@Plasma #XPL $XPL Imagine sending a stablecoin payment at a busy moment. Maybe you’re closing a trade, paying a supplier, or sending money to family across borders. You tap “send,” the wallet spins, and then comes the wait. The balance doesn’t update. The counterparty asks if it’s done. You refresh. Still pending. Minutes feel longer when real money is involved, and uncertainty creeps in. Did it fail? Should you resend? What if fees spike? That moment of friction is where most blockchains quietly lose users, not because the technology is broken, but because the experience doesn’t match how people expect money to behave.

This is why sub-second finality matters. Before getting technical, finality simply means certainty. It is the moment when a transaction is not just sent, but settled forever. No reversals. No extra confirmations. No “wait a bit longer to be safe.” In everyday terms, finality is the difference between handing cash to someone and watching a “processing” spinner on a screen. When finality is slow or probabilistic, users hesitate. When it is fast and deterministic, they relax and move on.

Plasma’s approach starts from this human reality, not from abstract throughput targets. PlasmaBFT is the mechanism behind this design choice. It is a Byzantine Fault Tolerant consensus system derived from Fast HotStuff, but the important part is not the name. The important part is the behavior it enables. Think of it like a small, disciplined committee that agrees quickly and decisively. Instead of asking thousands of participants to slowly converge on truth, Plasma relies on a tightly coordinated validator set that can reach agreement in a single, rapid exchange. Once they agree, the decision is final. There is no probabilistic “maybe” phase. The transaction is done.

This matters most for stablecoins, not speculative tokens. Stablecoins are used as money. They settle trades, pay salaries, move remittances, and bridge traditional finance with crypto rails. In these workflows, speed is not about bragging rights. It is about reducing operational risk. Traders need to redeploy capital instantly. Merchants need to know payment is complete before releasing goods. Remittance users need confidence that funds have arrived, not a technical explanation of why it might finalize later.

PlasmaBFT is designed with this exact settlement mindset. Sub-second finality means that when a USDT transfer is confirmed, it is finished in a way that feels natural to anyone used to instant payments. There is no cognitive load. No extra confirmations. No hidden risk window. This is especially important during volatile market conditions, where delays translate directly into losses or missed opportunities.

One of the quiet advantages of this approach is retention. Most blockchain projects compete on metrics like transactions per second or theoretical scalability. Plasma competes on habit formation. When users do not have to think about whether a transaction will clear, they keep using the system. When fees are predictable or effectively zero for core actions like USDT transfers, they do not search for alternatives. Over time, this reliability becomes a moat. Not because it is flashy, but because it becomes invisible.

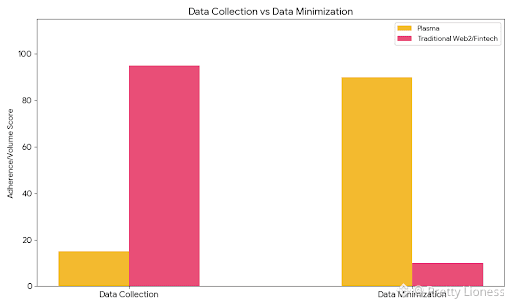

Consider the common pain points users face today. Transactions stuck in mempools. Confusing confirmation counters. Fee spikes during congestion. Wallets that show funds as sent but not usable. Each of these moments introduces doubt. Plasma’s payment-focused architecture strips these away by treating stablecoin settlement as the primary job, not a side feature. Zero-fee USDT transfers are not a marketing trick; they are a UX decision that aligns the network with how people actually use stablecoins.

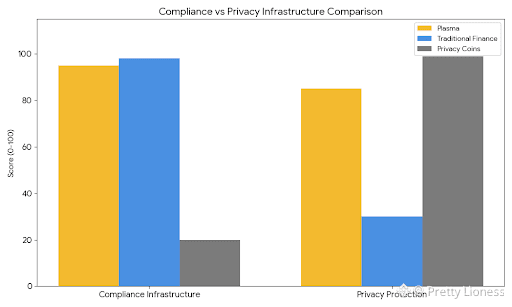

From an ecosystem perspective, this explains why platforms like Binance pay attention to Plasma projects. Large exchanges care deeply about user experience, risk management, and operational efficiency. Fast and deterministic finality reduces support tickets, failed withdrawals, and edge-case disputes. It also aligns with compliance and accounting workflows that require clear settlement boundaries, not probabilistic assurances.

Looking at a recent market snapshot, Plasma’s token reflects this positioning. With a modest market capitalization relative to major layer ones, steady trading volume, and a controlled circulating supply, the signal is not speculative frenzy but early infrastructure alignment. The market is valuing the network as a settlement layer rather than a narrative-driven asset. This does not predict price, but it does indicate how participants are framing its role.

The broader takeaway is simple. The next phase of crypto adoption will not be won by louder narratives or higher TPS charts. It will be won by systems that feel boringly reliable. Plasma’s sub-second finality through PlasmaBFT is less about technical elegance and more about respecting the user’s time and trust. When money moves the way people expect it to move, usage becomes habitual.

Seen through this lens, the investment thesis shifts. It is not about chasing hype cycles. It is about betting on infrastructure that people will keep using because it removes friction from real financial workflows. Sub-second finality is not impressive because it is fast. It is impressive because it disappears into the background, letting users focus on what they are actually trying to do. That quiet reliability is why Plasma stands out, and why long-term support follows.