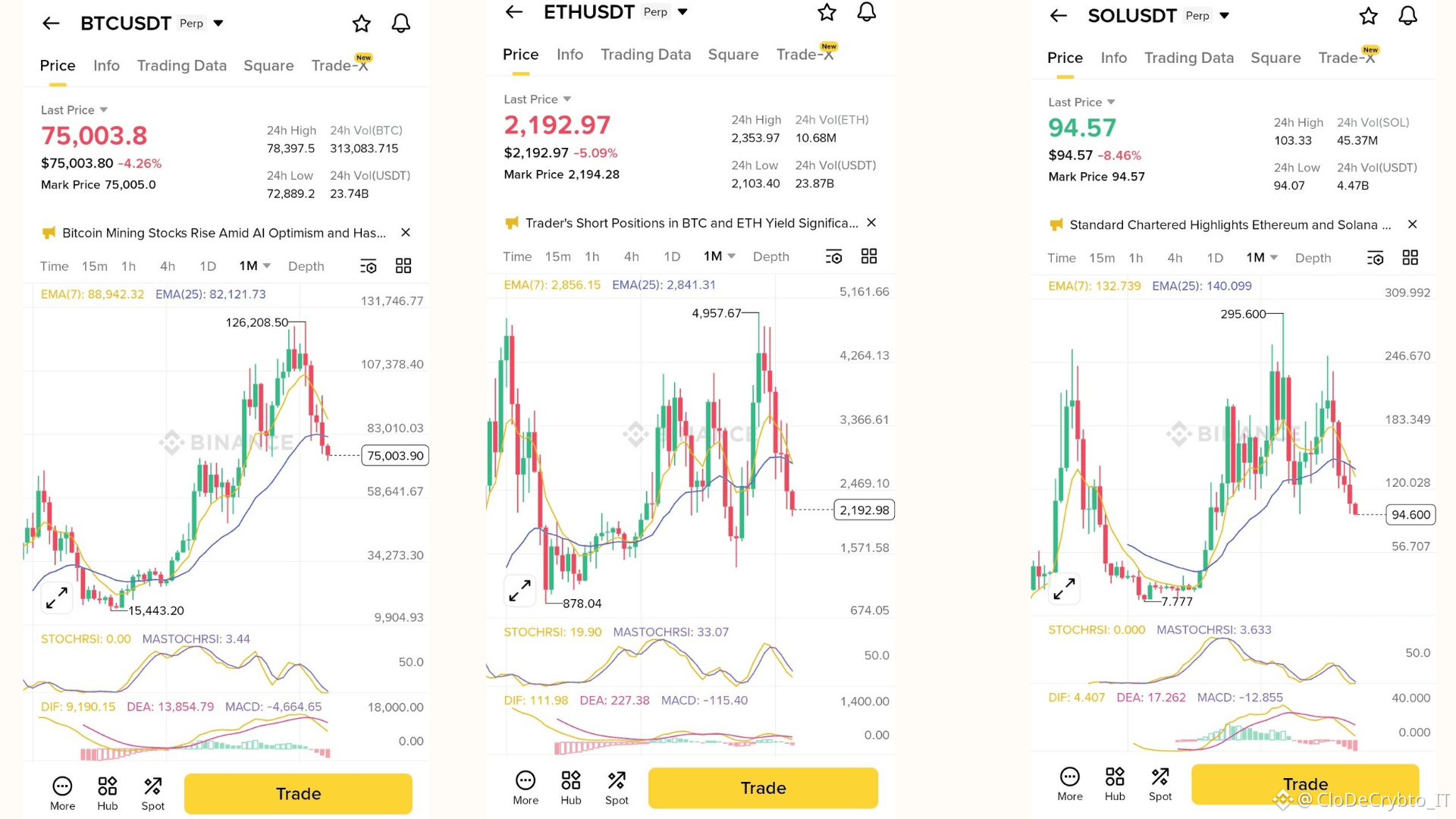

#Bitcoin (BTC), #Ethereum (ETH), and #Solana (SOL) reveal a synchronized pullback, with candlesticks showing lower highs and closes amid high volatility. This signals short-term weakness in a broader post-rally cooldown.

As of February 4, 2026, the crypto market grapples with extreme fear. The Fear & Greed Index sits at 15 after a deep adjustment phase. BTC dominance at 59.2% sucks liquidity from alts, and recent dips from peaks (BTC down 30%).

Monthly patterns align with this: $BTC and ETH testing support after January losses (ETH -7%), while SOL holds macro floors but battles descending trends.

Chart Insights

BTC's monthly chart displays a potential red candle forming near $75K. RSI divergence hints at exhaustion but no bullish reversal yet. This echoes forecasts of headwinds in mid-February. $ETH mirrors this, approaching a "decisive crossroads" post-January slump. It needs $3,520 breakout to flip bullish amid historical February medians of +15%.

Altcoin Dynamics

$SOL stands resilient at ~$94-99, backed by positive CMF inflows and seasonal +38% February averages. It eyes $147 resistance if it breaks the downtrend, contrasting BTC/ETH caution on the charts. Yet, unified downtrends across the trio suggest correlated risk. Weekend BTC sub-$76K tests amplify fear.

Bearish Outlook?

No prolonged bear market looms for months. Instead, brace for choppy dips and volatility in February, as charts show stabilization potential without velocity for new highs soon. Analysts eye $69K BTC floors and alt rebounds if supports hold. Failure risks deeper corrections before spring momentum.

Stay nimble. Crypto's fear phase offers dip buys if SOL leads alts higher, but BTC's dominance warns of more downside tests. Position for range-bound action over blind bears.

🔊NOT A FINANCIAL ADVICE

🔊ALWAYS D Y O R !