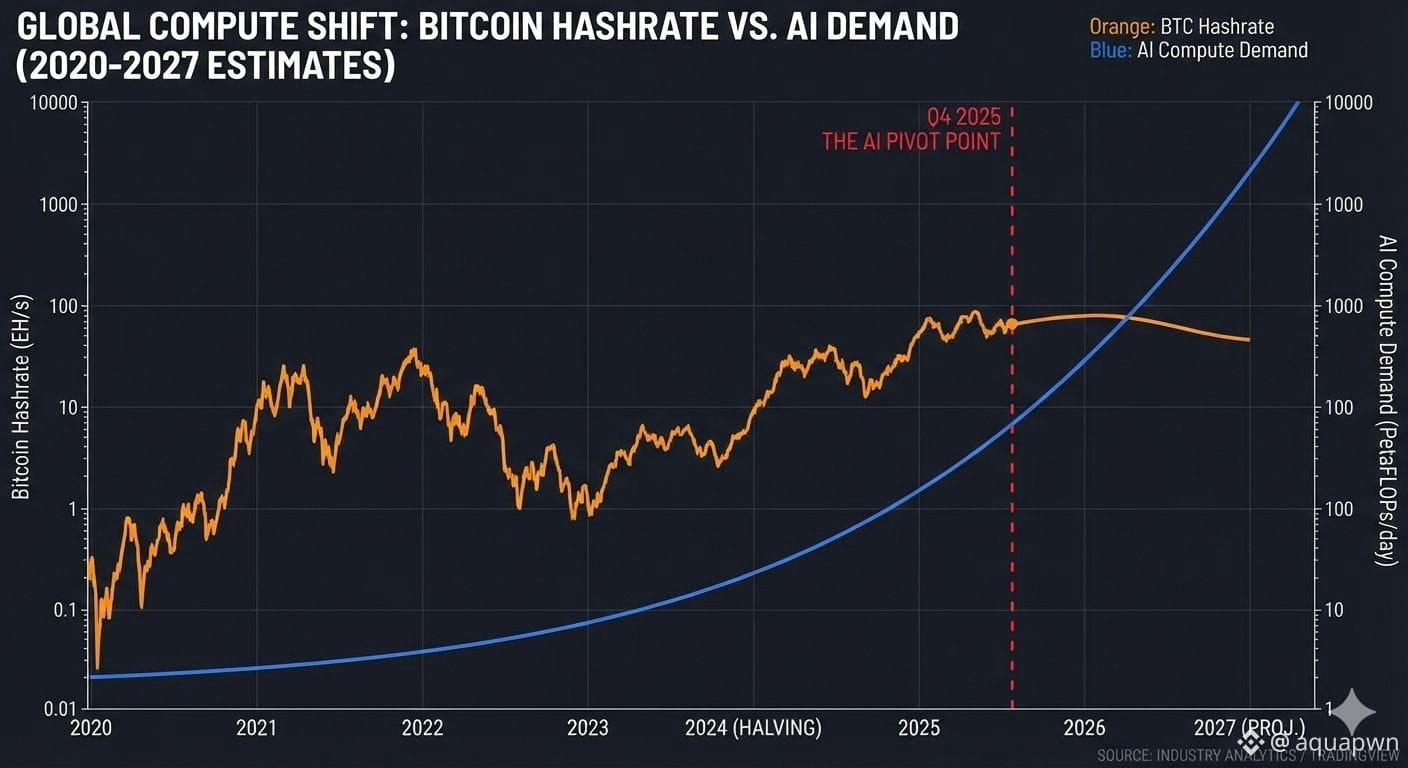

For a decade, the "Bitcoin Miner" was the ultimate crypto fundamental. They were the blue-collar backbone of the network, turning electricity into digital gold. But in 2026, the script has flipped.

If you’re still looking at "Hashrate" as the only metric for success, you’re missing the biggest structural shift in the history of digital assets. The 2024 halving didn't just squeeze margins; it triggered an evolutionary pivot.

The Death of the "Pure-Play" Miner

The math for traditional mining is getting ugly. With Bitcoin production costs in 2026 hovering around $70,000 to $85,000 per coin and the network hashrate crossing the 1 Zeta-hash (ZH/s) mark, the "ASIC arms race" has become a treadmill to nowhere for many.

The Result? The world’s largest miners are quietly gutting their facilities. They aren't selling their Bitcoin; they are selling their Power.

From ASICs to GPUs: The $65 Billion Pivot

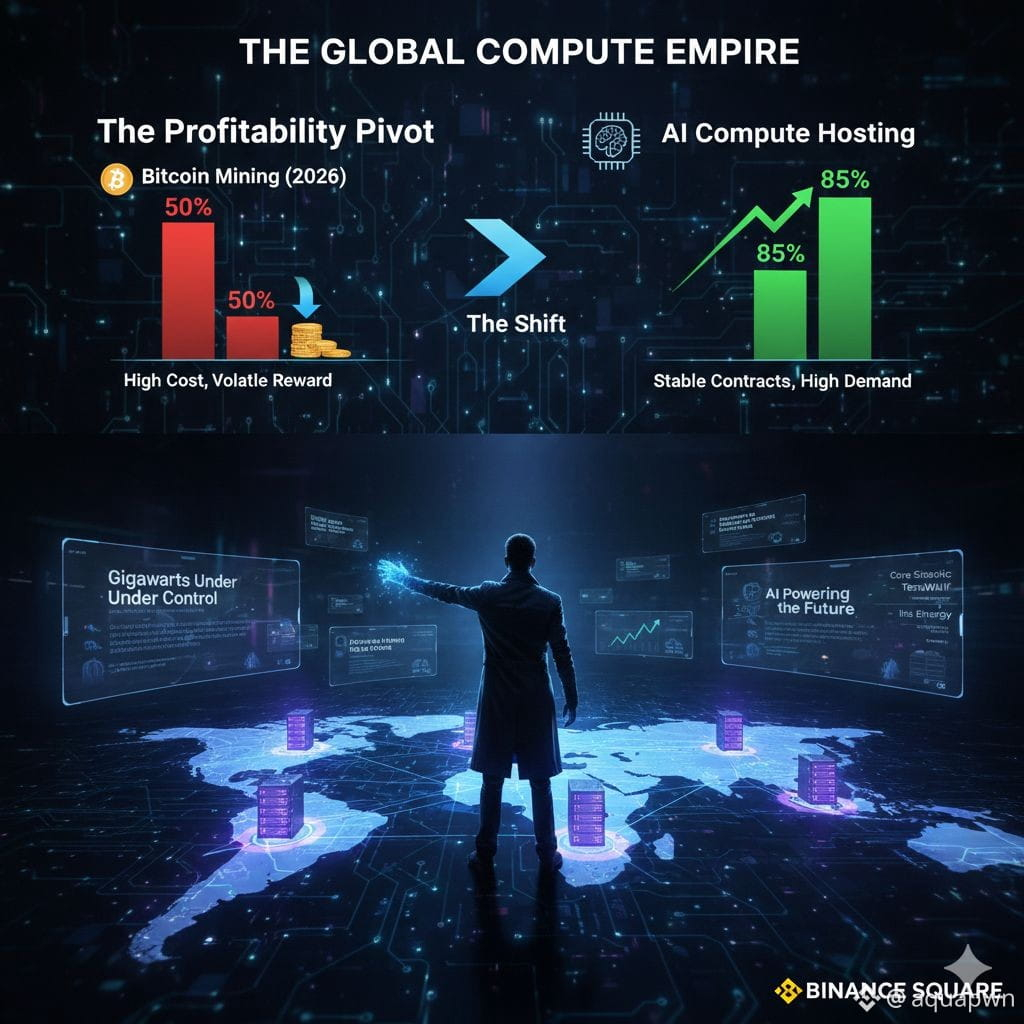

High-Performance Computing (HPC) for AI is the "New Digital Oil." While Bitcoin mining operates on roughly 50% margins, hosting AI workloads for tech giants can command margins of 80% or higher.

IREN (Iris Energy): Recently secured a staggering $9.7 billion AI cloud deal with Microsoft. They aren't just a "miner" anymore; they are an AI infrastructure giant.

Core Scientific (CORZ): After rising from the ashes of bankruptcy, they’ve signed a 12-year hosting deal with CoreWeave worth billions. They are swapping Bitcoin machines for Nvidia clusters as fast as the supply chain allows.

Hut 8 (HUT): Now markets itself as a "Digital Infrastructure" company. Their "GPU-as-a-Service" model provides more stable, predictable revenue than the volatile block rewards of the Bitcoin network.

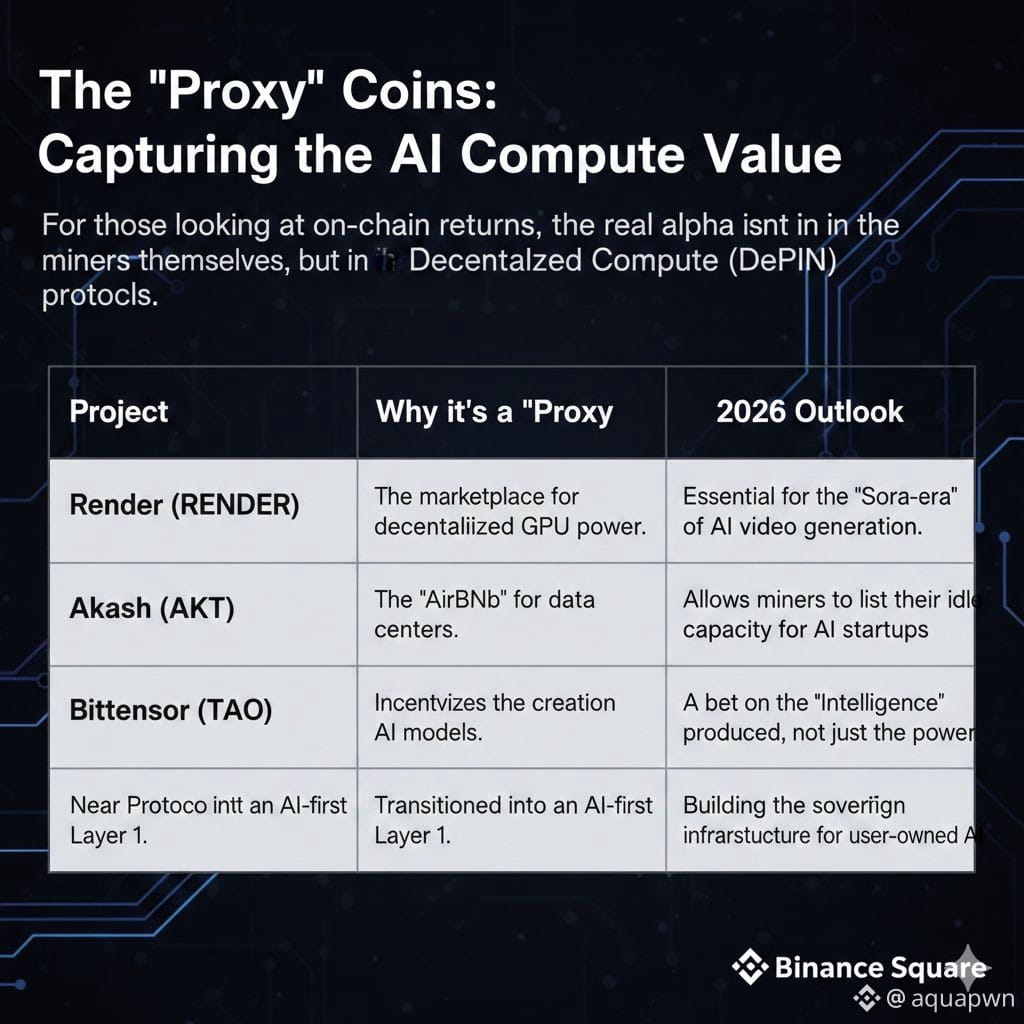

The Proxy Plays: Moving Beyond the "Stock"

If the miners are the landlords, who are the tenants? For retail investors, the real "asymmetric returns" aren't in the companies themselves, but in the DePIN (Decentralized Physical Infrastructure Networks) that bridge the gap between crypto and AI.

The Industry "Autopsy": What Happens to Bitcoin?

This shift forces a hard question: If the smartest money in mining is moving to AI, what happens to Bitcoin’s security?

Ironically, the "AI Pivot" might be the best thing to happen to Bitcoin. By diversifying their income, miners can afford to keep their BTC rigs running even when the price dips. They are becoming "energy load balancers"—mining Bitcoin when power is cheap and running AI models when demand (and profit) is high.

The Bottom Line

The "winners" of 2026 aren't the ones mining the most coins. They are the ones who control the Gigawatts. We are witnessing the birth of a new asset class: Compute-Backed Assets.