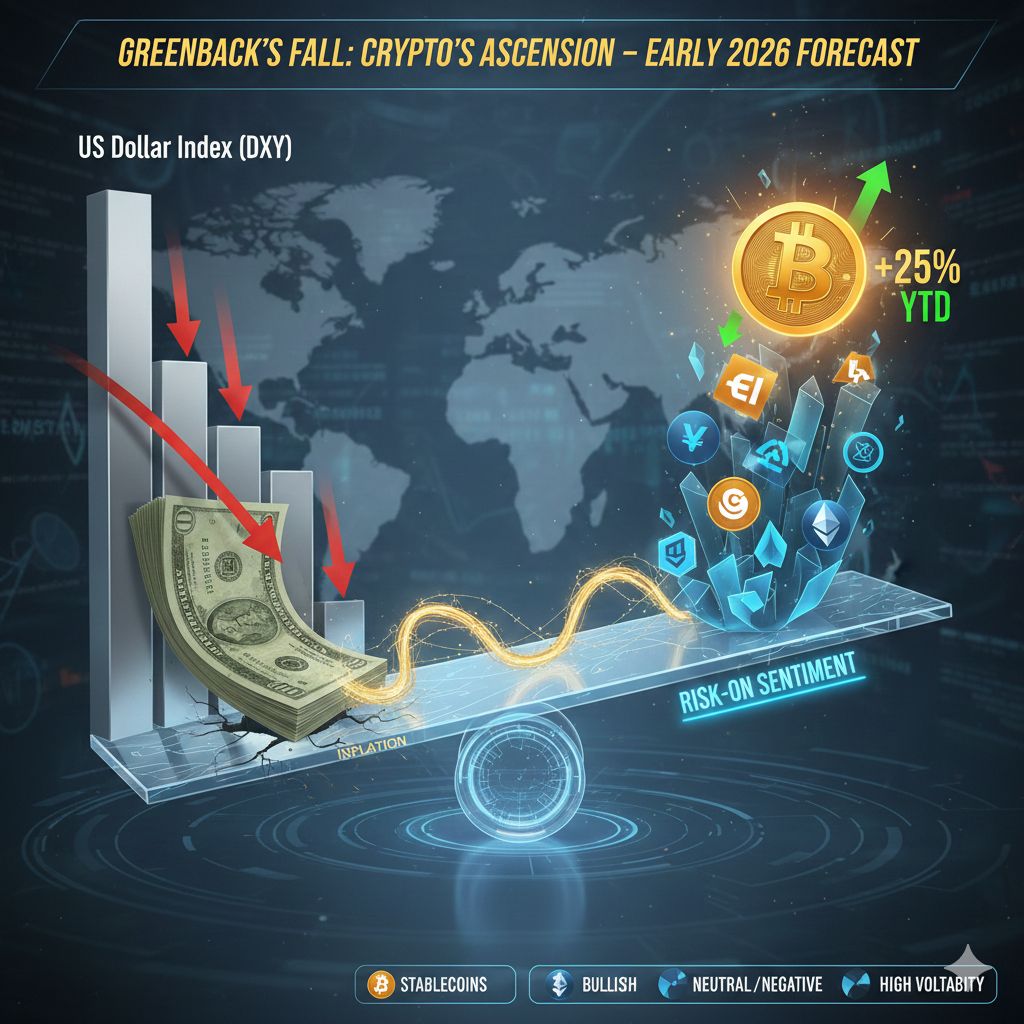

In the interconnected world of global finance, the relationship between the US Dollar and Cryptocurrency is often viewed as a high-stakes see-saw. When the "Greenback" falters, digital assets frequently find their footing.

As of early 2026, we are witnessing a unique macroeconomic environment where the US Dollar Index (DXY)—which measures the dollar against a basket of foreign currencies—has shown signs of cooling, dropping from 2025 highs. Here is an analysis of why this is happening and what it means for the crypto market.

1. The Inverse Correlation: The See-Saw Effect

The most fundamental relationship between the dollar and Bitcoin (BTC) is inverse correlation. Because Bitcoin is primarily priced in USD on global exchanges, a decrease in the dollar's value naturally puts upward pressure on the price of BTC.

Purchasing Power: If the dollar weakens, it takes more dollars to buy the same amount of Bitcoin.

The "Digital Gold" Narrative: When the dollar declines due to inflation or high government debt, investors seek "hard assets." Much like gold, Bitcoin has a fixed supply (21 million), making it a popular hedge against the debasement of fiat currency.

2. Global Liquidity and Risk Appetite

A weakening dollar is often a byproduct of Federal Reserve policy—specifically, lowering interest rates or pausing hikes. When the dollar is "cheap" to borrow:

Increased Liquidity: Capital flows more freely into the global economy.

Risk-On Sentiment: Investors move away from the "safe" but low-yielding dollar and hunt for higher returns in "risk-on" assets, such as tech stocks and cryptocurrencies.

Stablecoin Stability: Most stablecoins (USDT, USDC) are pegged to the dollar. A falling dollar makes these entry points cheaper for international investors using stronger local currencies (like the Euro or Yen), potentially driving more global volume into the crypto ecosystem.

3. The 2026 Context: Why the Dollar is Slipping

Several factors are currently weighing on the dollar, providing a tailwind for crypto:

Debt Concerns: US federal deficits remain a point of contention for global markets, leading some to question the long-term strength of the dollar as the world's reserve currency.

Monetary Pivot: With inflation cooling in early 2026, the market expects the Fed to maintain a more "dovish" stance, which typically weakens the dollar.

De-dollarization: Ongoing efforts by BRICS nations to trade in local currencies have marginally reduced the global demand for the greenback.

4. The "Altcoin" Surge

While Bitcoin often leads the charge, a falling dollar is frequently the catalyst for "Altseason." When the dollar is weak, Ethereum (ETH) and other large-cap altcoins often see significant gains as investors diversify their portfolios within the crypto space to maximize returns on their devalued fiat.

Current Market Note: In early February 2026, while the dollar has shown weakness, the crypto market has remained volatile due to specific regulatory hurdles and institutional liquidations. This suggests that while a weak dollar is a "tailwind," it is not the only factor driving prices.

Summary Table: Impact of a Falling Dollar