Crypto exchange-traded fund activity continues to reflect a cautious institutional stance, with Bitcoin and Ethereum ETFs extending their recent run of outflows while XRP-linked products post modest inflows.

Bitcoin ETFs recorded another day of sizable net outflows, led by continued pressure on major issuers

Ethereum ETFs also remained in negative territory, extending a multi-day redemption trend

Solana ETF flows stayed muted, with only marginal daily movement

XRP spot ETFs posted net inflows, bucking the broader market trend

The divergence underscores a broader risk-off environment across digital assets, even as selective capital continues to target specific narratives.

Bitcoin and Ethereum ETFs remain under pressure

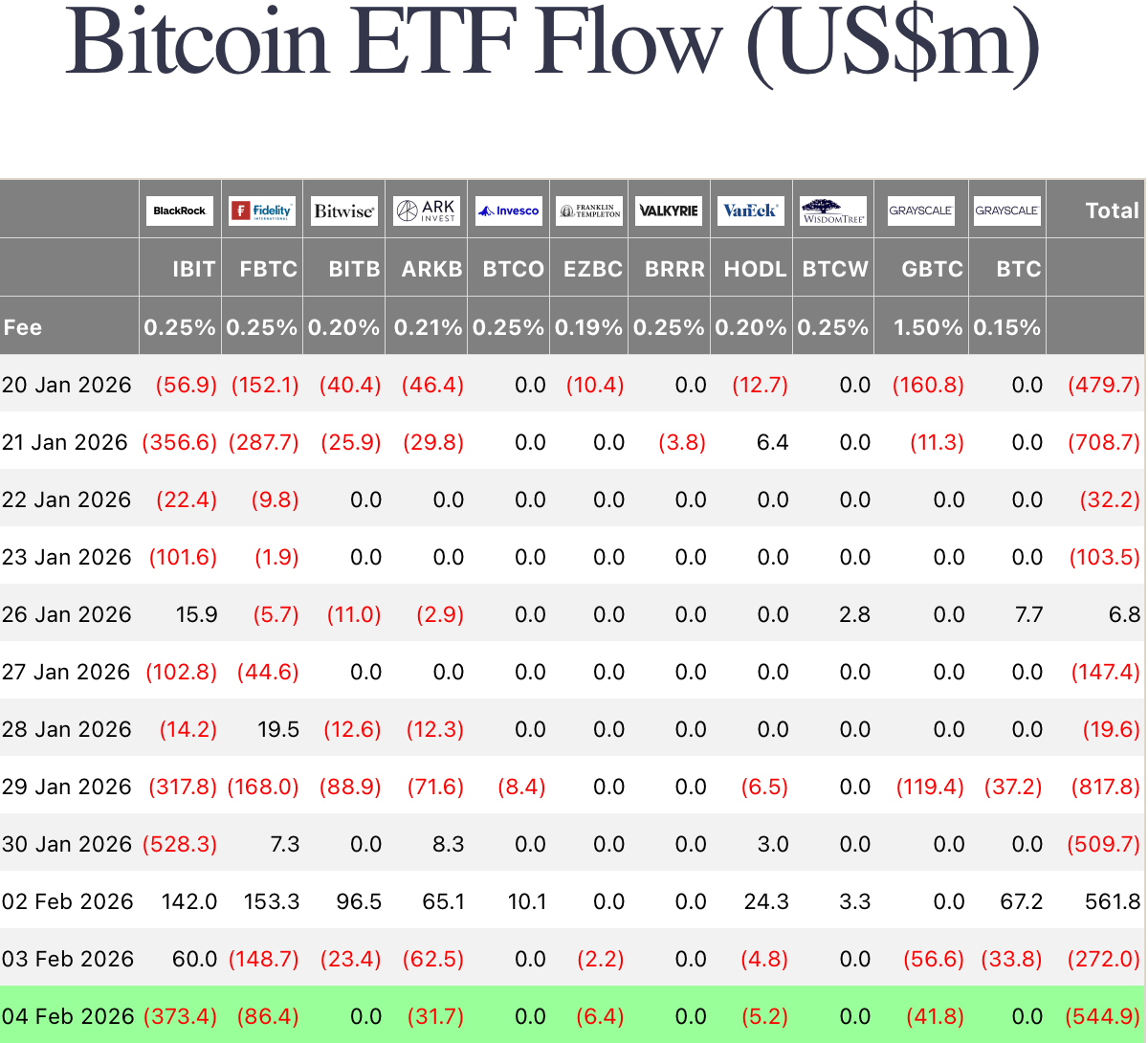

Bitcoin ETF flows stayed negative, with aggregate outflows totaling $544.9 millions accelerating on February 4. Large redemptions were again concentrated among major products, signaling that institutional investors remain reluctant to add exposure amid elevated volatility and weakening price structure. The continued withdrawals align with Bitcoin’s recent move toward key technical support levels, reinforcing a cautious near-term outlook.

Ethereum ETFs showed a similar pattern, recording $79.4 million net outflows despite isolated inflows into select products. The broader trend remains one of capital rotation away from ETH exposure, mirroring Ethereum’s relative underperformance versus Bitcoin and the wider market. With staking-related catalysts still unresolved for several funds, investor appetite appears limited for now.

Solana ETF flows remained subdued, with minimal net movement on the day. While the absence of heavy outflows suggests reduced selling pressure, it also points to a lack of conviction from institutional participants as risk sentiment stays fragile.

XRP ETFs attract selective inflows

In contrast to the broader ETF landscape, XRP spot ETFs recorded $4.83 million in net inflows on the day. The gains were distributed across multiple products, resulting in a positive total despite muted activity elsewhere. While the inflows remain modest in absolute terms, they stand out against the dominant outflow trend across Bitcoin and Ethereum ETFs.

The relative resilience in XRP-linked products suggests targeted positioning rather than a broad shift in sentiment. Investors appear to be selectively allocating capital toward assets perceived as having clearer regulatory trajectories or differentiated catalysts, even as overall market conditions remain challenging.

Taken together, the latest ETF flow data highlights a market still defined by caution and selectivity. Until Bitcoin and Ethereum ETF flows stabilize and turn decisively positive, institutional participation is likely to remain defensive, with inflows confined to isolated pockets rather than signaling a broad-based recovery.