Bitcoin briefly dropped below the $70,000 mark, extending a sharp downside move that has defined the past several sessions.

Key Takeaways

Bitcoin briefly slipped below $70,000 before stabilizing.

Crypto market liquidations surged to nearly $1 billion in 24 hours, with longs taking most of the hit.

RSI and MACD remain bearish, signaling continued downside pressure.

The break pushed price deeper into a short-term bearish structure, with lower highs and lower lows continuing to dominate on intraday charts. While the dip below $70K was short-lived, the move confirmed that sellers remain firmly in control for now.

Liquidations surge as leverage unwinds

The sell-off was accompanied by a sharp spike in liquidations across the crypto market. Nearly $1 billion in leveraged positions were wiped out over 24 hours, with long positions accounting for the overwhelming majority.

Bitcoin alone saw hundreds of millions of dollars in forced liquidations, highlighting how crowded long positioning amplified the drop below $70,000 and accelerated the move.

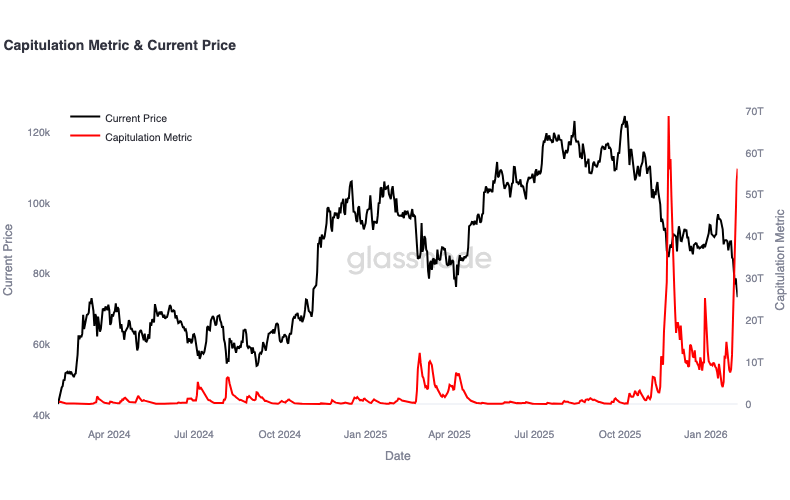

Capitulation signals flash on-chain

On-chain data suggests the move was driven more by stress than by orderly selling. According to Glassnode, Bitcoin’s capitulation metric printed its second-largest spike in the past two years.

Such events typically reflect forced selling and rapid de-risking as traders rush to reduce exposure. Historically, these spikes often occur during periods of heightened volatility and have sometimes preceded local market stabilization, though not always immediately.

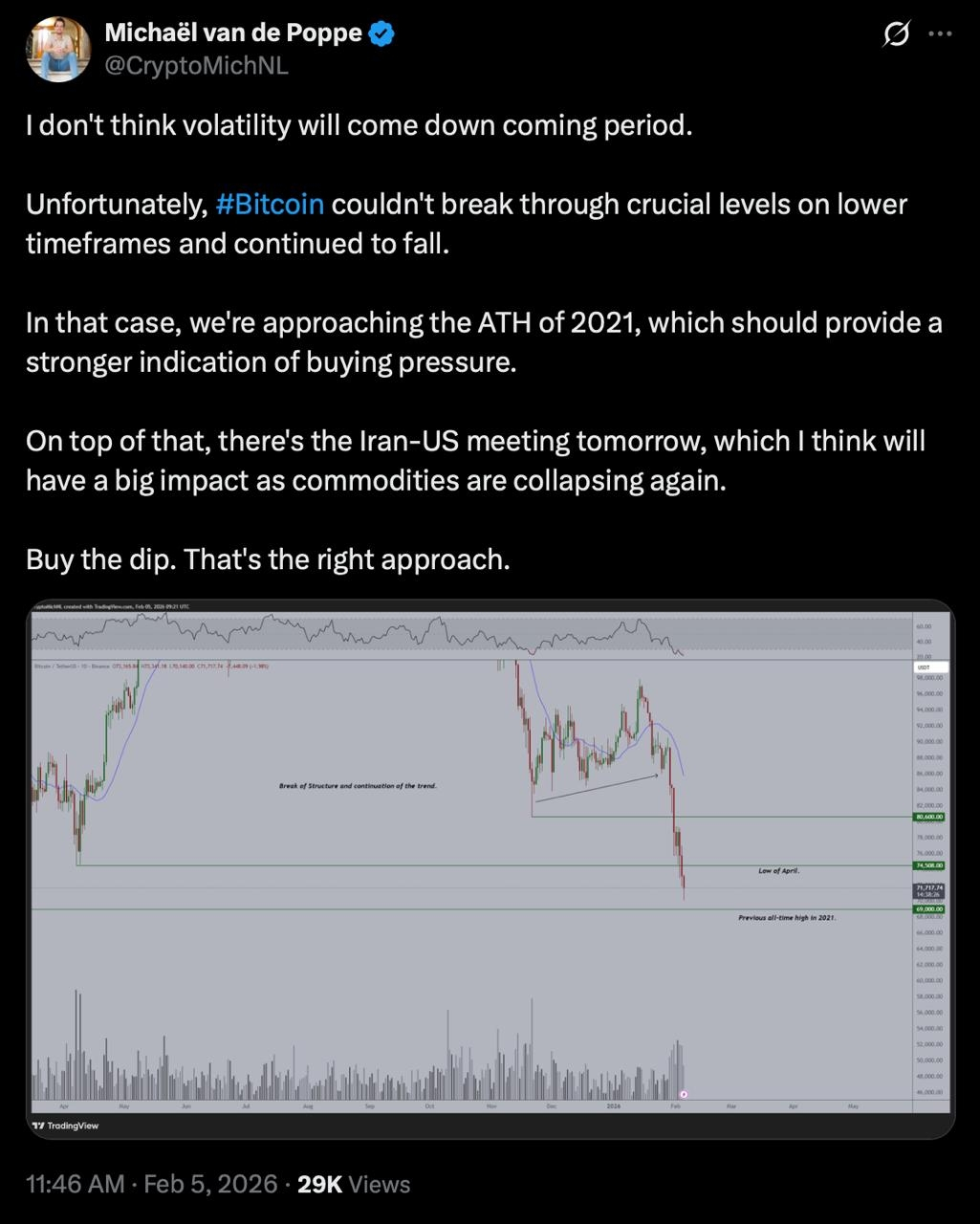

Analysts warn volatility is far from over

Market analyst Michael van de Poppe said volatility is unlikely to cool down in the near term, noting that Bitcoin failed to reclaim key resistance levels on lower timeframes.

He highlighted that price is now approaching the zone around the 2021 all-time high, an area that could act as a stronger demand region if selling pressure starts to fade. Despite the bearish trend, he argues that panic-driven sell-offs have historically offered better long-term entry opportunities than chasing strength.

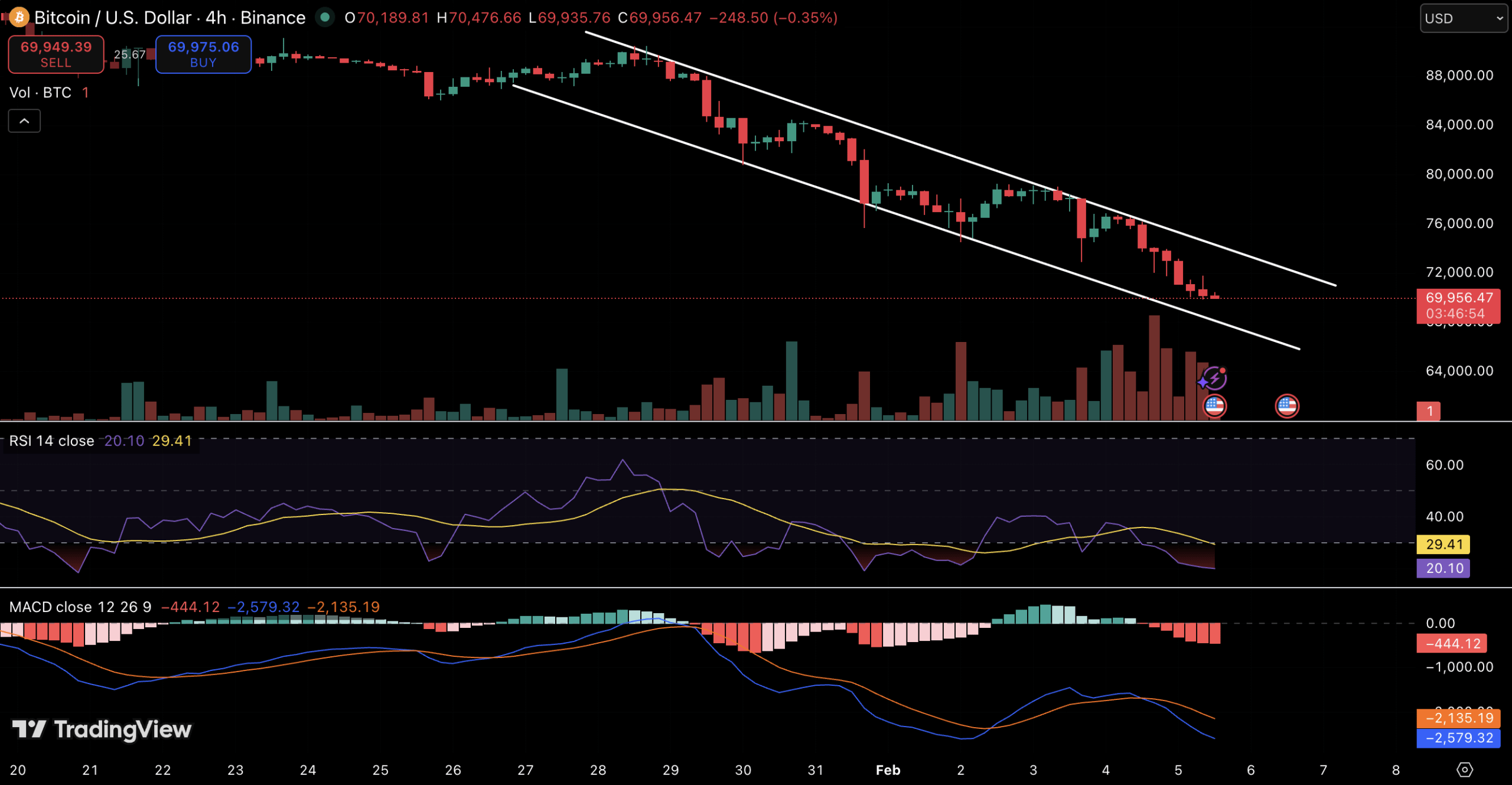

RSI and MACD confirm bearish momentum

On the 4-hour timeframe, Bitcoin continues to trade within a clearly defined descending channel. Every rebound attempt over recent days has been capped at lower resistance levels, suggesting that demand is still too weak to shift momentum. As long as price remains below the upper boundary of this channel, the broader short-term trend remains tilted to the downside.

From a momentum perspective, indicators remain weak. The Relative Strength Index on the 4-hour chart has dropped toward oversold territory, reflecting sustained selling pressure rather than a healthy pullback.

Meanwhile, MACD remains firmly in negative territory, with no clear bullish crossover in sight. Together, these signals suggest that downside momentum is still intact, even if short-term relief bounces emerge.

For now, Bitcoin’s inability to hold above $70,000 keeps the near-term outlook fragile. Heavy liquidations, strong capitulation signals, and weakening momentum point to continued volatility ahead, with the next decisive move likely to come once selling pressure either fully exhausts - or accelerates further.