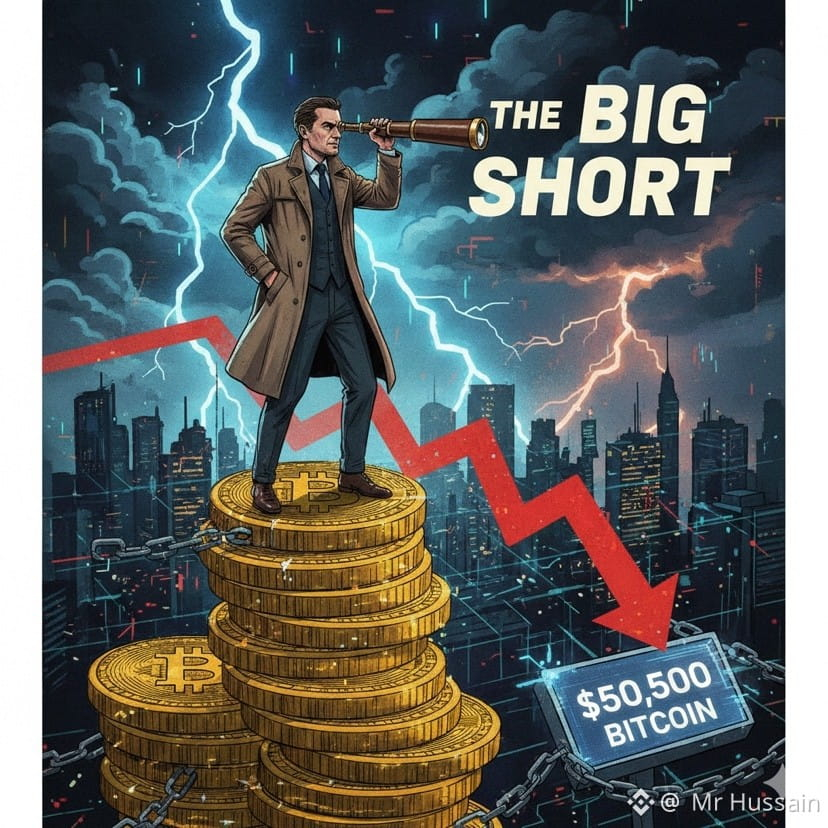

We all remember the man who stared into the abyss of the 2008 housing bubble and didn’t blink. When Michael Burry speaks, the financial world tends to lean in—mostly because his track record for spotting "the top" is legendary. Now, the Big Short protagonist has set his sights on the king of crypto, predicting a significant slide for Bitcoin back down to the $50,000 mark.

While the "diamond hands" crowd might dismiss this as mere FUD (Fear, Uncertainty, and Doubt), Burry’s thesis usually centers on one thing: mean reversion. After the meteoric rallies we've seen, he’s betting that the speculative steam is bound to evaporate, bringing the asset back to more "grounded" levels.

Why This Matters for Your Portfolio

Whether you’re a HODLer or a skeptic, a move to $50,000 represents a massive shift in market liquidity and sentiment. Here’s how to view this through a professional lens:

• Healthy Consolidation vs. Crash: In the world of high-growth assets, a pullback to $50k could actually be viewed as a healthy retest of previous support levels rather than a total collapse.

• The Macro Narrative: Burry often looks at broader inflationary pressures and interest rate cycles. If he’s right, Bitcoin’s move won't happen in a vacuum—it will be a symptom of a broader "risk-off" environment.

• The Psychological Floor: $50,000 isn't just a number; it’s a massive psychological barrier. Watching how the market reacts at that level will tell us if the bull run has legs or if the "Supercycle" was just a dream.

The Bottom Line

Market cycles are inevitable, and having a contrarian like Burry in the mix serves as a necessary reality check against irrational exuberance. Is this a savvy entry point in the making, or the beginning of a long crypto winter? Only time (and the charts) will tell.

I’m curious to hear your take: Do you think Burry is spot on with this $50k target, or is he underestimating the institutional "wall of money" supporting Bitcoin this time around? Drop your predictions below—let’s talk strategy.

#BTCMiningDifficultyDrop #BinanceBitcoinSAFUFund #RiskAssetsMarketShock #WhenWillBTCRebound #Write2Earn