In crypto, pulling off big trades comes down to three things: liquidity, speed, and keeping slippage low.

Pro tip: What’s price slippage?

It’s when your order executes at a different price than you expected, usually because the market moves fast or liquidity is thin.

If you trade serious size, this can make or break the deal. Without enough liquidity and solid execution rails, large orders can move the market, so the price you planned for isn’t the price you actually get.

Next, let’s break down why liquidity depth matters for large crypto transactions, and how platforms like ChangeNOW help execute them with minimal slippage.

Key takeaways

Liquidity depth keeps slippage low

Deep liquidity, especially when it’s aggregated across CEX and DEX venues like ChangeNOW does, helps large orders fill faster with less price impact, so you can execute size without getting wrecked on the entry or exit.

Custody makes big trades smoother and safer

Custody solutions let users park assets securely before and during execution, which speeds things up and helps reduce slippage. Off-chain conversions inside custody can also cut down on on-chain fees and delays.

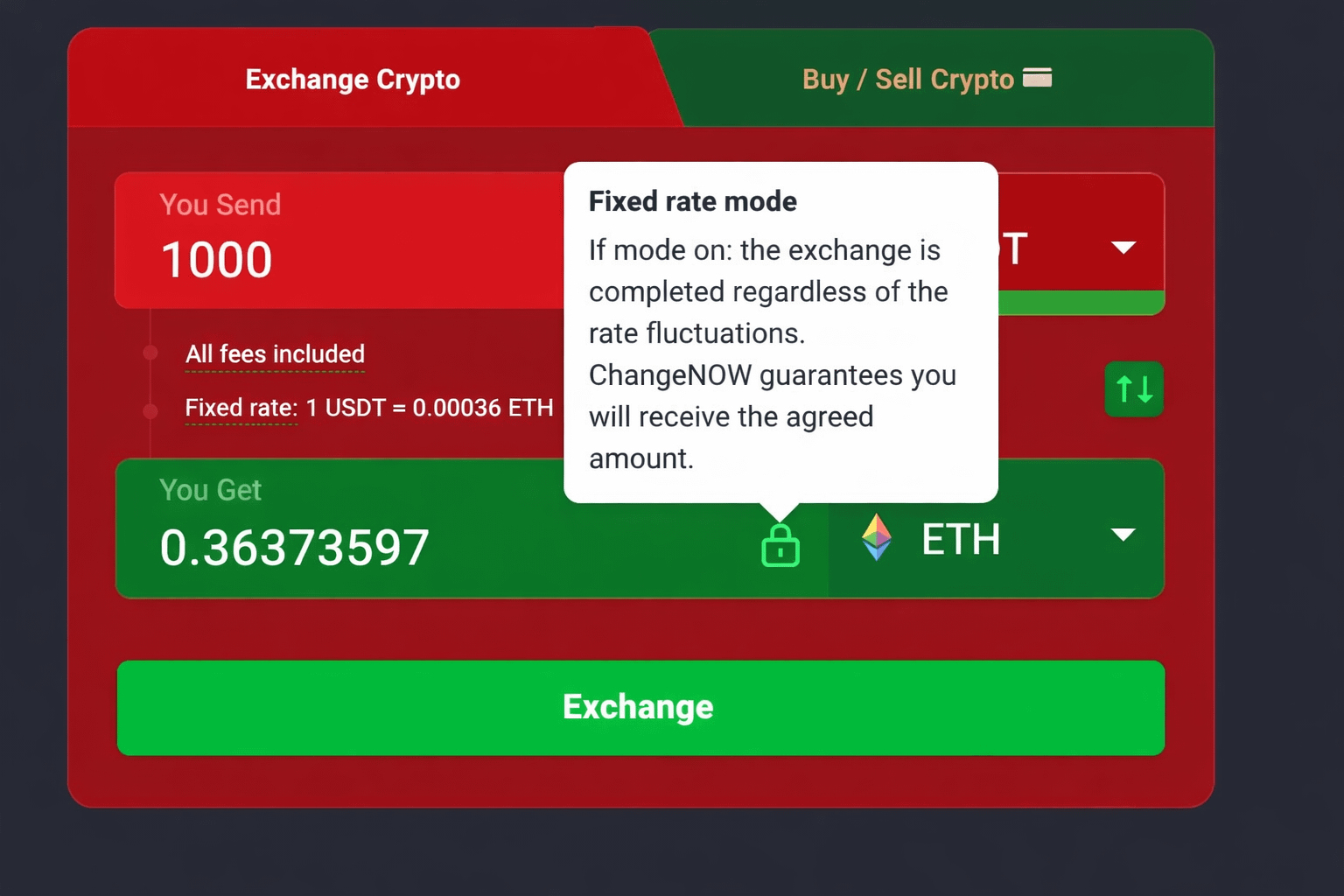

Fixed rate mode adds price certainty

For larger trades, ChangeNOW’s fixed rate option lets you lock a price upfront so you’re not chasing the market mid-swap. That adds predictability and lowers the risk of slippage from sudden moves.

The importance of liquidity in large trades

When you’re trading size in crypto, liquidity is everything. It’s what lets you buy or sell a large amount without moving the price too much. Deeper liquidity means less price impact and less slippage, which is why it matters so much for institutions and OTC-style execution.

OTC trades are basically large deals done off public exchanges. Instead of slamming a $10M BTC order into an order book and pushing price up, an OTC desk finds a counterparty privately and fills the trade without shaking the market.

ChangeNOW helps by aggregating liquidity across both CEX and DEX venues, so orders can route through deeper pools and execute with lower slippage.

Custody and execution

For big transactions, security and readiness matter. Custody solutions let users store assets safely and keep funds pre-positioned, so when the market gives a good window, execution can happen faster and cleaner, which also helps reduce slippage.

Fixed rate for certainty

For large trades, locking the price can be a big advantage. ChangeNOW’s fixed rate mode lets you secure a quote upfront, so you’re not exposed to market moves during execution. That adds predictability and cuts slippage risk.

How custody enhances market liquidity

Custody as a holding zone before big trades

For large transfers or swaps, custody works like a secure staging area. Clients can pre-deposit assets on the platform, so when the market window opens, execution is instant. Since the capital is already in place, trades can hit the best liquidity route at the right moment, which helps reduce slippage.

Custody enables off chain internal conversions

A big advantage of custody is internal conversions that stay inside the system instead of going on chain. That cuts network fees, confirmation delays, and chain related risk. It also reduces friction when moving value between assets or routes, which helps keep execution smooth for large size.

Custody plus a liquidity aggregator is the full package

ChangeNOW aggregates liquidity across CEX and DEX venues, giving access to deeper books and competitive spreads. Pair that with custody and you get an end to end setup for large clients: deposit funds, execute big trades with lower slippage, then keep assets in custody or move them out.

Who benefits

High volume individuals, OTC style flows, institutions, and businesses. Traders get better execution and less slippage. Institutions get secure storage plus fast routing. Businesses can plug liquidity into their own products through partner programs, offering smoother swaps without building infrastructure from scratch.

How it looks in practice

A large partner deposits assets into custody, then converts instantly through aggregated liquidity routes when conditions are best. After execution, funds can stay in custody for future use or be transferred out based on need. Simple, fast, and lower friction.

Conclusion

For big crypto trades, deep liquidity alone is not enough. You also need secure storage, fast execution, and fewer on chain delays. By combining custody with aggregated liquidity and optional internal conversions, ChangeNOW offers a practical setup for executing large transactions with more speed, control, and minimal slippage.