When people think of blockchain, most imagine transparency, but what if you could have privacy and compliance at the same time? That’s the idea behind Dusk Network. A project that’s not just another blockchain token, but a purpose built platform engineered to bring confidential finance to regulated markets in a way few others have tried.

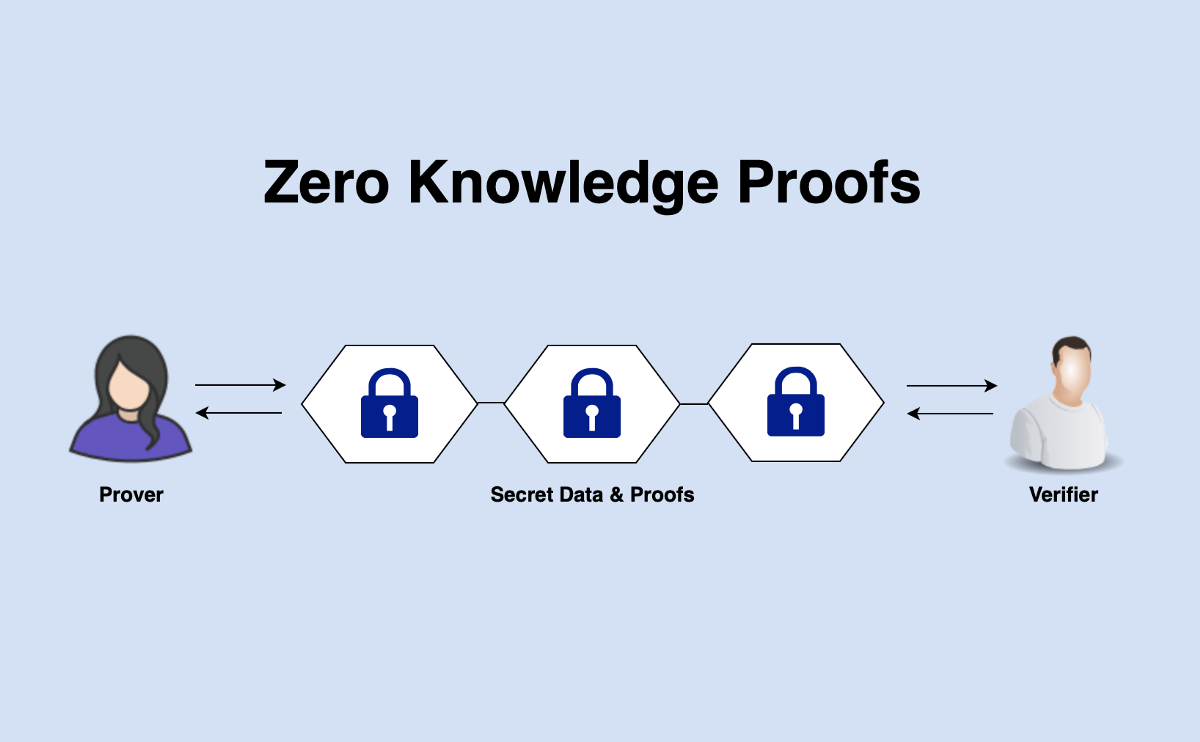

In simple terms, DUSK exists because traditional finance struggles with two conflicting needs: transparency for regulators and privacy for participants. Dusk solves this by applying zero-knowledge proofs and confidential smart contracts that hide sensitive details from the public eye while still allowing verified audits when required. This combination positions it uniquely for institutional adoption.

Looking at the market today, DUSK has experienced volatility like most altcoins, with recent price retracements after earlier gains but trading volumes have picked up, showing renewed interest from traders and investors in privacy-focused infrastructure projects. Sentiment in the space reflects a growing appetite for solutions that bridge the gap between decentralized finance and traditional regulation, especially as regulators worldwide increase scrutiny. DUSK’s recent listing on major exchanges, strategic partnerships, and integration of Chainlink standards for institutional assets have amplified attention on its real use case rather than speculative narratives.

So what real problem does Dusk solve? In a regulated world, financial institutions need a blockchain that can offer privacy without sacrificing compliance something most blockchains do not natively support. Traditional public chains reveal transaction data that regulators demand or risk disallowing; privacy coins hide too much to be compliant. Dusk’s technology unifies both needs.

If you’re researching the next wave of meaningful blockchain adoption, Dusk merits a closer look for its blend of privacy, regulation ready, infrastructure, and real-world utility, not hype.