects don’t. The value is not “privacy” as a slogan, but privacy as market structure. Dusk’s positioning makes more sense when you notice how it behaves. It’s been pointed at regulated finance from the start, which is probably why it pushes for confidentiality that’s built into the network rather than a workaround layered on top. The mainnet rollout followed that same mindset: not a single “we’re live” moment, but a step-by-step process—onramping, genesis prep, cluster deployment—ending with the first immutable block targeted for 7 January 2025. You can’t call that proof of safety, but you can call it a preference for control and structure.

The sharper point is how Dusk tries to make regulated assets behave on-chain. Instead of telling institutions to “wrap” compliance around a token after it exists, Dusk pushes the idea that compliance logic and confidentiality belong in the asset’s rulebook. Its Confidential Security Contract standard, XSC, is positioned for issuing and managing tokenised securities while keeping sensitive terms confidential, and it’s framed in a way that maps to what issuers and intermediaries actually do: corporate actions, auditability, shareholder handling, and the messy reality that securities aren’t just free-floating tokens. I’m not under the illusion that a standard solves regulation, but standards do something quietly powerful: they give lawyers and risk teams something concrete to interrogate, and they give developers a common interface that doesn’t need to be reinvented for every issuance.

The most tangible signal that Dusk is not operating in a vacuum is the regulated plumbing it is assembling with real counterparties. In February 2025, Quantoz Payments, NPEX, and Dusk announced EURQ as a MiCAR-compliant digital euro structured as an electronic money token, explicitly aimed at enabling regulated finance activity on Dusk. On its face, that might sound like yet another euro stablecoin headline. The difference is the institutional context: NPEX describes itself as an MTF-licensed venue, and its announcement framed this as the first time such an exchange would use EMTs through a blockchain rail. That doesn’t conjure liquidity overnight, but it does establish something institutions care about more than hype: a credible settlement unit designed for the regulatory perimeter.

Interoperability is where institutional ambitions usually stumble, because institutions rarely want assets trapped on one network, yet they also can’t tolerate ad-hoc bridges that break controls. Here again, Dusk’s relevance is in the choices it has made and the way it has documented them. In November 2025, Dusk and NPEX announced adoption of Chainlink standards: CCIP as the canonical cross-chain interoperability layer for tokenized assets issued by NPEX on Dusk, plus data tooling (including DataLink and Data Streams) to publish official NPEX exchange data on-chain. That combination matters more than it first appears. Cross-chain messaging without trusted market data is awkward for regulated products; trusted data without robust settlement paths is equally limiting. Putting both into the same institutional story—issuance, data, and settlement—moves Dusk from “privacy chain” toward “financial plumbing that happens to be private where it needs to be.”

None of this guarantees Dusk “wins” institutional flow in 2026. Privacy systems are hard to implement correctly, and they can become politically controversial the moment confidentiality is confused with concealment. But if the thesis is that trillions in equities, bonds, and other regulated instruments will gradually be represented on-chain, then radical transparency is a strange end state. Dusk’s case is that confidentiality isn’t a feature you tack on later—it’s the missing layer that lets regulated markets even consider operating on-chain in the first place, and it’s backing that case with mainnet delivery, standards for confidential securities, regulated money rails, and integration choices that look designed for audits rather than applause.